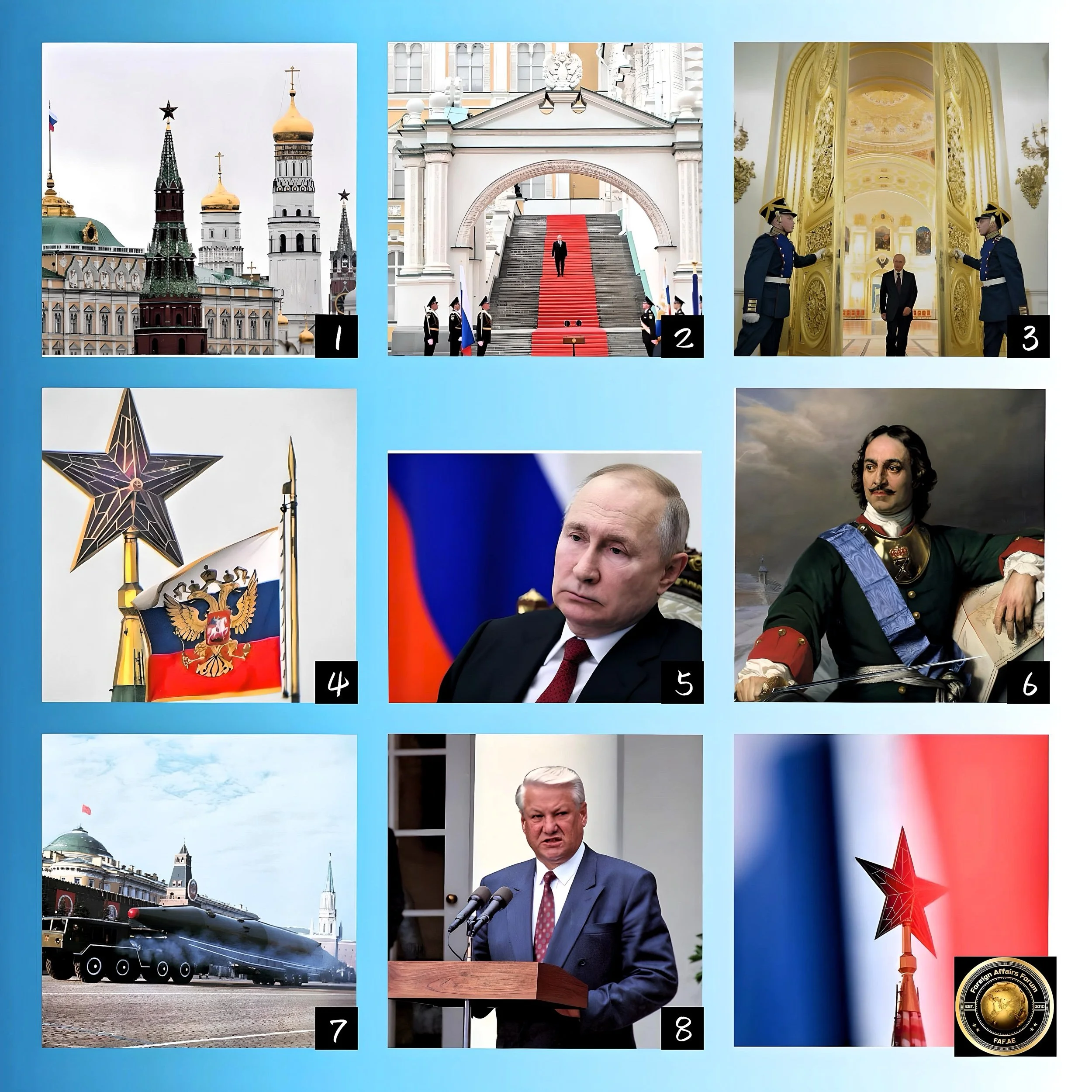

Assessing Europe's Defense Preparedness in Response to Russia: A Critical Examination Post-Alaska Summit- Europe Scrambling to head to America to support Zelenskky on Aug 18, 2025

Executive Summary

The FAF analysis provides an in-depth assessment of Europe’s defense posture in light of escalating tensions with Russia, particularly following the Alaska Summit, which failed to yield significant diplomatic progress.

