The Precipice: Iran’s Internal Collapse and the Threat of “Round Two”

Executive Summary

As of January 1, 2026, the Islamic Republic of Iran faces an existential convergence of internal and external threats.

Domestically, the nation is gripped by its most severe economic crisis in decades, with the Rial collapsing to record lows of 1.45 million against the U.S. dollar, triggering nationwide riots that began in Tehran’s bazaars and have spread to universities. Externally, the ceasefire following the “12-Day War” of June 2025 is fraying.

Israel, emboldened by the transitional U.S. administration’s support, is openly preparing for a “surprise war” to dismantle what remains of Iran’s nuclear and missile infrastructure. However, the regional anti-Iran coalition is fracturing, evidenced by the sudden military rupture between Saudi Arabia and the UAE in Yemen on December 30, 2025.

FAF analyzes whether Tehran’s internal paralysis provides the window for a decisive external strike or if regional chaos will shield the regime.

Introduction

The geopolitical landscape of the Middle East has entered a period of extreme volatility. Following the brief but destructive conflict in June 2025, a fragile status quo held for six months. That stability has now evaporated.

The trigger is not a military provocation, but an economic implosion within Iran that has forced the regime’s core constituency—the merchant class—into the streets.

Simultaneously, signals from Tel Aviv and Washington suggest that the window for a diplomatic resolution has closed. With the return of Donald Trump’s influence on U.S. policy and Prime Minister Netanyahu’s renewed mandate, the region stands on the brink of a “Round Two” conflict, potentially far more expansive than the clashes of 2025.

History and Current Status

The Shadow of June 2025

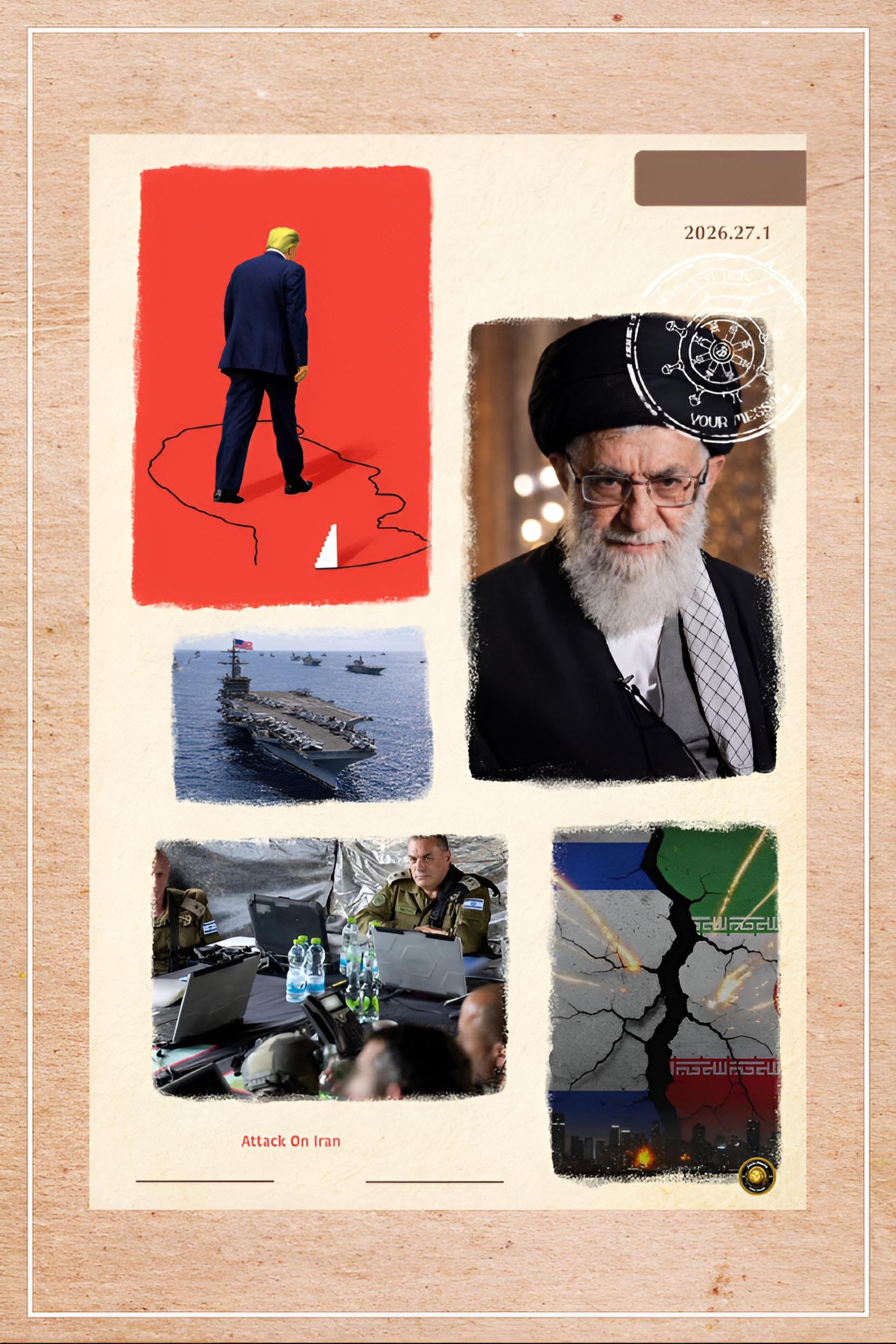

The current crisis is deeply rooted in the unresolved outcome of the “12-Day War” in June 2025. In that conflict, Israel, later joined by U.S. air assets, targeted Iran’s nuclear enrichment sites and ballistic missile production facilities. While the strikes inflicted heavy damage and killed over 1,000 Iranians—including senior IRGC commanders—they failed to completely decapitate the regime or eliminate its nuclear knowledge base.

