Can Washington and Beijing Walk Back Their Trade War? Navigating the Path to Negotiation

Introduction

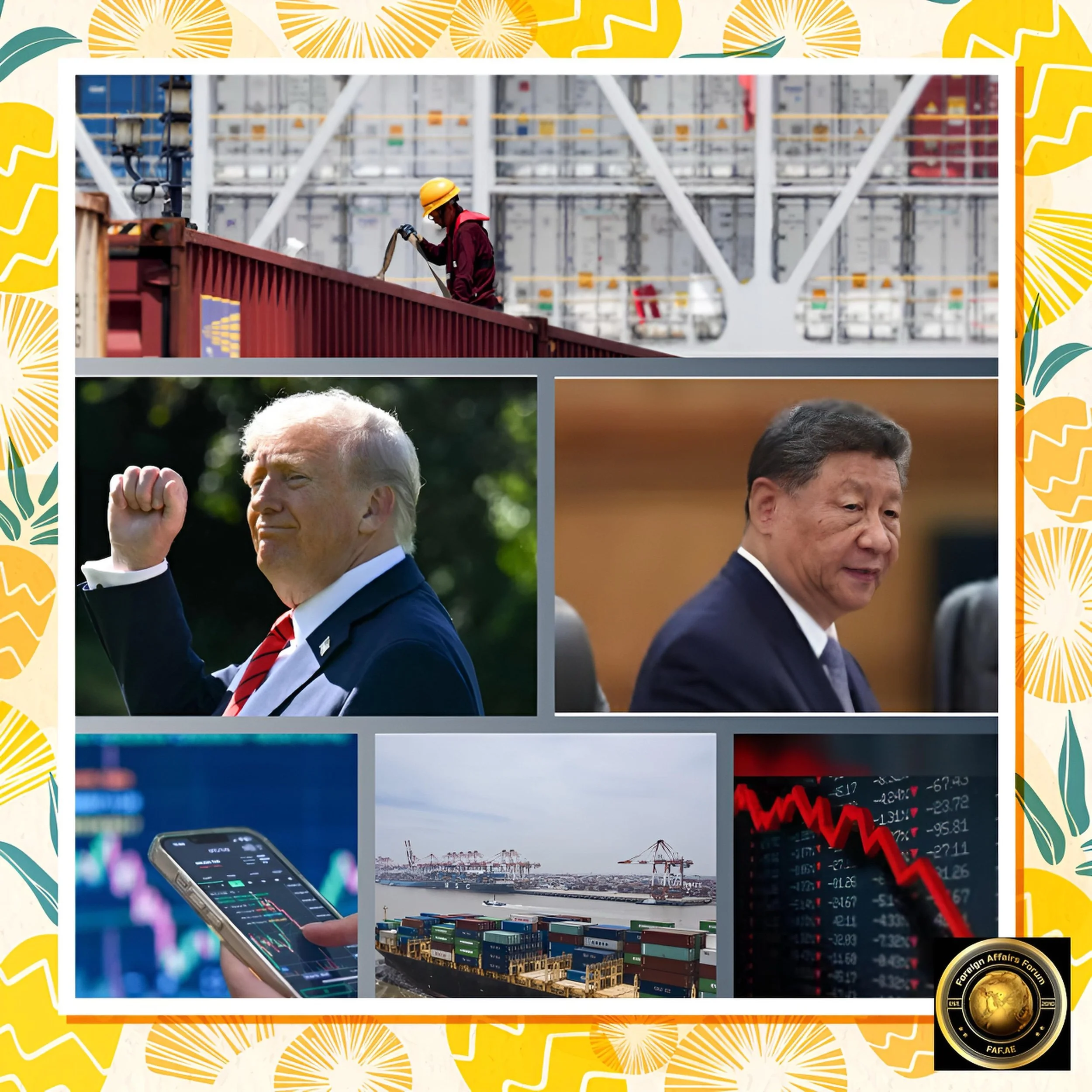

The escalating trade conflict between the United States and China has reached unprecedented levels, with tariffs now at an extraordinary 145% from the US and 125% from China. Despite these punitive measures, both nations are willing to engage in negotiations. However, the journey to meaningful dialogue faces substantial obstacles amid a climate of strategic posturing and economic brinkmanship. This report examines whether these economic superpowers can de-escalate their trade war and the complex factors determining this outcome.

