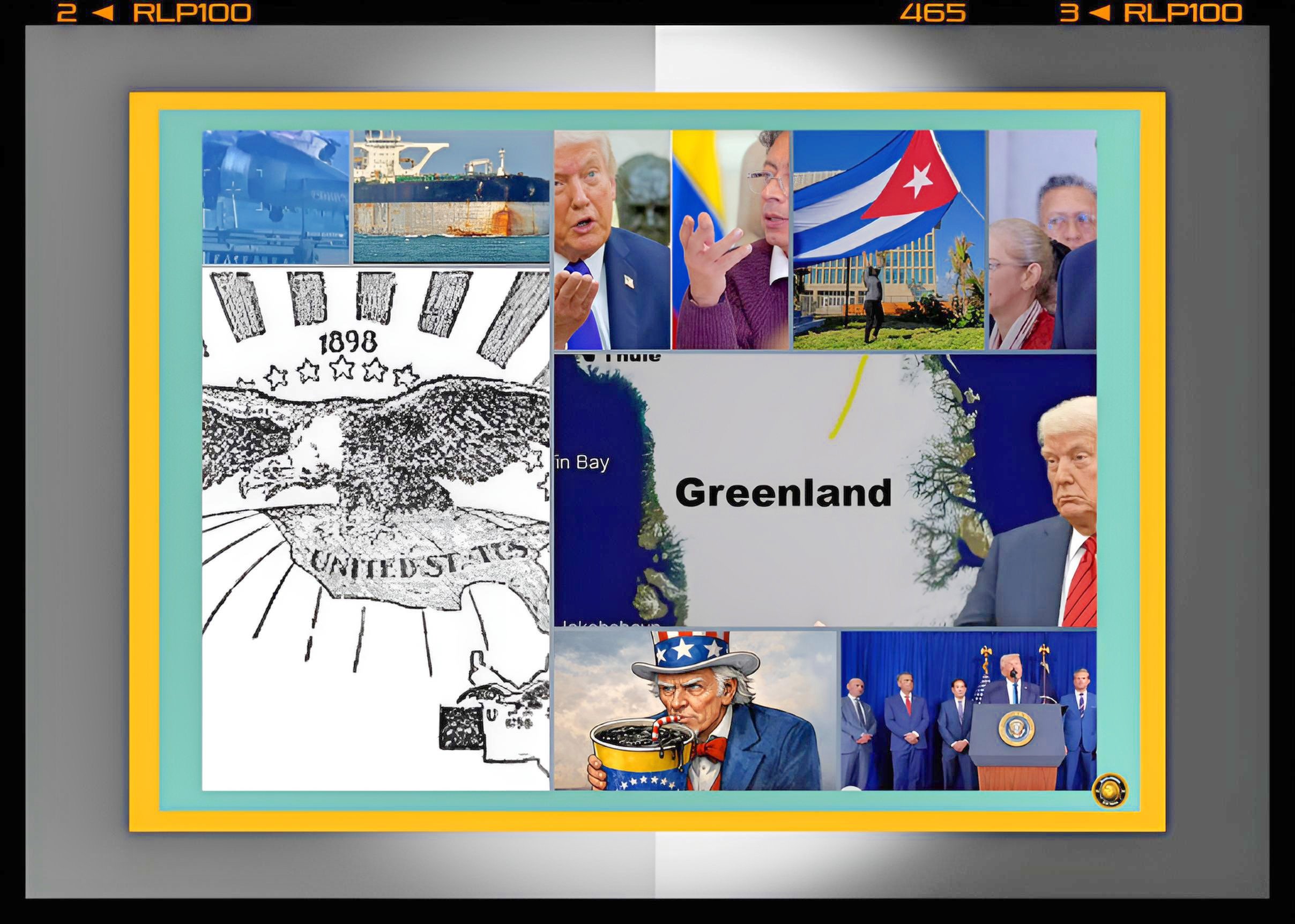

American Hegemony Over Venezuelan Hydrocarbons: The Implications of Trump’s Executive Order on Oil Sovereignty and Hemispheric Control

Executive Summary

The Trump administration has implemented a transformative geopolitical intervention in Venezuela through dual mechanisms: the military capture of President Nicolás Maduro on 3 January 2026, followed by an executive order signed on 10 January 2026 that designates Venezuelan oil revenues held in United States Treasury accounts as sovereign Venezuelan property immune from judicial seizure.

