Will Countries Stop Investing Money in America Because of the New Pentagon Strategy?

EXECUTIVE SUMMARY

How America's Military Plan Could Make Foreign Investors Want to Pull Their Money Out

The new Pentagon strategy will not cause all foreign investors to rush out of America tomorrow, but it does make it more likely that they will slowly pull some of their money out over time. Countries and significant investment funds that own American stocks, bonds, and other assets are now wondering if they should trust America as much as they used to. When America's leaders seem unpredictable or willing to hurt their own economy, investors get nervous. The new strategy sends a signal that America cares less about keeping the world stable and more about protecting itself.

This makes foreign investors think twice about how much of their money to keep in America. This article explains why that matters and what could happen next.

INTRODUCTION

WHY MILITARY STRATEGY MATTERS TO INVESTORS

Most people think that military strategy is something that only generals and politicians care about. But investors care a lot about military strategy, too. Investors have to decide where to put their money.

They want to know: Will this country stay stable?

Will the government keep its promises? Will bad things happen that make my investments lose value?

When a government changes its military strategy, it tells investors something important about how the country thinks about the future.

The new Pentagon strategy tells foreign investors a different story from the old one.

The old story said: "America protects the world, keeps things stable, and follows the rules. If you put your money in America, it will be safe."

The new story says: "America is going to focus on protecting itself first. It will help other countries less. It might get into fights with other countries more often."

That new story makes investors nervous. If America becomes less predictable and less friendly toward countries whose people own American investments, those investors may want to move their money elsewhere.

WHAT IS HAPPENING TO FOREIGN MONEY IN AMERICA RIGHT NOW

For many decades, money from all over the world has been flowing into America. Why? Because America looked safe and stable. Foreign countries kept their savings in American banks and government bonds.

Companies worldwide bought American stocks. Rich people in other countries bought American real estate and businesses. America became the place where the world kept its most essential savings.

The United States government borrowed vast amounts of money from other countries by selling them Treasury bonds. These are pieces of paper that promise to pay back the money with interest. Foreign governments, pension funds, and investment companies have bought trillions of dollars worth of these bonds. Foreign countries have also invested trillions of dollars in American companies, banks, and real estate.

But something is starting to change.

Some countries are slowly withdrawing their funds from the U.S. and investing them elsewhere. China has been doing this for years. India has started doing it. Saudi Arabia is doing it. They are not pulling everything out—that would be too dramatic. Instead, they are slowly putting less new money into America and more into gold, other countries, or other kinds of investments.

When investors slowly move money from one place to another, it is called "diversification" or sometimes "capital flight" when it happens fast.

AT THE SAME TIME, MARKETS HAVE SHOWN HOW FAST MONEY CAN LEAVE

A good example occurred in late January 2026, just a few days before the new Pentagon strategy was released. President Trump said he wanted to put very heavy tariffs on countries in Europe that are America's friends. He also said he wanted to buy Greenland from Denmark or take it over somehow. When investors heard this, they got scared. They thought: "If America attacks its friends with tariffs and talks about taking over countries, maybe America is becoming crazy and unpredictable. Maybe I should move my money out of America."

So investors did precisely that. They sold American stocks, pulled money out of American government bonds, and bought European government bonds instead. The dollar went down in value. American interest rates went up. It happened very fast—in just a few days. This showed that if investors ever get truly scared, they can move a lot of money out of America very quickly.

But then something else happened. President Trump backed off on some of his threats. He made a deal about Greenland that saved face. Investors saw that the situation might not be as bad as they feared. So money started flowing back into America. Stock prices went up again. Interest rates came down. This showed that investors are willing to believe that America will not do anything crazy, but they are watching carefully.