The Rapid Escalation of Trade Tensions

The US-China trade relationship has deteriorated dramatically since President Trump’s inauguration in January 2025. What began as relatively modest tariff increases has spiraled into a full-scale economic confrontation in just three months:

Timeline of Escalation

The conflict accelerated rapidly through a series of retaliatory measures:

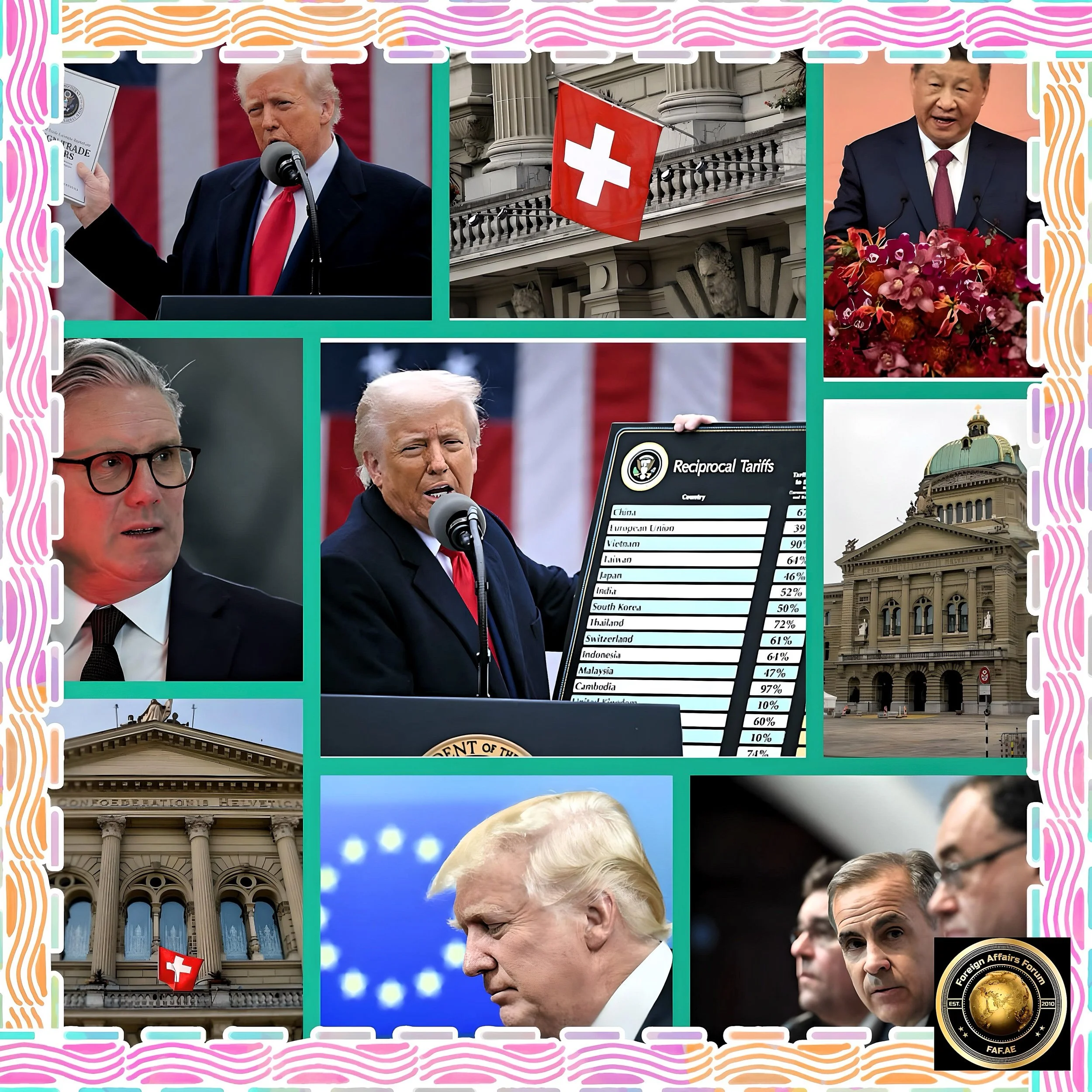

February 4, 2025: Trump reinstated 10% tariffs on all Chinese imports; Beijing responded with duties on US coal, gas, and agricultural machinery.

March 4, 2025: Additional 10% US tariffs took effect, prompting China to raise duties on key US exports.

April 3, 2025: Trump declared “Liberation Day,” implementing a 34% tariff on Chinese imports, effectively raising the total tariff rate to 54%.

April 4, 2025: China retaliated with matching 34% tariffs, suspended purchases of US agricultural products, announced export controls on rare earth minerals, and blocked 27 US firms.

April 9, 2025: US tariffs surged to 104% after China refused to withdraw retaliatory measures.

April 10, 2025: Trump raised tariffs on Chinese imports to 125% (later clarified as 145%) while pausing tariffs for other nations for 90 days.

April 11-12, 2025: China raised its tariffs on all US goods to 125%, declaring it would “fight to the end.”

This rapid intensification has created the most severe trade conflict between significant economies in modern history, threatening $600 billion in bilateral trade and risking significant economic damage globally.

Mixed Signals on Negotiation Readiness

Both Washington and Beijing have sent contradictory signals regarding their willingness to negotiate, creating uncertainty about the prospects for de-escalation.

The US Position

President Trump has repeatedly claimed that China wants to make a deal but “doesn’t know how to go about it.” On April 10, after announcing the 125% tariffs, Trump stated he was awaiting a response from Chinese President Xi Jinping to negotiate an agreement. He added that he “can’t imagine” raising tariffs on China further.