This strategic maneuver represents a fundamental recalibration of United States foreign policy toward Latin America, establishing Washington as the de facto administrator of Venezuelan petroleum assets and revenues.

The executive order, titled "Safeguarding Venezuelan Oil Revenue for the Good of the American and Venezuelan People," ostensibly protects Venezuelan sovereignty whilst simultaneously consolidating American control over oil sales, distribution channels, and financial flows.

The ramifications extend across multiple dimensions: the curtailment of creditors' long-standing legal claims against Venezuela, the reassignment of Venezuela's hydrocarbon wealth from Chinese and Russian economic interests toward American commercial advantage, and the establishment of precedent for unprecedented American intervention in a sovereign nation's natural resource management.

Historical Context and Antecedent Conditions

The Genesis of Venezuelan Oil Nationalisation and Foreign Investment Expiration

Venezuela's oil sector emerged during the twentieth century as a cornerstone of economic development and governmental revenue. Until 2007, multinational corporations including ExxonMobil and ConocoPhillips maintained substantial operational investments and productive capacity within Venezuelan territory.

The administration of Hugo Chávez executed a comprehensive nationalisation campaign commencing in 2007, seizing the productive assets of foreign petroleum companies and consolidating control under Petróleos de Venezuela, S.A. (PDVSA), the state-owned enterprise. ExxonMobil and ConocoPhillips departed Venezuela whilst pursuing multibillion-dollar claims through international arbitration mechanisms and United States federal courts.

Arbitration tribunals consistently awarded substantial compensation to these companies. ConocoPhillips obtained an international arbitration award of approximately $8.7 billion, whilst ExxonMobil secured awards surpassing $1.4 billion, though numerous claims remain outstanding.

These legal victories transformed into structural impediments to Venezuela's economic reconstruction, as creditors invoked the "alter ego" doctrine within American courts, establishing that PDVSA functioned as the Venezuelan state's economic extension and therefore bore liability for national debts.

The Accumulation of External Debt and the Citgo Precedent

Venezuela accumulated approximately $200 billion in international debt obligations whilst PDVSA faced supplementary liabilities estimated between $20 billion and $30 billion from expropriation claims.

Creditors seized upon Citgo Petroleum Corporation, a United States-based refining subsidiary owned by PDVSA's holding company, as collateral for debt recovery. A prolonged court-supervised auction process commenced in 2023 within the Delaware federal system, culminating in November 2025 with the sale of Citgo shares to Amber Energy, an affiliate of Elliott Management, for $5.9 billion—substantially below the asset's estimated valuation of $11 billion to $13 billion.

This legal precedent established that Venezuelan national assets within United States jurisdiction remained vulnerable to attachment proceedings, notwithstanding claims of sovereign immunity. The Citgo transaction represented the largest transfer of Venezuelan state property to foreign creditors since the nationalization campaigns of the Chávez era.

The Maduro Regime's Decline and American Intervention Preparation

The Nicolás Maduro administration presided over Venezuela's economic deterioration, characterised by hyperinflation, currency devaluation, widespread humanitarian suffering, and the emergence of narcotics trafficking networks operating with governmental acquiescence.

The Trump administration identified Venezuelan instability as simultaneously presenting opportunity for hemispheric realignment and justifying military intervention. The capture of Maduro represented the culmination of months of planning involving Delta Force special operations units, Central Intelligence Agency ground intelligence collection, and United States Air Force airstrikes designed to suppress Venezuelan air defences.

Current Status and Immediately Consequences of the Executive Order

The Executive Order's Structural Mechanisms

The executive order signed on 10 January 2026 employs the International Emergency Economic Powers Act and the National Emergencies Act as legal foundations for designating Venezuelan oil revenues held in American Treasury accounts as sovereign Venezuelan property immune from attachment by private creditors. The order explicitly prohibits "attachment, judgment, decree, lien, execution, garnishment, or other judicial process" against Foreign Government Deposit Funds, defined as Venezuelan oil revenues and diluent sales held in Treasury custodial accounts.

This manoeuvre appears paradoxical: the order simultaneously asserts that revenues constitute Venezuelan sovereign property whilst granting the United States exclusive authority over their distribution and allocation.

