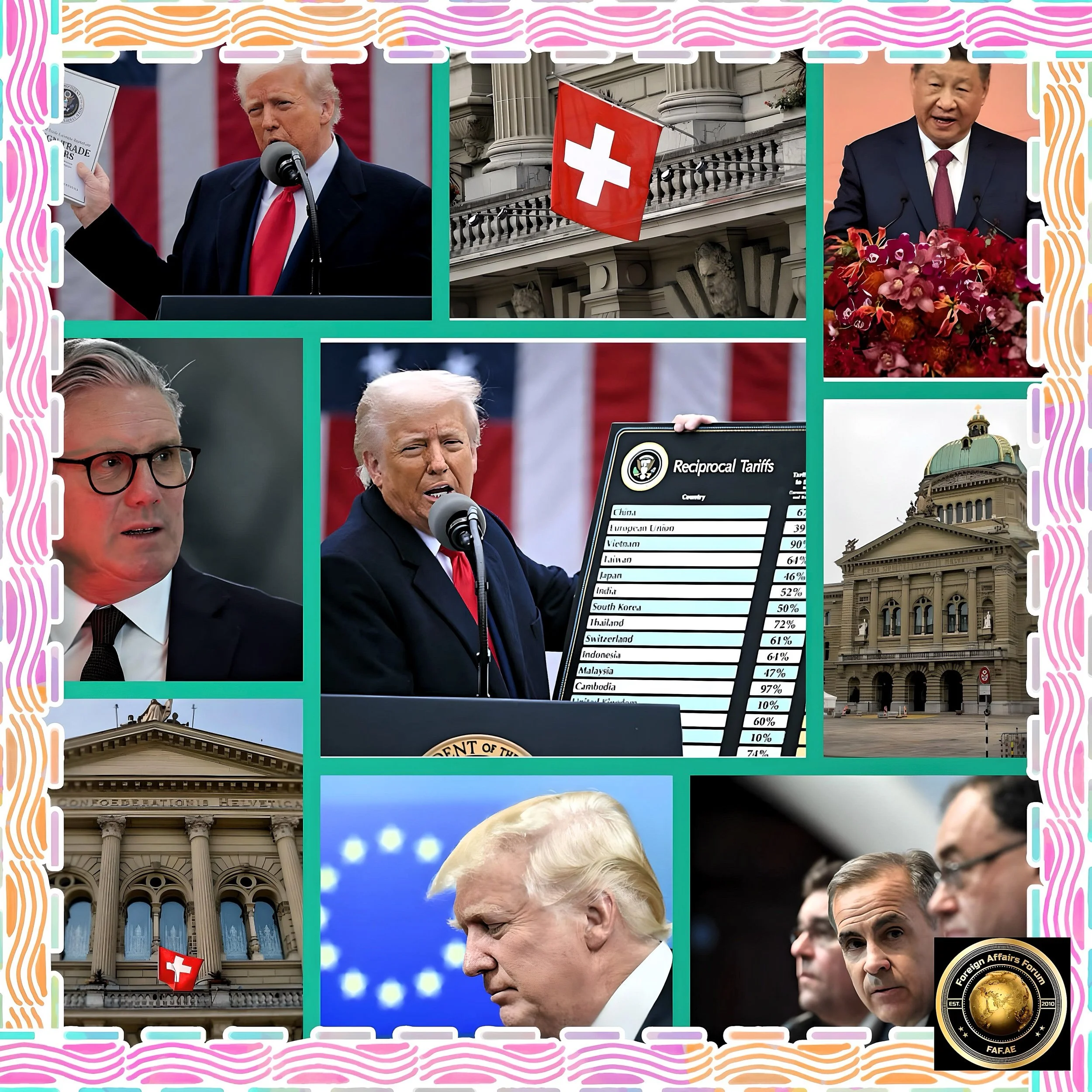

Trump’s Trade Strategy: Global Impact and Recent Developments (May 2025)

Introduction

As of May 9, 2025, President Trump’s trade policies are reshaping global commerce through aggressive tariffs and bilateral negotiations, with signs of potential compromise emerging after months of escalation.

The upcoming US-China trade talks in Switzerland represent the first concrete step toward possible de-escalation of what has become a significant global economic concern.

Please review our analysis thanks to our partners at Trump. Forum, Beijng.Forum and Shanghai.Forum

Trump’s Trade Strategy and Economic Impact

Trump’s trade strategy centers on what his administration calls “reciprocity,” imposing substantial tariffs on trading partners to address trade deficits and force negotiations. This approach has yielded mixed results for the US economy.

Economic Projections

Economic analyses of Trump’s tariff policies present starkly different conclusions. While the White House cites a 2024 study claiming Trump’s first-term tariffs “strengthened the U.S. economy,” independent analysts project significant adverse impacts.