This analysis scrutinizes the current military capabilities of European Union member states, focusing on the operational readiness of their armed forces, the sophistication and diversity of their weapon systems, and the resilience of their cyber defense infrastructures.

It underscores how these nations are evaluating their capacity to respond effectively to potential threats and to conduct military operations in a rapidly changing security environment.

Additionally, the report explores strategic initiatives aimed at enhancing Europe's defense autonomy, with the goal of reducing reliance on external military support, especially from NATO, and promoting self-sufficiency in defense strategies.

Member states are investigating collaborative models, leveraging technological advancements, and optimizing resource allocation to develop a more independent and integrated defense posture.

The FAF also provides a detailed roadmap outlining both short-term and long-term objectives essential for achieving strategic independence.

It situates these ambitions within the current regional security dynamics, which are increasingly affected by shifting global power structures.

A key finding of the analysis indicates that by 2027-2028, the European Union may find itself inadequately equipped to counteract provocations from Russia.

This concern is particularly pronounced for the Baltic and Nordic regions, which may be placed in a vulnerable position should NATO fail to bolster its collective defense capabilities.

The transatlantic uncertainties, compounded by the variable political landscape—highlighted by the impact of figures such as Trump on US foreign policy—further complicate Europe’s northern defense vulnerabilities.

The upcoming assembly on August 18th in Washington, DC, marks a critical juncture, as European leaders recognize the intensifying threat from Russia and prepare to enhance their support for Ukraine while fortifying their military preparedness.

Introduction

Recent warnings from European intelligence agencies indicate that Russia may test NATO’s Article 5 commitments within the upcoming three to five years, with some forecasts suggesting potential provocations as soon as two to three years from now.

This alarming assessment conveys a sobering reality: Europe is presently ill-equipped to defend itself against a Russian incursion without substantial support from the United States.

Nevertheless, ambitious rearmament initiatives are in motion, which could reshape this landscape from 2027 to 2030.

Europe Scrambling to head to America to support Zelenskky on Aug 18, 2025

On Monday, August 18, 2025, several top European leaders are heading to Washington, D.C. in a concerted effort to support Ukrainian President Volodymyr Zelensky and persuade U.S. President Donald Trump not to concede to Russian demands regarding Ukraine.

This reflects growing anxiety across Europe over Trump’s recent summit with Russian President Vladimir Putin, in which he appeared to soften his stance toward Russia, making European allies nervous about the future of Western support for Kyiv.

European Leaders Joining Zelensky in Washington

The following European leaders have officially confirmed their attendance at the White House talks with Trump:

Ursula von der Leyen: President of the European Commission.

Emmanuel Macron: President of France.

Friedrich Merz: Chancellor of Germany.

Giorgia Meloni: Prime Minister of Italy.

Alexander Stubb: President of Finland.

Mark Rutte: Secretary General of NATO.

Other senior officials and heads of state from Europe may attend or join via videoconference, but these are the confirmed attendees flying to Washington for the meeting.

The Goal of the European Delegation

European leaders are scrambling to prevent Trump from accepting any proposals from Russia that would force Ukraine to cede territory or lessen Western sanctions pressure on Moscow.

The group goals include.

Present a united European front with Zelensky.

Press Trump to protect Ukraine’s sovereignty.

Ensure continued Western support for Ukraine’s defense.

Mediate and buffer potential confrontations between Trump and Zelensky, particularly after previous tense Oval Office meetings.

Why This Is Happening

The urgency comes after Trump’s recent Alaska summit with Putin, which failed to yield a breakthrough but signaled a shift away from immediate ceasefire demands.

European leaders fear Trump may be preparing to push for a peace settlement that could undermine Ukraine’s vital interests.

Ahead of Monday’s meeting, European officials have voiced concerns about Trump backing proposals to freeze the conflict along lines that favor Russian control over certain Ukrainian regions.

Monday’s high-level meeting in Washington will see Europe’s “heavy hitters” rallying behind Zelensky, reflecting serious geopolitical anxieties about maintaining Western unity and support for Ukraine in the face of changing U.S. policy.

Current Military Balance: A Serious Assessment

Russian Military Dominance in Production and Scale

Since 2022, Russia has significantly accelerated its defense production, surpassing European capabilities and posing a strategic threat to NATO’s conventional deterrence posture.