The Trump administration frames this arrangement as protective of Venezuelan sovereignty yet maintains that Venezuelan interim authorities possess no independent capacity to access or deploy these funds without American authorization.

In Trump's formulation, all proceeds from Venezuelan oil sales settle initially in United States-controlled accounts at internationally recognized banking institutions, with subsequent dispersal determined at American governmental discretion.

The Suppression of Creditor Claims and Sovereign Immunity Reassertion

The executive order directly contravenes the judicial doctrine established through years of litigation wherein American courts determined that creditors possessed enforceable claims against Venezuelan oil revenues.

The order explicitly supersedes all prior executive orders that might regulate or restrict these funds, effectively negating the accumulation of legal precedents granting creditors attachment authority over PDVSA assets.

This represents a dramatic reversal of American jurisprudential development, wherein courts had progressively eroded Venezuelan claims of sovereign immunity through application of the expropriation exception to the Foreign Sovereign Immunities Act.

The Trump administration reasserts sovereign immunity for Venezuelan oil assets not through conventional diplomatic channels but through unilateral executive action, simultaneously deploying this immunity for purposes of American foreign policy advancement rather than Venezuelan protection.

The Interim Government's Instrumentalisation

Following Maduro's capture, the Venezuelan Supreme Court—dominated by Maduro loyalists—appointed Delcy Rodríguez, Maduro's former vice president, as interim leader. The Trump administration maintained this continuity of personnel despite the existence of democratically legitimized opposition figures, most notably María Corina Machado, whose party achieved electoral victory in the 2024 presidential contest and subsequently received international recognition including the Nobel Peace Prize.

Trump justified this peculiar arrangement by asserting that Rodríguez provided the United States with "everything we deem necessary" and that American leverage rendered her compliance inevitable.

The administration explicitly stated that deviation from American prescriptions would result in consequences "probably bigger than Maduro" faced, transforming the interim government into an instrumentality of American policy rather than a transitional democratic institution.

Key Developments and Contemporary Manifestations

The White House Meeting with Petroleum Executives

On 9 January 2026, Trump convened approximately twenty senior executives from major petroleum corporations including ExxonMobil, ConocoPhillips, Chevron, Shell, and international operators such as Spain's Repsol and Italy's Eni.

The administration proposed that these corporations invest approximately $100 billion in Venezuelan oil infrastructure reconstruction, with Trump personally guaranteeing security through the United States military presence maintained offshore.

Trump articulated a three-phase financial structure: corporations would advance capital for infrastructure rehabilitation, recover their initial investments through preferential oil sales arrangements, subsequently divide remaining profits among investors, the American government, and Venezuelan institutions.

This formulation privileges American financial instruments and corporate interests whilst subordinating Venezuelan resource nationalism to American commercial advantage.

Significantly, executives refrained from committing to investment during public portions of the meeting. Industry analysts emphasised that Venezuela requires not merely capital infusion but comprehensive institutional reform, rule-of-law guarantees, and political stabilisation exceeding any timeline realistically achievable within Trump's stated governance duration.

The executives noted that Venezuela's expropriation history, decades of underinvestment, technological degradation, and workforce depletion create unprecedented reconstruction challenges.

Venezuela's Hydrocarbon Production Prospects and Infrastructure Deficiencies

Venezuela's oil production has deteriorated catastrophically from peaks exceeding three million barrels per day in the early 2000s to approximately 800,000 barrels daily as of 2026.

The Orinoco Belt's deteriorated infrastructure, including dysfunctional pipelines, malfunctioning pump stations, and degraded refining facilities, necessitates comprehensive technological rehabilitation. Energy analysts estimate that restoring production to 1.2 million barrels daily by year's end 2026 requires capital expenditures of $10 billion to $20 billion alongside restoration of the Petrocedeno and Petropiar upgraders that convert heavy crude into exportable grades.

Advancing production beyond two million barrels daily would demand approximately $110 billion in upstream investment over the 2026-2030 period, with additional infrastructure expenditures for pipeline restoration, power generation, and refinery rehabilitation.

These capital requirements substantially exceed the $100 billion Trump proposed during petroleum executive discussions, suggesting significant projections diverge from operational realities.