The Uneasy Interbellum

Since the ceasefire in late June 2025, Iran has engaged in a rapid, clandestine reconstitution of its missile arsenal. Israeli intelligence has repeatedly warned that Tehran is using the pause to harden its facilities against future bunker-buster munitions.

Meanwhile, the Iranian economy, battered by the war and the “snapback” of UN sanctions, has slowly suffocated.

The government of President Masoud Pezeshkian has proven unable to stabilize the currency or restore energy supplies, leading to a winter of discontent that has now boiled over.

Key Developments (December 2025 – November January 2026)

Three distinct vectors have converged in the last 72 hours to create a perfect storm:

The Bazaar Riots

On December 28, 2025, shopkeepers in Tehran’s Grand Bazaar—historically the barometer of regime stability—shuttered their stores.

The protests rapidly evolved from economic grievances to anti-regime demonstrations, spreading to Isfahan, Yazd, and university campuses. Unlike the 2022 protests, these are driven by absolute economic desperation rather than social liberties alone.

The Trump-Netanyahu Summit

In late December 2025, Prime Minister Netanyahu met with President Donald Trump (amidst the U.S. transition period). Leaked details suggest a “green light” for Israel to initiate “Round Two” if Iran is found to be reconstituting its nuclear program. Trump’s rhetoric has been bellicose, promising to “knock the hell” out of Iran if provocations continue.

The Gulf Rift

In a shocking geopolitical twist, the anti-Iran coalition fractured on December 30, 2025. Saudi Arabia launched airstrikes against UAE-backed separatist forces in Yemen, accusing them of destabilizing the border.

The UAE responded by announcing a full withdrawal of its remaining forces from Yemen. This split between Riyadh and Abu Dhabi complicates any coordinated regional defense against Iran, potentially creating a chaotic vacuum Tehran could exploit.

Latest Facts and Concerns

Economic Collapse

The Rial is trading at approximately 1,450,000 to the USD, a devaluation that has made basic imports impossible. Inflation has officially breached 50%, though real-world figures are likely higher.

Military Posture

Israel and the U.S. recently concluded high-level aerial drills involving B-52 strategic bombers and F-35I Adir fighters, simulating deep-strike missions against fortified targets.

Regime Crackdown

As of January 1, 2026, the first fatalities have been reported. A member of the Basij paramilitary force was killed in Lorestan, and security forces have deployed live ammunition in Tehran. The regime has threatened a “severe response” to both the rioters and any external aggressors

Strategic Warning

Israeli intelligence has warned the U.S. that ongoing Iranian missile drills may be a ruse to mask a surprise launch, mirroring the tactics used in previous conflicts.

Cause-and-Effect Analysis

The Economic-Military Feedback Loop

The riots are a direct downstream effect of the June 2025 war. The destruction of infrastructure and subsequent sanctions isolated Iran’s economy.

Cause

The regime prioritized military rebuilding over economic relief, diverting scarce hard currency to the IRGC.

Effect

This led to a liquidity crisis, causing the Rial’s freefall.

Secondary Effect

The currency collapse triggered the bazaar strikes.

Strategic Consequence

The internal chaos forces the regime into a “use it or lose it” dilemma. Feared to be weak by its own population, the IRGC may launch an external attack on Israel to rally nationalist sentiment and justify a martial law crackdown at home.

The Israeli Opportunity Calculation

Tel Aviv views the internal riots as a dual-edged sword.

Opportunity

A distracted and unpopular Iranian regime might be unable to coordinate an effective defense against airstrikes. The internal division weakens the “home front.”

Risk

An external attack could inadvertently save the regime by transforming an anti-government protest into a “defense of the fatherland” movement. However, current Israeli assessments suggest they believe the regime is too brittle to benefit from a “rally around the flag” effect.

Future Steps and Scenarios

Scenario A

The Preemptive Strike (High Probability)

Israel, utilizing the current window of U.S. transition and Iranian chaos, launches a massive “decapitation” strike targeting the Supreme Leader’s command centers and remaining nuclear sites. This would likely occur before the Iranian New Year (Nowruz) in March 2026.

Scenario B

Implosion and Civil War (Moderate Probability)

The protests escalate into armed insurrection. The IRGC fractures, with lower ranks refusing to fire on citizens. In this scenario, Israel holds fire to avoid unifying the factions, preferring to let the regime consume itself.

Scenario C

The Regional Wildfire (Low to Moderate Probability)

Iran, sensing imminent collapse, lashes out not at Israel, but at the fractured Gulf states. Exploiting the Saudi-UAE rift, Iran activates proxies in Yemen and Iraq to attack Saudi oil infrastructure, aiming to spike global oil prices and force a diplomatic intervention that preserves the regime.

Conclusion

The convergence of the Rial’s collapse and the aggressive posture of the U.S.-Israel alliance has pushed the Middle East to a critical juncture.

The Islamic Republic is currently fighting a two-front war: one against its own starving population and another against a technologically superior external adversary preparing for a definitive strike.

The decisive factor will likely be the cohesion of Iran’s security services; if the Basij and IRGC waver in suppressing the riots, Israel may strike immediately to finish what began in June 2025.

Conversely, if the regime stabilizes the streets with brutality, it may turn its reconstituted missile arsenal outward to break its isolation.