In 2025, Russian defense spending soared to approximately 6.7% of its GDP—almost double the pre-war levels—while many European nations struggled to meet NATO’s recommended defense spending target of 2% of GDP.

The disparity in military production is stark and concerning. Russia reportedly manufactures around 3 million artillery shells each year, nearly three times the combined production capacity of the United States and Europe.

In 2024 alone, the Russian military produced and refurbished an estimated 1,550 tanks, 5,700 armored vehicles, and 450 artillery pieces—a remarkable 220% increase in tank production and a 150% increase in armored vehicles compared to the 2022 period.

As of late 2024, the Russian military presence in Ukraine was approximately 700,000 troops, significantly exceeding the invading force from 2022.

Despite suffering over one million casualties, Russia's military is now described as “considerably larger, more experienced, and better equipped” than it was at the outset of the invasion, possessing invaluable battlefield experiences unmatched by any other military force, except for Ukraine itself.

European Military Capabilities: A Fragmented Yet Evolving Landscape

When combined, Europe’s military strength appears formidable on paper.

The European Union and the UK collectively boast approximately 1.47 million active military personnel, compared to Russia’s 1.32 million.

European naval forces have a significant advantage over Russia, with over 2,000 warships—including six aircraft carriers—compared to Russia’s 419 ships and one aircraft carrier.

However, these numbers obscure critical weaknesses within Europe’s military framework.

The forces are plagued by severe fragmentation, highlighting 178 different weapon systems instead of just 30 in the United States.

Regarding air power, Europe operates 20 different types of fighter aircraft compared to only six in the US, and maintains 14 main battle tank models while the US relies on just one.

This level of fragmentation severely hinders military effectiveness and interoperability among European forces.

Critical Vulnerabilities and Strategic Gaps

The Baltic States: NATO's Most Exposed Front

The Baltic states—Estonia, Latvia, and Lithuania—represent Europe’s most prominent strategic vulnerability.

Intelligence analyses from NATO, Germany, Poland, Denmark, and the Baltic nations consistently identify these countries as potential primary targets for Russian aggression within a three to ten-year timeframe.

Particularly concerning is the Suwalki Gap—a crucial 65-kilometer corridor linking Belarus and the Russian exclave of Kaliningrad—which remains NATO’s Achilles’ heel and serves as the sole land connection to the Baltic states.

In response to these threats, Estonia has emerged as a leader within NATO regarding defense spending, allocating an impressive 5.4% of its GDP to defense. Latvia and Lithuania are investing 3.15% and 2.85%, respectively.

All three Baltic states have reintroduced compulsory military service and are constructing the “Baltic Wall,” an extensive fortification system designed to secure their borders against potential incursions from Russia and Belarus.

Nuclear Deterrence Gap

Europe's nuclear deterrence strategy relies heavily on the United States' capabilities.

Currently, France and the UK possess a combined total of approximately 515 nuclear warheads, whereas Russia boasts an arsenal exceeding 5,000 nuclear weapons, approximately 1,700 of which are deployed. The remainder is undergoing a modernization initiative expected to conclude by 2027.

While both European nuclear powers are exploring mechanisms for closer coordination—including the Northwood Declaration established between France and the UK in July 2025—critical gaps remain that need addressing for Europe to fully fortify its strategic nuclear posture.

Strategic Enablers Deficit

Europe faces a significant shortfall in essential "strategic enablers," critical for effective military operations.

This includes vital components such as intelligence, surveillance, and reconnaissance (ISR) capabilities, which are crucial for situational awareness on the battlefield; strategic airlift assets necessary for rapid troop and equipment deployment; advanced satellite communications that ensure secure and reliable information transfer; and long-range precision strike capabilities that allow for effective remote engagement of targets.

These dependencies on U.S. military assets create fundamental weaknesses, severely limiting Europe's ability to respond robustly in various conflict scenarios.

The reliance on U.S. capabilities underscores a critical vulnerability in European defense strategy, potentially compromising military effectiveness in times of crisis.

Industrial Rearmament: Progress and Challenges

Artillery Production Surge

Europe has made significant strides in increasing the production of artillery shells, transitioning from production levels described as "almost handmade" in 2022 to impressive projections of 2.4 million shells annually by 2026.