However, US Trade Representative Jamieson Greer has expressed skepticism about China’s readiness for negotiations. After China announced retaliatory measures, Greer noted: “Other countries have indicated they want to find a path forward on reciprocity. China has not indicated that, and we’ll see how this plays out”.

The Chinese Position

China’s stance has hardened noticeably since early April. While initially appearing open to dialogue, recent statements show a shift in tone:

China has dropped previous calls for trade negotiations in recent communications that condemned US tariffs.

China’s commerce and foreign ministries have repeatedly stated they are open to negotiations only if conducted under conditions of “equality and mutual respect.”

Commerce Ministry spokesperson Yong Liu emphasized that China will not yield to “pressure, threats, and blackmail” and is prepared to “fight to the end.”

President Xi Jinping stated that China is “not afraid” and “undaunted” by US pressure in his first public comment on the trade war.

This hardened stance suggests China believes it must demonstrate resolve before any productive negotiations can occur. As analysts at Eurasia Group noted, “A strong, asymmetric, retaliatory tariff response is a prerequisite for Beijing to engage in negotiations”.

Obstacles to De-escalation

Several significant barriers stand in the way of meaningful negotiations between Washington and Beijing:

Strategic Resolve Over Economic Pragmatism

The conflict has evolved beyond purely economic considerations. As Zhao Minghao, deputy director at the Centre for American Studies at Fudan University, observed: “It is no longer a game about tariffs themselves, but a game of strategic resolve”. China has adopted an attitude of being “prepared to go the distance and pay any price,” suggesting that economic pain alone may not be sufficient to force concessions.

This strategic dimension makes compromise more difficult, as both sides view backing down as a sign of weakness in the broader geopolitical competition. The conflict has become a test of wills that transcends trade policy.

Domestic Political Considerations

For both leaders, there are significant domestic political constraints. Trump campaigned on taking a tough stance against China and has portrayed the trade conflict as defending American workers. Any perceived capitulation could be politically damaging.

