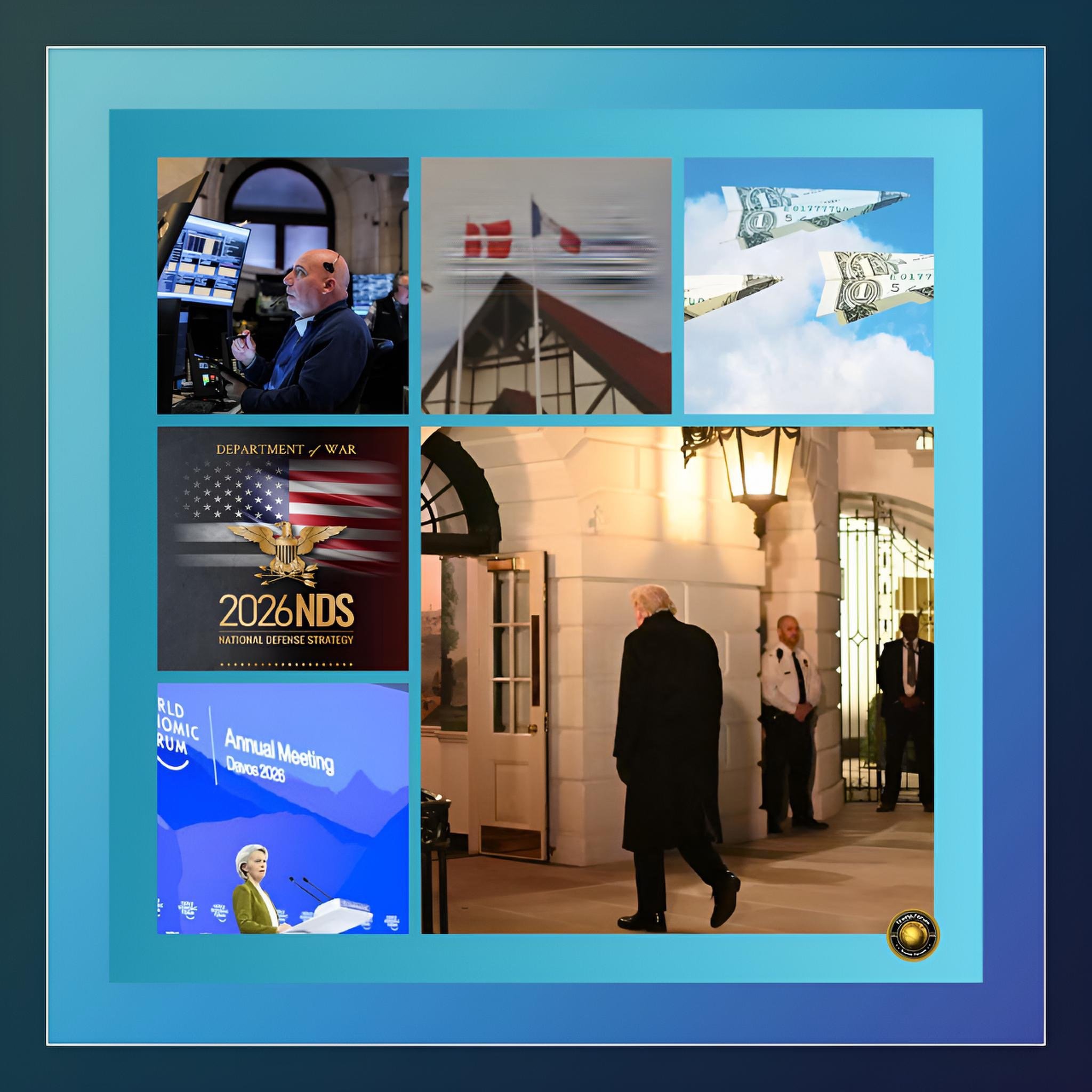

How Treasuries and Capital Flows Are Rewriting Modern Geopolitics

Executive Summary

Bond Markets Become Weapons in Rising Global Financial Power Struggles

Global finance is reentering an era in which capital markets function not only as economic mechanisms but as strategic weapons.

The Greenland crisis preceding Davos revealed how sovereign debt, reserve holdings, and institutional capital flows can be mobilized to influence state behavior without formal sanctions or military escalation.

Europe’s implicit threat to reduce holdings of U.S. Treasurys, echoed by private pension fund reallocations, demonstrated the latent power embedded within bond markets.

The episode underscores a broader transformation in international relations: finance has become an arena of coercion, signaling, and retaliation.

FAF analysis delves into the historical roots, current dynamics, and future implications of weaponized finance in a fragmenting global order.

