U.S. Tariff Power Crisis: Supreme Court Checks Trump, Global Impact - Part I

Executive Summary

Supreme Court Limits Presidential Tariff Power: Constitutional Shockwaves at Home and Abroad

The recent ruling by the Supreme Court of the United States striking down former President Donald Trump’s sweeping emergency tariffs marks a defining constitutional and economic moment in contemporary American governance.

In a closely watched decision, the Court held that the president exceeded statutory authority by invoking the International Emergency Economic Powers Act to impose broad, near-universal tariffs on imported goods without explicit authorization from the Congress of the United States.

At its core, the judgment reaffirms the allocation of taxing authority under the United States Constitution, restoring legislative primacy in matters of duties and trade taxation. The consequences are far-reaching.

For Trump, it curtails a signature economic instrument. For the United States, it rebalances institutional authority while introducing fiscal uncertainty, including potential refund claims exceeding $175 billion.

For the global economy, it signals a recalibration of American trade strategy and injects renewed unpredictability into global supply chains.

Introduction

High Court Blocks Emergency Tariffs, Redefines Presidential Trade Power

The Supreme Court’s decision did more than invalidate a tariff schedule. It intervened at the intersection of constitutional design, executive ambition, and global economic interdependence.

Trump’s emergency tariff program, introduced during his second presidential term, applied baseline tariffs of 10% on a wide range of imports, with higher “reciprocal” duties on selected countries.

The administration justified these measures as necessary responses to trade imbalances, national security vulnerabilities, and what it described as structural unfairness in global commerce.

Yet critics argued that such sweeping fiscal measures required congressional approval. The Court agreed.

History and Constitutional Foundations

Supreme Court Curbs Trump Tariffs, Reshaping Global Trade Order

Congressional Control of Taxation

From the founding era, the Constitution vested the power to “lay and collect Taxes, Duties, Imposts and Excises” in Congress. Tariffs historically served as both revenue instruments and strategic trade tools.

Even when Congress delegated limited authority to the executive branch, such delegation was typically specific, conditional, and bounded.

Throughout the 20th century, Congress passed trade statutes allowing presidents to adjust tariffs in defined circumstances, often subject to investigations or national security determinations.

Yet these delegations never amounted to a general blank check.

The Origins of IEEPA

The International Emergency Economic Powers Act of 1977 was enacted to enable presidents to regulate international economic transactions during extraordinary foreign threats. Traditionally, IEEPA was used to freeze assets, impose targeted sanctions, or restrict financial flows involving hostile states.

It did not explicitly mention tariffs as a general fiscal instrument. The Trump administration’s interpretation treated the statute’s language broadly, arguing that regulating economic transactions necessarily included imposing import duties. The Court rejected that expansive reading.

Trump’s Tariff Strategy and Political Context

Tariffs as Political Economy

Trump’s political brand has long emphasized economic nationalism.

During both of his presidencies, tariffs were framed as tools to revive domestic manufacturing, protect American jobs, and counter strategic competitors.

The emergency tariffs were portrayed as leverage against persistent trade deficits and as bargaining chips in negotiations. Supporters credited them with strengthening U.S. negotiating positions.

Critics argued they functioned as de facto taxes on American consumers and import-dependent industries.

Revenue and Market Effects

The tariffs generated substantial revenue, with federal collections estimated at over $175 billion during implementation.

However, economists widely debated who ultimately bore the cost. Many studies suggested that importers and consumers absorbed much of the burden through higher prices.

The policy also triggered retaliatory tariffs from trading partners, increasing volatility in sectors ranging from agriculture to automotive manufacturing.