THE NEW PENTAGON STRATEGY AND WHY IT MATTERS FOR INVESTORS

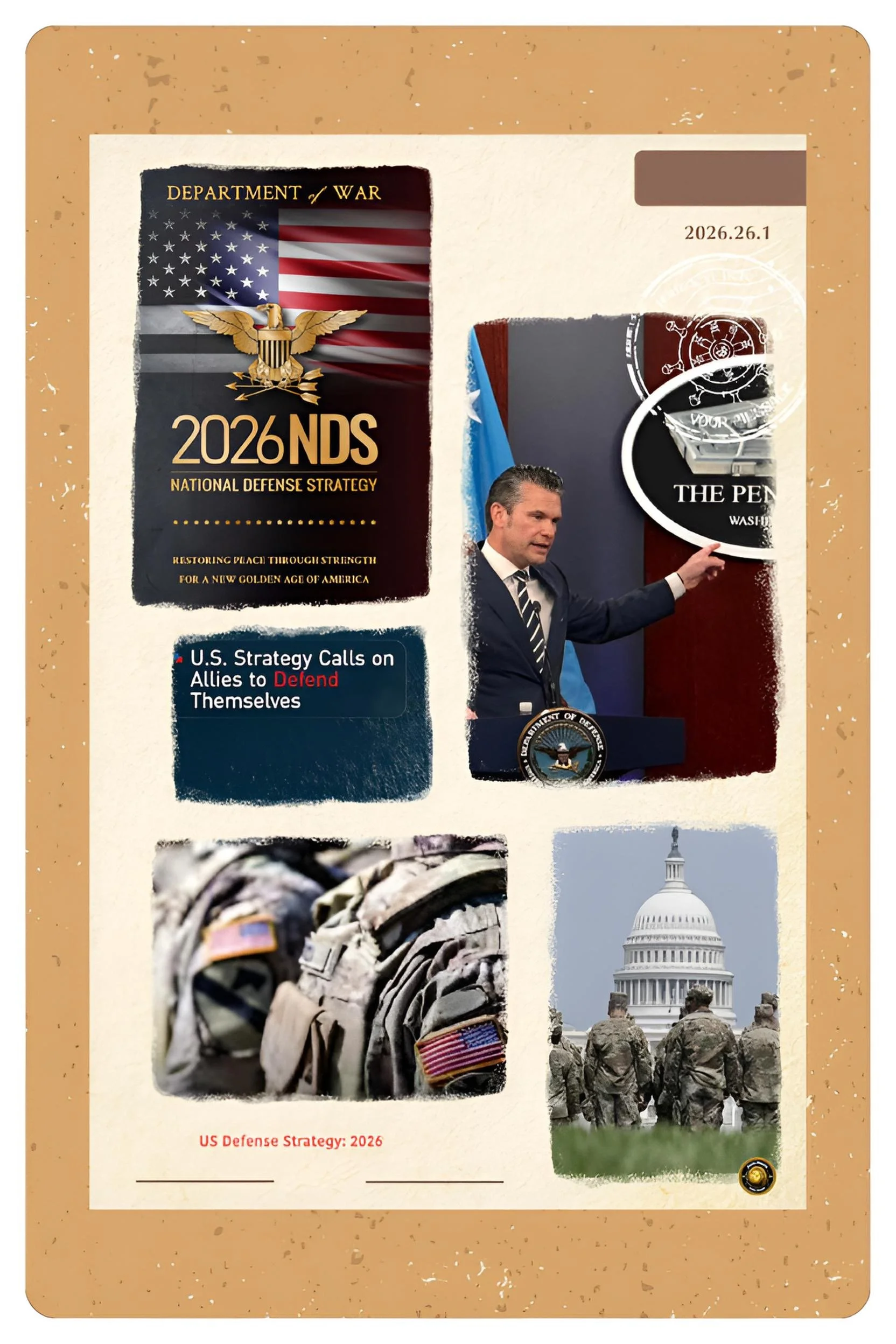

The new Pentagon strategy sends signals to investors in several ways. First, it says that America will focus on protecting itself and the countries near it (Canada, Mexico, the Caribbean, Central America, and South America). It says America will help distant allies less than before. This means that if bad things happen in Europe or Asia, America might not help as much as people expect.

For investors, this matters because they have significant assets in Europe and Asia. American investors hold Asian stocks and companies. American investors have money in European banks and businesses. If those regions become less safe because America is providing less support, those investments could lose value. Foreign investors, living in those regions, know this too. So they think: "If America is not going to help protect my region as much, maybe I should not trust my money to America as much either."

Second, the strategy says America wants "more limited" support for its allies. This is a nice way of saying: "America is going to do less for you." For a country like Germany, Japan, or South Korea that depends on America for protection, this is scary news. Those countries are now thinking: "Maybe we should not depend on America as much. Maybe we should build up our own power and not trust America as much with our money."

Third, the strategy says that China is no longer America's biggest problem. Instead, America wants to be strong in the Pacific Ocean and stop China from taking over. This sounds softer toward China. For investors in technology and finance companies, this is confusing. They do not know if America will start a trade war with China or get along with China. This uncertainty makes investors nervous, and nervous investors move their money.

Fourth, the strategy says nothing about Taiwan. Taiwan is an island near China, and many American companies have factories there or do business there. The fact that the plan does not address protecting Taiwan suggests that America may not help Taiwan as much as it said it would. This worries investors who have money in Taiwan or in companies that depend on Taiwan.