Introduction

Weaponized Finance Returns as States Turn Markets Into Strategic Tools

For much of the post-Cold War period, global capital markets were treated as neutral infrastructure.

Bonds, currencies, and reserves were understood as technical instruments governed by efficiency, liquidity, and trust. That assumption no longer holds.

As geopolitical competition intensifies and diplomatic channels erode, states increasingly view financial interdependence as leverage rather than vulnerability.

The events surrounding the Greenland dispute offered a revealing glimpse into this new reality. European policymakers and financial institutions openly discussed the possibility of using U.S. Treasury holdings as strategic pressure against Washington.

Even without formal execution, the signaling effect alone altered diplomatic tone.

The episode confirmed that bond markets are no longer passive reflections of power but active instruments of it.

History and Current Status

Weaponized finance is not new. During the Cold War, capital controls, embargoes, and currency restrictions were standard tools of statecraft. What distinguishes the current era is scale and integration.

Global financial markets are deeper, faster, and more interconnected than at any point in history. Trillions of dollars circulate daily through sovereign debt markets, reserve portfolios, and institutional funds.

After 1991, the expansion of liberalized capital flows created the illusion of permanence.

The U.S. Treasury market became the world’s ultimate safe asset, supported by American military dominance, legal stability, and economic size. Europe, China, Japan, and Gulf states accumulated vast Treasury holdings as reserves and collateral.

This arrangement functioned smoothly as long as geopolitical alignment remained broadly intact.

That alignment has fractured. Strategic rivalry, trade disputes, sanctions regimes, and contested sovereignty have eroded trust. Financial assets once considered apolitical now carry implicit allegiance.

The current status is a world in which capital mobility remains high, but political neutrality has vanished.

Key Developments

The Greenland episode crystallized several developments already underway.

First, financial actors are increasingly willing to speak openly about geopolitical leverage embedded in capital allocation.

Second, private institutions such as pension funds are no longer insulated from political signaling.

Third, states recognize that even marginal shifts in sovereign debt demand can influence exchange rates, yields, and diplomatic posture.

Europe’s leverage derives not from dominance but from coordination.

Collectively, European public and private institutions hold a significant share of U.S. Treasurys.

Even a modest reduction can generate market attention, particularly when framed as politically motivated. The effect is psychological as much as material.

The U.S. response revealed awareness of vulnerability. Public disavowals and reassurance efforts signaled concern not about immediate financing capacity, but about precedent.

Once debt markets are openly politicized, the assumption of automatic demand weakens.

Latest Facts and Concerns

Since the incident, volatility in sovereign bond markets has increased modestly. Yield sensitivity to political statements has grown. Reserve diversification discussions have intensified in Europe, Asia, and the Gulf.

While the dollar remains dominant, marginal flows increasingly favor Euro assets, gold, and selective non-Western instruments.

The primary concern among policymakers is escalation. Weaponized finance invites retaliation. If one bloc treats debt holdings as leverage, others may respond in kind.

This dynamic risks fragmenting liquidity and increasing borrowing costs globally. Another concern is miscalculation.

Market signaling can produce outsized reactions disconnected from policy intent.

Cause-and-Effect Analysis

The cause of weaponized finance lies in strategic distrust. As states lose confidence in mutual restraint, they seek influence through instruments short of force.

The effect is a redefinition of financial stability as a security issue. Bond yields now respond not only to inflation or growth expectations, but to diplomatic posture and alliance cohesion.

Europe’s signaling caused a measurable softening in U.S. rhetoric toward European strength.

This illustrates the feedback loop between markets and diplomacy. Financial pressure alters political tone, which in turn stabilizes markets. The system becomes reflexive rather than rule-based.

Over time, repeated use of such tools erodes their effectiveness. If markets anticipate politicization, they price it in. This raises systemic risk and reduces the stabilizing function of reserve assets.

Future Steps

The next phase will involve institutional adaptation. States will seek to insulate critical financing from geopolitical exposure.

This may include regional clearing systems, bilateral debt arrangements, and alternative reserve compositions. Financial diplomacy will become a formal domain alongside trade and security.

For the U.S., preserving Treasury primacy will require restoring predictability and alliance trust.

For Europe, leverage will depend on coordination rather than scale. For emerging powers, the incentive to build parallel financial infrastructure will intensify.

Conclusion

From Davos to Debt Markets Finance Enters a New Cold War

Bond markets have become arenas of power projection.

The Greenland episode was not an anomaly but a signal of structural change. In an era of contested globalization, finance is no longer neutral territory.

It is a battlefield shaped by perception, coordination, and credibility. States that understand this reality will shape outcomes.

Those that ignore it will be shaped by them.