This surge may allow Europe to surpass Russia's artillery output. Notable developments facilitating this rise include:

The company plans to reach a production rate of 750,000 shells annually by 2026 and an ambitious target of 1.1 million shells by 2027.

BAE Systems has established a new production line in Glascoed, designed to dramatically enhance output, ramping up production by a staggering 16-fold.

The STV Group in Czechia has already achieved a production rate of approximately 1 million shells annually.

Platform Production Challenges

Despite the promising advancements in artillery ammunition production, there are significant challenges concerning the production of military platforms, such as tanks and armored vehicles.

For instance, Germany has ordered only 123 Leopard 2 tanks, which are expected to be delivered by 2030, highlighting the broader issue of scalability in European defense manufacturing.

European defense firms have acknowledged that while they can ultimately meet delivery requirements, significant delays may frustrate customer expectations.

This situation is compounded by stark contrasts in production costs: European-made 155mm artillery shells range from $4,000 to $8,000 each, whereas Russian equivalents, using the 152mm caliber, can be produced for as little as $1,000.

In comparison, Ukraine manufactures similar artillery shells for around $1,500 each, underscoring the industrial inefficiencies that Europe must address.

Funding and Investment Surge

The landscape of defense spending in Europe is witnessing unprecedented escalation. Spearheaded by the EU's ambitious “ReArm Europe Plan/Readiness 2030,” the initiative seeks to catalyze €800 billion in defense investments over the next decade.

Countries are making bold commitments to defense expenditures, showcasing their strategic priorities:

France intends to allocate €448 billion toward its defense sector from 2024 to 2030.

Germany has earmarked € 108 billion in a special fund specifically for military modernization efforts.

Poland plans to escalate its defense spending from 2.2% of GDP in 2022 to 4.7% by 2025.

Timeline for Strategic Autonomy: A Realistic Assessment

2025-2027: Critical Vulnerability Window

Intelligence analyses point to 2025 to 2027 as a critical vulnerability window for Europe. Multiple assessments converge on 2027 as a pivotal year when Russia is anticipated to finalize its military reconstitution.

NATO defense professionals estimate that this could occur within two to five years, with some Norwegian assessments suggesting readiness could be achieved in just two to three years.

During this crucial period, Europe is expected to rely heavily on U.S. military capabilities.

Current NATO planning envisions adding up to 200,000 U.S. troops to bolster the 100,000 already stationed in Europe in the event of Russian aggression.

Without this American support, European military forces may be inadequate to deter or engage Russian military actions effectively.

2027-2030: Potential European Readiness

Should investment trends continue on their current trajectory, Europe could potentially enhance its defense capabilities to a meaningful level by 2030.

According to the Bruegel Institute, Europe would need to field forces equivalent to 300,000 U.S. troops—approximately 50 newly constituted European brigades—to establish credible deterrence independent of American backing. This enhancement would necessitate:

A minimum of 1,400 operational tanks, supported by 2,000 infantry fighting vehicles and 700 artillery pieces.

A stockpile of at least one million 155mm artillery shells to sustain high-intensity combat for at least 90 days.

An additional 300,000 trained military personnel are ready for deployment.

Significant upgrades in aviation, transport, and communication capabilities to support operational effectiveness.

Beyond 2030: Full Strategic Autonomy

Achieving genuine European strategic autonomy—the capability to defend itself against Russian threats without U.S. involvement—remains a long-term objective that demands sustained political commitment and substantial financial investment.

The new NATO spending target of 5% of GDP by 2035 acknowledges this potential timeline.

However, many experts express skepticism regarding the political viability of maintaining such high defense spending levels in the long term.

NATO Article 5 Response Scenarios

Collective Defense Mechanisms

NATO's Article 5, which articulates the principle of collective defense, remains fundamental to European security; however, the activation of this provision could encounter certain complications.

This article mandates unanimous consensus among all 32 NATO member states and allows individual nations to determine their specific response levels, which could vary significantly—“such action as it deems necessary.”

Expert analysis suggests a strong likelihood of a united front for defending core European allies, with countries like the United Kingdom, Nordic nations, Poland, and the Baltic states expected to react swiftly.

Nonetheless, potential delays in response could stem from NATO members such as Hungary and Turkey, which have demonstrated occasional hesitance regarding full participation in NATO operations.

