Donald Trump, the Supreme Court, and New Tariff Threats: Why the Global Economy Faces More Uncertainty

Executive Summary

A Constitutional Clash with Economic Consequences

On February 20th, The Supreme Court delivered a landmark ruling in Learning Resources v Trump, striking down the bulk of President Donald Trump’s tariffs as unlawful under the International Emergency Economic Powers Act.

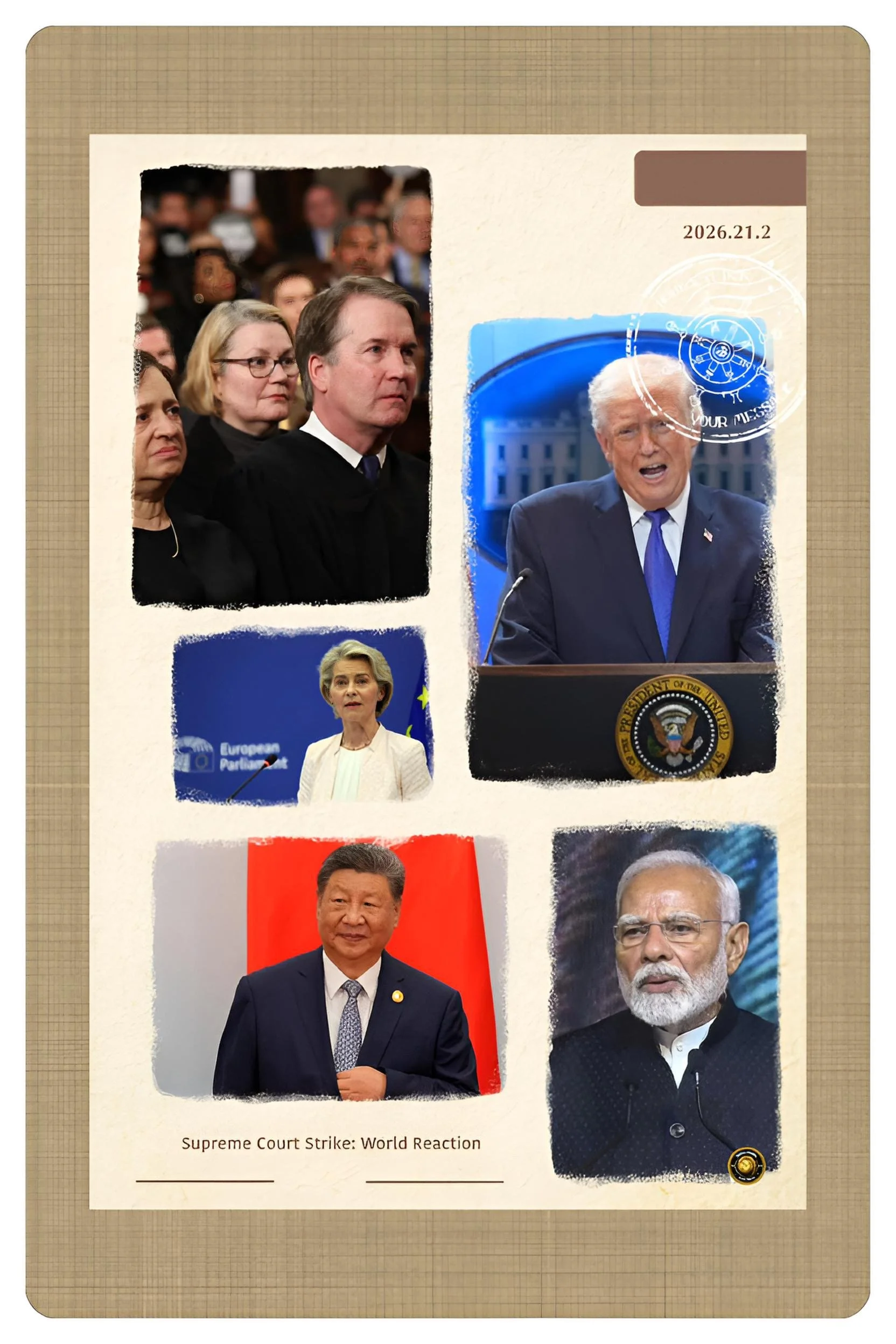

In a 6–3 decision that included Chief Justice John Roberts in the majority, the Court concluded that the 1970s-era statute did not authorize the executive branch to impose sweeping tariff regimes absent clear congressional approval.

President Donald Trump responded within hours, calling the decision “deeply disappointing” and signaling that new trade barriers were under consideration.

The ruling has immediate legal clarity but introduces fresh economic uncertainty. Markets must now evaluate whether the administration will seek alternative statutory tools, appeal through legislative maneuvering, or escalate trade tensions through new mechanisms.

FAF article examines the constitutional foundations of tariff authority, the historical evolution of executive trade power, the economic effects of unilateral tariffs, and the broader implications of the Court’s rebuke.

The central argument is that the immediate economic impact will not be tariff removal alone but renewed uncertainty. Investors, corporations, and trading partners face a new phase of ambiguity in U.S. trade policy.

The clash between judicial restraint and presidential assertiveness may redefine executive authority for decades.