The Geopolitical Displacement of Chinese and Russian Interests

The executive order's mechanisms fundamentally redirect Venezuelan hydrocarbon flows away from China, historically Venezuela's largest petroleum customer. Chinese entities, including state-owned oil companies and construction firms, previously supplied technological expertise, capital investment, and debt financing that partially compensated for Western sanctions. Chinese refineries, colloquially termed "teapots," imported approximately 400,000 barrels daily of Venezuelan crude, substantially funding Venezuelan debt servicing.

The Trump administration's assertion of control over Venezuelan oil sales disrupts this relationship, simultaneously undermining Chinese leverage within Latin America whilst eliminating Venezuelan mechanisms for debt repayment to Beijing.

The order explicitly prohibits "non-hemispheric competitors" including China from maintaining controlling interests in Venezuelan hydrocarbon infrastructure, coinciding with broader Trump administration strategy of excluding Chinese economic participation from Western hemispheric resource development.

Similarly, Russian economic interests in Venezuela face marginalisation, as the order subordinates Venezuelan petroleum allocations to American commercial purposes and redirects profits toward American governmental coffers and corporate investors rather than enabling Venezuelan purchasing power for Russian manufactured goods or services

Structural Analysis of Implication

Implications for Venezuela

The executive order fundamentally reconstitutes Venezuelan economic sovereignty, subjugating the nation's principal wealth-generating asset to American governmental administration. Ostensibly, this arrangement protects Venezuela by preventing creditor attachment; pragmatically, it grants Washington discretionary authority over resource allocations that constitute Venezuela's only significant source of foreign exchange and governmental revenue.

Venezuela's interim authorities retain nominal sovereignty yet exercise no substantive control over petroleum asset disposition. The Trump administration explicitly acknowledged this arrangement, with Vice President JD Vance stating that American governance of Venezuela operates through "controlling financial resources, overseeing energy assets, and informing the regime, 'You can sell oil as long as it aligns with America's national interests.'"

This articulation renders transparent the subordination of Venezuelan agency to American strategic preferences.

The executive order simultaneously perpetuates Venezuela's economic devastation by deferring settlement of international creditor claims. Creditors previously pursued judicial remedies within American courts; the executive order now requires American governmental authorisation for claim settlement. Energy Secretary Chris Wright explicitly stated that creditor claims constitute "long-term" rather than immediate priorities, indicating Venezuela will bear protracted uncertainty regarding future debt obligations.

Venezuelan reconstruction depends upon attraction of foreign investment, stabilisation of the currency, humanitarian assistance provision, and institutional development. Each dimension requires either capital infusion or concessional financing that creditors might provide through debt restructuring agreements.

The executive order's suppression of creditor claims denies Venezuela access to these negotiation mechanisms, simultaneously preventing debt resolution and credit market access necessary for economic rehabilitation.

Implications for American Petroleum Companies

The executive order creates unprecedented opportunities for American petroleum corporations whilst shielding them from Venezuelan governmental expropriation or unilateral contract termination.

The Trump administration's explicit security guarantees, emphasizing that corporations engage with the United States rather than Venezuela directly, fundamentally alter operational risk profiles.

Historically, Venezuela's nationalization campaigns and subsequent political instability rendered petroleum investments exceptionally hazardous. The Trump administration's demonstrated willingness to deploy military force to capture a Venezuelan president and impose governance frameworks suggests American commitment to guaranteeing security conditions necessary for petroleum operations.

This security guarantee, unprecedented in specificity and credibility, constitutes the principal advantage offered petroleum executives.

However, capital requirements substantially exceed investment commitments elicited during the White House meeting. Industry executives acknowledged that massive reconstruction costs necessitate not merely security assurances but institutional reform, regulatory predictability, and political stabilisation.

The Trump administration's indication that American governance of Venezuela might extend "for years" creates operational uncertainty antithetical to long-term capital deployment. Petroleum corporations require certainty regarding governance duration, investment regulation, profit repatriation mechanisms, and contract stability.

The three-phase profit-sharing arrangement articulated by Trump remains undefined regarding specific allocations to American governmental coffers, corporate investors, and Venezuelan recipients.

This ambiguity regarding return structures creates investment hesitation, as corporations lack clarity concerning investment recovery timelines and profitability projections.