HOW INVESTORS MIGHT REACT: NOT A STAMPEDE, BUT A SLOW LEAK

It is essential to understand that the new strategy will likely not trigger a sudden stampede of capital leaving America. That would be too dramatic and too painful for the countries and investors doing it. If every country sold all its American investments at once, prices would crash, it would lose a lot of money, and there would be a world financial crisis. Countries do not want that.

Instead, a slow leak is more likely. Picture it like a bathtub with a small hole in the bottom. The water does not drain all at once—it just slowly drips out. The tub stays full for a while, but over time, less and less water remains in it.

The slow leak would look like this: When a German pension fund decides to invest new money, instead of putting 50% in America like they used to, they put 40% in America and 10% in Europe. When a Japanese bank decides to hold savings, instead of having 60 percent in dollars, it holds 50 % in dollars and 10 percent in yen. When a Saudi government official thinks about where to keep oil money, instead of thinking "America is the only safe place," they think "Maybe I should keep some in gold or in other countries too."

When millions of investors and funds all do this at the same time, it adds up. Money stops flowing into America as fast as it used to. Companies need to offer higher interest rates to borrow money. Stock prices might be lower. The dollar might become less valuable.

EXAMPLES OF WHAT COULD HAPPEN

Let us say you are a French pension fund manager. You manage money for French workers' retirement. Right now, you have one billion euros, and you put 40% of it into American Treasury bonds (€400 million). You put another 30% in European bonds, and the rest in other things.

After reading the new Pentagon strategy, you start thinking: "The US strategy document says America will not help Europe as much. That means Europe might not be as safe. That means American investors might get nervous about Europe and pull their money out. If American money leaves Europe, my European bonds might lose value. So maybe I should not keep 40% in America. Maybe I should keep 30 % in America and 40 % in Europe to balance the risk."

So over the next year or two, your fund quietly shifts some money from American to European bonds. You are not announcing it to the newspapers. You are just making a quiet decision about where to invest new money. But thousands of pension funds, banks, and investment companies all make similar decisions. Suddenly, America is not getting as much foreign money flowing in as it used to.

HOW THIS CONNECTS TO WHAT HAPPENED IN JANUARY 2026

In late January, when Trump started threatening hefty tariffs on Europe and making dramatic demands about Greenland, investors got scared. They remembered they had a lot of money in America, and they thought: "What if America does something really crazy? What if America punishes us financially?" So they started moving money out fast.

This showed investors something important: you can move money out of America quickly if needed. It does not take months—it takes days. So if investors already have a reason to worry (like the new Pentagon strategy saying America will help less), and then something scary happens, they can move money out very fast.

A QUESTION ABOUT WHAT HAPPENS NEXT

The new Pentagon strategy does not make people want to pull money out right now. But it does make them more nervous. It makes them think that America might be less reliable. It makes them start asking questions like: "Should we have so much money in America? What if America does something that hurts us?"

And it gives investors a reason to start making small moves: keeping a bit less in dollars, buying a bit more gold, investing a bit more in Europe or Asia. Those small moves by millions of investors add up over time. They can change whether America gets as much foreign money as it needs.

WHAT COULD STOP THIS FROM HAPPENING

The American government can take steps to prevent foreign investors from withdrawing their money. If America shows it is still stable and sensible about money, investors will not worry as much. If the Federal Reserve and the Treasury Department make clear plans and stick to them, investors will believe America is safe. If America keeps its promises to allies and avoids crazy fights, investors will not get so nervous.

But if America does the opposite—if it uses tariffs to fight even with its friends, if it talks about not paying its debts, if it seems unpredictable and willing to damage its own economy—then investors will get more nervous. Each time something scary happens, investors become more convinced they should move money out of America.

WHAT THIS MEANS FOR THE FUTURE

The new Pentagon strategy is unlikely to cause a financial crisis in America tomorrow or next week. America still has the world's biggest and deepest financial markets. Most investors still think America is pretty safe. Most foreign countries still have most of their money in dollars and American investments.

But the strategy does mark a change. It says that America is less interested in being a stable world leader and more interested in protecting itself. For investors, that is not good news. It makes them want to keep a little less money in America and a little more in other places.

If this happens slowly over the years, people might not notice. But if something scary happens and investors all try to move money out at once, there could be a problem. The American economy depends on foreign countries being willing to invest in the United States. If they stop being so willing to lend, America will have to offer much higher interest rates to borrow money. That makes it more expensive for the government, for companies, and for regular people to borrow money for mortgages or business loans.

The 2026 Pentagon strategy is not a crisis by itself. But it is a signal that things are changing. Foreign investors are listening to that signal. And over time, their actions in response to that signal could matter greatly to America and the world.