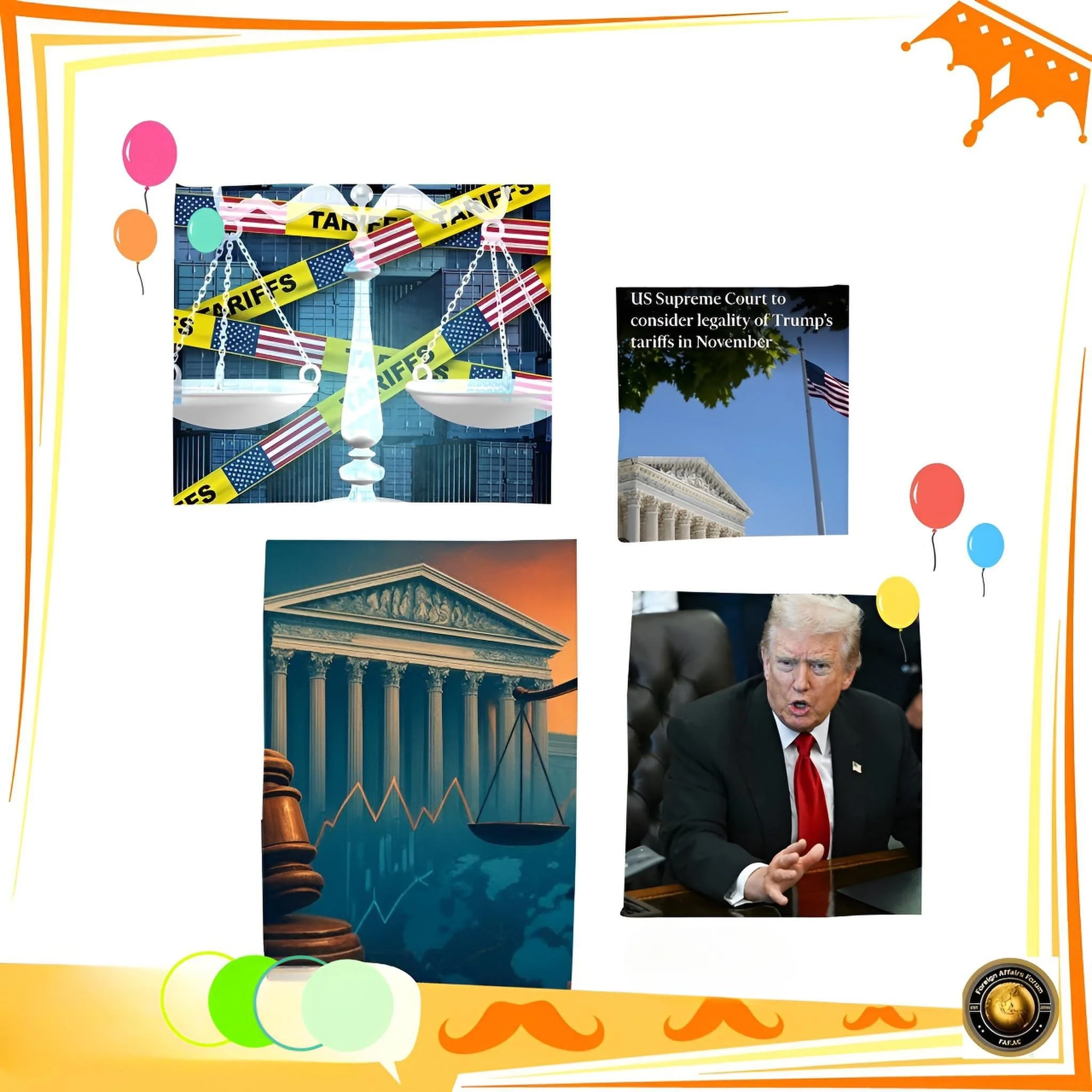

The Supreme Court Decisions

Majority Reasoning

In a 6–3 ruling, the Court concluded that IEEPA does not authorize broad tariff imposition absent explicit congressional language.

The majority opinion emphasized textual interpretation and constitutional structure. If Congress intended to transfer core taxing authority to the executive branch, it would have done so unmistakably.

The Court stressed that emergency powers cannot swallow the constitutional allocation of fiscal authority. Allowing unilateral tariff imposition under a generalized emergency statute would effectively relocate taxing power from Congress to the presidency.

Dissenting Perspective

The dissenting justices argued that Congress had granted the executive sufficient discretion under IEEPA’s broad regulatory language.

They contended that courts should defer to the political branches in matters involving foreign policy and national economic security.

The majority, however, prioritized structural safeguards over executive flexibility.

Current Status and Immediate Consequences

Legal and Administrative Implications

The ruling invalidates tariffs imposed under IEEPA authority. It does not automatically dismantle sector-specific tariffs authorized under other statutes. However, the sweeping global framework central to Trump’s economic strategy is effectively nullified.

The most immediate legal challenge concerns refund claims.

Importers who paid tariffs may seek reimbursement. If courts order repayment, the Treasury could face liabilities exceeding $175 billion.

Such refunds would strain federal finances and complicate budget projections.

Political Repercussions

For Trump, the decision represents a political setback. His administration must now seek congressional cooperation for future tariff initiatives. In a polarized legislature, securing such approval may prove difficult.

Opponents hail the ruling as a victory for constitutional governance. Supporters criticize it as judicial interference in economic strategy.

Global Trade Repercussions

Market Recalibration

Global markets reacted with cautious optimism. Investors interpreted the ruling as reducing immediate trade friction. Companies reliant on imported components anticipate cost relief.

However, uncertainty remains. Businesses must assess whether Congress will enact new tariff legislation or whether the administration will pivot to alternative trade tools.

Diplomatic Signals

Allies and rivals alike interpret the ruling as evidence that American institutions can constrain executive volatility.

For countries affected by tariffs, including major exporters in Asia and Europe, the decision may improve trade prospects.

Yet unpredictability persists. Trade diplomacy now depends more heavily on congressional processes, potentially slowing negotiations but increasing procedural legitimacy.

Cause-and-Effect Analysis

Executive Expansion and Judicial Correction

The cause of the crisis lay in expansive statutory interpretation.

The administration sought to transform emergency regulatory authority into a fiscal instrument. This produced immediate economic effects but triggered legal backlash.

The effect of the Court’s intervention is a reassertion of institutional balance. It restores congressional primacy but reduces executive agility in trade disputes.

Economic Ripple Effects

Short-term effects include potential price adjustments as tariffs disappear. Consumers may benefit from lower import costs. Certain domestic producers may face renewed competition.

Long-term effects depend on congressional response. If legislators codify new tariff powers, executive authority may return in modified form. If not, American trade policy could become more negotiation-driven and less unilateral.

Future Steps

Legislative Clarification

Congress may respond by drafting explicit legislation granting conditional tariff authority during national emergencies. Such legislation would likely include procedural safeguards and sunset clauses.

Litigation and Fiscal Adjustment

Courts will oversee refund processes. The executive branch must coordinate with customs authorities and importers. Fiscal planning will require revision to accommodate potential repayments.

Strategic Trade Policy

The administration may shift emphasis toward targeted trade remedies under existing statutes or toward multilateral negotiations.

Conclusion

Trump Tariff Strategy Halted By Landmark Supreme Court Decision

The Supreme Court’s ruling reshapes the architecture of American trade governance. By reaffirming Congress’s exclusive authority over taxation, it restores constitutional clarity while constraining executive discretion.

For Trump, the judgment curtails a central policy lever.

For the United States, it rebalances institutional power and introduces fiscal uncertainty.

For the world, it signals that American trade policy, though politically contentious, remains anchored in constitutional limits.

In an era of geopolitical competition and economic fragmentation, the decision underscores a foundational truth: durable trade policy must rest not only on strategic ambition but on constitutional legitimacy.