Implications for International Creditors and the Creditor-Sovereign Relationship

The executive order represents extraordinary reassertion of executive authority over judicial proceedings, fundamentally altering the relationship between sovereign debt, creditor rights, and national security claims.

The Trump administration asserts that Venezuelan oil revenue seizure by private creditors constitutes an "unusual and extraordinary threat" to American national security, thereby justifying executive suppression of judicial processes previously established through years of litigation.

This doctrine creates precedent suggesting that when presidential determinations of national security considerations conflict with creditor enforcement mechanisms, the executive branch possesses unilateral authority to override judicial adjudication. Such reasoning extends beyond Venezuela, potentially applicable to other sovereigns whose debt servicing conflicts with perceived American strategic interests.

Creditors holding arbitration awards totalling approximately $20 billion to $30 billion face indefinite deferral of claim satisfaction. ConocoPhillips's $12 billion claim, ExxonMobil's multibillion-dollar awards, and claims from international mining and industrial companies now depend upon American governmental authorisation for recovery.

The executive order effectively transforms Venezuelan debt from private contractual obligations into American foreign policy instruments, subordinating creditor interests to presidential foreign policy preferences.

This innovation threatens the established international financial architecture wherein creditor rights receive judicial protection and national courts enforce arbitration awards.

The precedent of executive suppression of creditor claims based on national security determinations could inspire similar executive actions regarding other sovereigns, potentially destabilising international credit markets and increasing borrowing costs for sovereign entities.

Future Developments and Anticipated Trajectories

The Three-Phase American Governance Architecture

The Trump administration has articulated a three-phase governance strategy for Venezuela. The immediate phase involves military stabilisation, imposition of interim governmental structures subordinate to American preferences, and commencement of petroleum extraction. The intermediate phase encompasses infrastructure reconstruction, capacity expansion toward production levels yielding $100 billion in annual revenues, and establishment of governance institutions compatible with American strategic interests.

The long-term phase, extending potentially beyond the Trump presidency, involves transition toward Venezuelan self-governance within parameters established during American occupation. However, this transition remains indefinite; Trump explicitly declined to establish timelines for elections or transfer of governance authority. This indefiniteness suggests the administration contemplates extended American governance of Venezuela's hydrocarbon sector, potentially decades rather than years.

Petroleum Production Trajectories and Revenue Projections

Energy analysts project that Venezuelan production could reach 1.2 million barrels daily by year's end 2026 through infrastructure rehabilitation, capital investment, and sanctions relief. This production level would generate approximately $25 billion in annual revenues at current international prices. By 2028, production could escalate toward 1.7 to 1.8 million barrels daily through upgrader restart and well interventions, yielding approximately $40 billion annually.

Achieving Trump's aspirational $100 billion annual production would require output exceeding three million barrels daily, replicating production levels last achieved in the early 2000s. Such production demands comprehensive infrastructure reconstruction, massive capital deployment, and technological rehabilitation exceeding capital mobilisation timelines and available expertise. Energy analysts consider such production targets unrealistic absent extraordinary capital commitments and technological innovation.

Anticipated Geopolitical Reverberations

The executive order and accompanying governance arrangements fundamentally recalibrate hemispheric geopolitics. Removal of Venezuelan resources from Chinese economic orbit eliminates a significant mechanism of Chinese influence within Latin America.

Simultaneously, exclusion of Russian and Iranian economic interests reorients Venezuelan alignment toward the Washington-centred international system.

Other Latin American sovereigns observe American willingness to deploy military force for regime removal and subsequent petroleum asset appropriation. This demonstration of American power projection capabilities and willingness to employ force for resource control could precipitate defensive alliance formation among regional actors, potentially escalating hemispheric tensions.

Alternatively, Latin American leaders might accommodate American preferences to avoid Venezuelan military intervention precedent.

Chinese and Russian strategists confront explicit exclusion from Western hemispheric petroleum infrastructure, potentially accelerating efforts toward alternative energy sources, diversified resource acquisition from other regions, and development of energy self-sufficiency.

The executive order thus may catalyse broader geopolitical restructuring extending beyond Venezuelan specifics toward fundamental reconfiguration of international energy security arrangements.