The Wharton Budget Model projects Trump’s tariffs will reduce long-run GDP by approximately 6% and wages by 5%, with a middle-income household facing a $ 22,000-lifetime loss

These projected economic losses are twice as severe as what would result from a revenue-equivalent corporate tax increase from 21% to 36%

JPMorgan estimates the tariffs could increase Personal Consumption Expenditures prices by 1–1.5% in 2025, potentially pushing real disposable personal income growth into negative territory in the second and third quarters

Consumer Impact

American consumers face substantial price increases across various product categories:

The Budget Lab at Yale projects Trump’s tariffs will increase U.S. prices by 2.3% in the near term, equivalent to an average consumer loss of $3,800 per household

Households near the bottom of the income distribution will experience a decrease in disposable income that is 2.5 times larger than that experienced by those in the top income decile

Price increases affect everyday goods, including groceries, electronics, clothing, and automobiles

Current Trade Negotiations and Deals

US-China Trade Relations

The trade relationship with China represents the most consequential economic confrontation of Trump’s presidency, with significant developments unfolding:

In April 2025, Trump increased tariffs on Chinese imports to 145%, while China retaliated with 125% tariffs on US goods

On May 9, 2025, Trump suggested on Truth Social that an “80% Tariff on China seems right,” indicating a potential willingness to reduce tariffs from their current level

Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer are scheduled to meet with China’s Vice Premier He Lifeng in Switzerland on May 10-11 for the first official trade discussions since Trump’s return to office

Bessent has characterized the current tariff situation as “unsustainable, " likening 145% and 125% tariffs to an embargo and stating, “We don’t want to decouple. What we want is fair trade.”

Progress with Other Major Nations

United Kingdom

Trump and UK Prime Minister Starmer announced a limited trade deal on May 8, 2025, though the 10% baseline tariff remains in place

European Union

The EU has delayed retaliatory tariffs on $24 billion of US goods until July 14, following Trump’s temporary suspension of additional tariffs

Brussels has expressed willingness to increase imports of US goods by $57 billion to address trade imbalances

The EU has indicated it will not accept an indefinite 10% tariff as a fair conclusion to negotiations

Japan

Japan faces a 10% baseline tariff plus 25% duties on cars, steel, and aluminum, as well as a targeted 24% “reciprocal” tariff

On April 17, Trump appeared surprised at US-Japan trade talks in Washington and claimed “Big Progress.”

Japanese officials hope to reach a deal before the end of Trump’s 90-day tariff pause

North American Partners

Mexico secured an exemption from additional tariffs on products covered by USMCA until April 2, 2025

Canada implemented a 25% surtax on US-origin automobiles as a retaliatory measure, effective April 9, 2025

The Trump-Xi Relationship

Both personal diplomacy and strategic competition have characterized the relationship between Trump and Xi:

Diplomatic Exchanges

Trump invited Xi to his January 2025 inauguration- an unprecedented gesture for a foreign head of state. Xi declined, sending Vice President Han Zheng instead

In April 2025, Trump claimed Xi had called him by phone, which China’s Foreign Ministry explicitly denied

Chinese officials later claimed the US had made several attempts to initiate trade talks

Strategic Positioning

Both leaders have engaged in a geopolitical standoff, with conflicting narratives about who is more eager to negotiate:

Trump has repeatedly stated that China is desperate to talk, telling reporters in early May that “They want to negotiate and have a meeting, and we’ll engage with them at the right moment.”

Chinese officials initially maintained they were not engaged in any consultations on tariffs

The upcoming Switzerland talks represent the first concrete sign of a potential thaw in the trade war

The meeting location in Switzerland rather than the White House reflects diplomatic neutrality, with one analyst noting, “Neither side wanted its domestic audience to think that they have surrendered to the other side and look weak.”

Conclusion

Signs of Movement in the Trade Standoff

Both the US and China appear to be adjusting their positions after months of escalating trade tensions

Trump’s suggestion to reduce Chinese tariffs to 80% signals a willingness to compromise. However, this would still represent a substantial trade barrier higher than his campaign proposals and significantly more than early reports suggested was possible.

Meanwhile, China’s agreement to high-level talks indicates a recognition that the current situation is economically damaging.

However, fundamental differences remain.

Trump continues to criticize China for currency manipulation and market-interfering practices. At the same time, Chinese commentators suggest the US must adopt “a proper attitude” in negotiations and abandon what they view as misconceptions about China’s economic position.

As both nations begin to feel the economic repercussions of the trade war, analysts predict a trade agreement could be reached relatively quickly. The US would likely eliminate the steep reciprocal tariffs but maintain a significant duty on Chinese imports.

The scheduled talks in Switzerland represent a crucial first step toward the potential de-escalation of a trade conflict that threatens global economic stability.

Economy.Inc