Similarly, Xi Jinping faces pressure to maintain China’s dignity and sovereignty. The Chinese government has framed US actions as “bullying” and “unilateral,” making it difficult to accept terms that might appear as submission to American pressure.

Fundamental Economic Differences

The trade dispute reflects deeper structural differences between the American and Chinese economic systems. US concerns about intellectual property protection, forced technology transfer, and state subsidies to Chinese industries represent fundamental disagreements about economic governance.

These structural issues are more difficult to resolve than simple tariff levels, requiring significant policy changes that either side may be unwilling to make.

Heightened Mistrust

The rapid escalation of tariffs has damaged trust between the two nations. China’s perception that the US is seeking to “humiliate China and wreck its economy” rather than negotiate in good faith creates a significant barrier to productive dialogue.

Pathways to Potential Resolution

Despite these obstacles, several factors suggest that a resolution, though difficult, remains possible:

Economic Reality as a Driving Force

The economic costs of sustained high tariffs are substantial for both countries:

Analysts at Goldman Sachs predicted that even the 104% tariffs (before the increase to 145%) would reduce China’s GDP growth by 2.4 percentage points.

Morgan Stanley’s chief economist for China, Robin Xing, estimated that the trade conflict could impede China’s economic growth by approximately 1-2 percentage points per year.

For the US, JP Morgan analysts estimated the economic burden could reach about $860 billion for American consumers before alternative suppliers can be found.

These mounting economic pressures could eventually compel both sides to seek a compromise, particularly if domestic economic conditions deteriorate.

The Global Economic Context

The threat of a global recession resulting from the US-China trade war creates additional incentives for resolution. Other nations affected by disrupted supply chains and market volatility may exert diplomatic pressure on both Washington and Beijing to find a solution.

Potential for Phased De-escalation

A full resolution may not be immediately achievable, but a phased approach could begin the de-escalation process:

Initial confidence-building measures: Both sides could agree to pause further tariff increases while maintaining current levels.

Targeted concessions: Specific areas of mutual interest could be addressed first, such as agricultural trade or certain manufacturing sectors.

Gradual tariff reduction: A step-by-step reduction of tariffs, tied to progress on structural issues.

This approach would allow both sides to claim victories while working toward a more comprehensive agreement.

India as a Potential Beneficiary

As the US-China trade war continues, India stands to gain significantly by positioning itself as an alternative manufacturing and trade partner:

Apple has already increased iPhone manufacturing in India, with approximately 1.5 million units airlifted to the US in March 2025 to avoid Chinese tariffs.

Indian exporters could seize more than $50 billion in market opportunities over the next two to three years, according to the Federation of Indian Export Organisations.

India’s Production-Linked Incentive (PLI) program is actively promoting manufacturing in electronics, pharmaceuticals, and renewables, attracting businesses seeking to diversify from China.

India’s potential emergence as a manufacturing alternative demonstrates how the trade war is reshaping global supply chains, creating both challenges and opportunities in the international economic landscape.

Conclusion

A Painful but Possible Journey

The path to resolving the US-China trade war appears long and fraught with difficulties. Both nations have adopted hardened positions that make immediate reconciliation unlikely. As Nick Marro, an economist at the Economist Intelligence Unit, noted, the current situation may be “the clearest indication we’ve seen of pushing a hard decoupling”.

However, the economic realities and global stakes remain powerful incentives for eventual de-escalation. Most analysts believe that after several months of economic pain and strategic positioning, both sides may return to more rational negotiations. The interdependent nature of the global economy makes a permanent, complete decoupling highly problematic for both nations.

The most likely scenario is a protracted period of tension followed by gradual, incremental steps toward resolution. While Washington and Beijing can theoretically walk back their trade war, they appear set to take a painful and circuitous route to get there.

The journey toward negotiation will require patience, strategic reassessment, and a willingness on both sides to find face-saving compromises that address their core interests while avoiding economic self-harm.