The Convergence of Creditor Claims and American Governmental Revenue Objectives

The executive order simultaneously protects Venezuelan oil revenues from creditor seizure whilst serving American governmental revenue objectives. The Trump administration has indicated that American governmental revenues from Venezuelan oil sales will fund American infrastructure, defence, or discretionary spending. This conflation of Venezuelan national resources with American governmental revenues extends beyond foreign policy interests toward direct American economic benefit derivation from Venezuelan sovereign assets.

Previous American interventions in foreign sovereigns typically maintained formal separation between intervention costs and resource appropriation. The Trump administration explicitly articulates that Venezuelan petroleum wealth benefits the American people through presidential discretionary allocation, representing unprecedented transparency regarding American economic extraction from foreign sovereignty subordination.

This arrangement creates legal and ethical questions regarding American constitutional authority, international law compliance, and precedent for future resource appropriation accompanying American military interventions. Congress possesses constitutional authority over federal revenues and expenditures; the Trump administration's assertion of presidential control over Venezuelan oil revenues circumvents legislative oversight, creating constitutional tensions regarding separation of powers and executive authority limitations.

Cause-and-Effect Analysis

Causal Sequence Leading to the Executive Order

The executive order represents culmination of multiple causal chains converging upon Venezuelan political instability and American strategic recalibration. Proximate causation flows from Maduro's military capture on 3 January 2026, enabling Trump administration assertion of de facto governance authority. The capture itself resulted from long-term American destabilisation efforts, sanctions regimes, support for opposition movements, and intelligence operations undertaken across multiple presidencies to undermine Venezuelan governmental stability.

More distant causation originates in Venezuelan economic mismanagement, chronic underinvestment in petroleum infrastructure, politicisation of PDVSA reducing operational efficiency, and ideological orientation toward anti-American positioning under the Chávez and Maduro administrations.

These factors produced economic deterioration that created receptivity among certain Venezuelan constituencies toward American intervention potentially restoring economic functionality.

International creditor litigation against Venezuela constituted secondary causation, establishing legal precedents that subordinated Venezuelan governance authority to American judicial processes and creditor claims. The Crystallex case and subsequent "alter ego" doctrine applications created structural vulnerability whereby Venezuelan sovereign assets faced attachment regardless of contemporary Venezuelan governmental positions.

The Trump administration's strategic recalculation prioritised hemispheric resource control and great-power competition with China simultaneously. The determination that Chinese economic interests in Venezuela required exclusion coincided with broader Trump foreign policy objectives regarding Chinese economic containment. Venezuelan hydrocarbon resources represented sufficiently valuable assets to justify military intervention costs when calculated against geopolitical competition benefits and petroleum corporate profit opportunities.

Effects of the Executive Order

Immediate effects of the executive order include legal uncertainty for billions of dollars in creditor claims, disruption of Chinese petroleum importation arrangements, and acceleration of Venezuelan capital flight as uncertainty regarding resource allocation increases. Corporations previously positioned to import Venezuelan petroleum now confront American governmental regulations requiring transaction authorisation, substantially complicating commercial arrangements.

Intermediate effects encompass potential petroleum infrastructure investment by American corporations, gradual production increase as rehabilitation projects progress, and consolidation of American governmental control over Venezuelan petroleum commercialisation. These effects generate revenue flows to American governmental coffers and corporate entities, simultaneously creating governance dependencies wherein Venezuelan interim authorities depend upon American authorization for all significant resource allocation decisions.

Long-term effects extend toward fundamental hemispheric reorientation, with American control of Venezuelan petroleum establishing precedent for American resource governance across Latin America. Chinese and Russian interests confront explicit exclusion from Western hemispheric energy development, potentially catalysing alternative energy security arrangements or conflict escalation. Democratic governance institutions in Venezuela face indefinite subordination to American governance priorities, potentially creating long-term Venezuelan resentment and anti-American political movements once American military presence diminishes.

Projected Future Trajectories and Anticipated Concerns

Political Transition Ambiguities and Regime Consolidation Uncertainties

The Trump administration has declined to establish timelines or parameters for Venezuelan political transition toward democratically legitimised governance structures. The maintenance of Delcy Rodríguez, a Maduro regime loyalist, as interim leader whilst excluding María Corina Machado, the legitimately elected opposition candidate, suggests American preferences for governance continuity over democratic transition.