Introduction

From Emergency Power to Judicial Constraint

Rarely does a signature presidential policy receive so categorical a repudiation from the nation’s highest court.

In Learning Resources v Trump, the Supreme Court ruled that the International Emergency Economic Powers Act, or IEEPA, does not grant the president unlimited discretion to impose tariffs.

The decision struck at the legal architecture underpinning much of Mr. Trump’s recent tariff expansion.

The ruling represents more than a technical statutory dispute. It is a confrontation over constitutional boundaries.

For decades, Congress has delegated elements of trade authority to the executive branch.

Presidents have used those powers expansively, particularly in matters framed as national security. The Court’s decision signals a recalibration.

Yet the president’s immediate response suggests confrontation rather than accommodation.

By pledging new trade barriers, Mr. Trump has transformed a judicial defeat into a political campaign issue.

The result is a new layer of volatility in global markets already sensitive to geopolitical strain.

History and Legal Foundations

The Evolution of Tariff Authority in the United States

The U.S. Constitution grants Congress the authority to regulate commerce with foreign nations.

For much of the 19th and early 20th centuries, tariffs were explicitly legislative instruments. Over time, however, Congress delegated increasing flexibility to the executive branch.

The International Emergency Economic Powers Act of 1977 was enacted to provide presidents with authority to regulate financial transactions during declared national emergencies.

Its language focused primarily on freezing assets and restricting financial flows, not imposing general tariffs.

President Trump argued that IEEPA’s emergency provisions permitted broad trade restrictions, including tariffs, when national economic security was threatened.

The Supreme Court disagreed. Writing for the majority, Chief Justice John Roberts emphasized statutory interpretation. Congress had not clearly authorized such sweeping tariff power under IEEPA.

This interpretation restores congressional primacy in tariff setting, at least under this statute. It does not eliminate executive trade tools entirely, but it constrains one of the most expansive claims of emergency authority.

Current Status

Markets, Allies, and Institutional Reaction

Following the ruling, financial markets initially reacted with relief at the invalidation of certain tariffs. However, that relief was tempered by presidential rhetoric promising alternative measures.

Corporate leaders now face uncertainty. Supply chains adjusted over several years to accommodate tariff costs.

Some firms relocated production; others absorbed price increases. If tariffs are reimposed under different statutory authority, planning becomes more complex.

International partners face similar ambiguity. Countries targeted by prior tariffs may hesitate to reduce retaliatory measures until policy clarity emerges.

The administration has several legal pathways.

It could invoke Section 232 of the Trade Expansion Act, citing national security. It could pursue Section 301 investigations under trade law frameworks. Or it could seek new congressional legislation.

Key Developments

The Supreme Court’s Majority and Dissent

The 6–3 majority opinion emphasized statutory limits rather than broad constitutional doctrine. Chief Justice John Roberts wrote that emergency financial powers do not equate to general tariff authority.

The dissent warned that the ruling may unduly restrict presidential flexibility in responding to economic threats.

President Trump’s public remarks were unusually direct in criticizing the Court. He expressed disappointment and pledged new barriers. Such rhetoric intensifies institutional tension between branches of government.

Latest Facts and Concerns

Economic Uncertainty as Immediate Impact

The most immediate economic impact is uncertainty.

Businesses make investment decisions based on predictable cost structures. When tariff regimes change abruptly, capital expenditures slow.

Inflation dynamics also enter the equation. Tariffs function as taxes on imported goods. Their removal could reduce certain prices. Yet if alternative tariffs emerge, price volatility returns.

Foreign exchange markets must assess implications for the dollar.

Trade partners may reconsider agreements. The ripple effects extend beyond direct tariff targets.

Cause and Effect Analysis

Legal Constraint and Policy Escalation

The cause of the present volatility is the Court’s decision limiting executive authority under IEEPA. The immediate effect is removal of certain tariffs.

However, the secondary cause is presidential reaction. By signaling new barriers, Mr. Trump introduces renewed uncertainty. Investors must consider whether replacement tariffs will equal or exceed previous levels.

Legal constraint does not automatically produce economic stability. Instead, it shifts the battlefield. Policy may migrate from emergency authority to other statutory channels.

Future Steps

Legislative, Executive, and Electoral Pathways

The administration could appeal politically by urging Congress to expand executive trade authority. Alternatively, it may rely on existing trade statutes to reconfigure tariffs.

Congress faces a choice: reassert control or permit broader delegation. The outcome may depend on electoral dynamics.

If new tariffs emerge, legal challenges will likely follow. The judiciary may again be called upon to define limits.

Conclusion

A Rebalanced Constitution and an Uncertain Economy

The Supreme Court’s ruling in Learning Resources v Trump reasserts congressional authority over tariffs and constrains expansive interpretations of emergency power. It marks a constitutional inflection point.

Yet economic stability does not automatically follow judicial clarity. The president’s pledge to pursue new trade barriers ensures continued uncertainty.

In the near term, the economy faces volatility rather than resolution. In the long term, the decision may strengthen institutional balance.

Whether that balance yields a predictable trade policy depends on political choices yet to be made.

Donald Trump, the Supreme Court, and the Politics of Tariff Power: Unpacking Executive Authority, Judicial Limits, and Their Impact on Economic Uncertainty