This arrangement creates structural contradictions: American occupation ostensibly advances Venezuelan democracy and freedom whilst simultaneously suppressing the democratically expressed preferences that opposition candidates represent. This contradiction potentially delegitimises American governance claims, generating political resistance among Venezuelan constituencies that expected liberation rather than continued authoritarian governance under different auspices.

Anticipated regime consolidation trajectories suggest the Trump administration will construct governance institutions compatible with American petroleum interests rather than Venezuelan democratic preferences. The indefinite extension of American military presence and economic control creates conditions for institutional sclerosis wherein Venezuelan administrative structures calcify around American preferences rather than evolving toward responsive democratic governance.

The Sustainability of American Military Presence and Resource Extraction

Indefinite American military occupation of Venezuela requires sustained Congressional appropriations, military deployment, and intelligence agency commitments. These commitments face domestic American political constraints: public reluctance toward extended foreign military presence, budgetary pressures from competing domestic priorities, and political opposition from Democrats questioning the legality and wisdom of Venezuelan military intervention.

The sustainability of American petroleum resource extraction depends upon technological competence, capital availability, and operational security. Venezuelan circumstances present challenging operational environments wherein political instability, criminal activity, and potential sabotage threaten petroleum infrastructure. Extended American military presence creates financial and military costs that could eventually exceed commercial benefits derived from petroleum extraction, creating conditions for withdrawal despite stated long-term commitments.

International Legal Challenges and Geopolitical Pressures

The executive order faces potential international legal challenges questioning its compatibility with international law principles regarding sovereign equality, territorial integrity, and prohibition of military intervention. International courts or arbitration bodies might subsequently determine that the executive order violates international law, creating contradictions between American claims and international legal norms.

Geopolitical pressures from China and Russia regarding Venezuelan resource exclusion could manifest through proxy conflicts in Venezuela or other Latin American locations. Chinese and Russian strategists might determine that acquiescence to American Venezuelan domination encourages further American interventions elsewhere, potentially catalysing defensive alliance formation or proxy conflict escalation.

Conclusion

The Trump administration's executive order designated Venezuelan oil revenues held in American Treasury accounts as sovereign Venezuelan property immune from creditor seizure whilst simultaneously consolidating American governmental control over petroleum asset disposition and revenue allocation.

This arrangement represents unprecedented American assertion of governance authority over a foreign sovereign's natural resources, accomplished through military intervention elimination of prior governmental structures and subsequent institutional reconstruction under American governance preferences.

The executive order simultaneously protects Venezuelan sovereignty against private creditor claims whilst subordinating Venezuelan governmental authority to American foreign policy preferences.

This paradoxical positioning reflects the inherent contradictions within American humanitarian rhetoric regarding Venezuelan liberation contrasted with actual governance arrangements that perpetuate Venezuelan economic subordination and political dependency.

The implications extend across multiple dimensions: American petroleum corporations gain unprecedented investment security through military backing; international creditors face indefinite deferral of claim satisfaction through executive action; Venezuelan governance structures remain subordinate to American preferences; and geopolitical competition dynamics shift adversarially toward exclusion of Chinese and Russian economic interests from hemispheric resource development.

The executive order establishes precedent suggesting that American national security determinations can override established international legal frameworks regarding creditor rights, judicial authority, and sovereign immunity.

This precedent threatens the established international financial architecture, potentially increasing sovereign borrowing costs and destabilising international credit markets as creditors anticipate American executive intervention regarding debt obligations conflicting with American strategic interests.

Venezuelan political reconstruction remains fundamentally contingent upon American choices regarding governance duration, political transition parameters, and resource allocation mechanisms. The indefinite extension of American occupation creates conditions for institutional sclerosis, political delegitimisation, and potential long-term Venezuelan resentment toward American governance despite near-term benefits from petroleum infrastructure reconstruction.

Sustainable Venezuelan democracy requires that American governance ultimately transitions toward democratic institutions responsive to Venezuelan preferences rather than perpetuating structures subordinate to American strategic interests.

The executive order exemplifies contemporary American geopolitical assertiveness wherein military capability, economic leverage, and strategic determination override international legal constraints and humanitarian rhetoric regarding foreign governance arrangements.

Whether this approach generates geopolitical stability or precipitates escalating conflict depends upon responses from China, Russia, and regional Latin American actors to American assertion of hemispheric resource control authority.