Regional Defense Variations

There is a stark contrast in defense readiness across Europe, heavily influenced by geographic and political factors.

Eastern European nations, particularly Poland, the Baltic States, and Nordic countries, have attained high levels of military readiness, underpinned by a robust political commitment to confronting the perceived Russian threat.

These frontline states recognize the urgency and have allocated resources accordingly to bolster their defenses.

In contrast, Western European countries exhibit a varying sense of urgency.

Germany's combat readiness experienced a notable decline between 2022 and 2024 despite increased financial inputs.

Although France maintains capable military forces, it has yet to fully integrate its nuclear deterrent capabilities into NATO's collective planning framework, revealing gaps in the broader European defense architecture.

Strategic Recommendations and Implications

Immediate Priorities (2025-2027)

In order to navigate the impending vulnerability window, Europe must concentrate its efforts on three essential domains that are vital for immediate security enhancement:

Accelerated Production

The foremost priority should be the expedited production of critical military assets, such as ammunition, advanced air defense systems, and anti-tank weaponry.

These elements are crucial for creating immediate battlefield impact and ensuring European armed forces are well-equipped to respond to emerging threats.

The focus should be on ramping up production lines and implementing innovative manufacturing processes that allow for rapid deployment to front-line troops.

Enhanced Coordination

A significant challenge facing European defense is the current fragmentation which undermines military effectiveness, estimated to be reduced by 30-40%.

To address this issue, Europe must establish unified command structures that streamline operational command and control.

Furthermore, standardizing equipment across member states will enhance interoperability among forces, ensuring seamless joint operations and more efficient resource allocation.

Strategic Partnership with Ukraine

Building a deep, strategic partnership with Ukraine can greatly benefit Europe’s defense industrial base.

Ukraine possesses a robust, battle-tested defense industrial capacity that is available at a relatively low cost.

By integrating Ukrainian production capabilities, European nations can significantly increase their output of essential military equipment and leverage Ukraine's experience in modern warfare to enhance strategic planning and operational effectiveness.

Long-term Strategic Framework (2027-2035)

To achieve true European strategic autonomy, a comprehensive restructuring of defense strategies must occur, centered on several crucial pillars:

Nuclear Coordination

Strengthened nuclear cooperation between France and the United Kingdom within the NATO framework is imperative.

This could involve pre-positioning nuclear-capable aircraft in Eastern Europe, which not only serves as a deterrent but also enhances collective security arrangements and reassures Eastern European allies of NATO’s commitment.

Industrial Consolidation

The establishment of a cohesive European defense market is vital. This entails creating joint procurement programs to enable economies of scale, which can drastically reduce costs and increase efficiency in defense spending.

By consolidating resources and streamlining procurement processes, Europe can achieve a more integrated and competitive defense landscape.

Strategic Enablers

To underpin these strategies, Europe must prioritize the development of independent capabilities such as satellite communications, intelligence gathering, and strategic airlift capacity.

These enablers will ensure that European forces can operate autonomously and effectively, independent of external support.

Political and Economic Sustainability

The scale of investment needed for these initiatives is historically unprecedented, posing significant economic and political challenges.

Achieving NATO’s target of 5% of GDP on defense would necessitate Germany alone to allocate an approximate €329 billion annually by 2035—this figure far exceeds current allocations for education and social services.

Addressing this will require extraordinary political consensus among member states and might necessitate innovative financing mechanisms, such as the issuance of EU-level defense bonds and collaborative procurement programs.

Conclusion

A Race Against Time

Europe currently faces a pivotal strategic dilemma: without substantial and consistent backing from the United States, the continent finds itself ill-equipped to mount an effective defense against the looming threat of Russian aggression.

Nonetheless, if investment trends in defense and security are accelerated positively, Europe has the potential, by the years 2027 to 2030, to harness its economic and technological strengths to establish credible deterrents against potential threats.

This ambitious goal, however, is contingent upon one critical challenge: can the political frameworks across European nations uphold the necessary levels of defense spending while overcoming decades of fragmentation and disunity in defense strategies?

As it stands, Europe is in a precarious vulnerability period that lasts until 2027, a time in which its security heavily depends on the unwavering commitment of the United States to uphold NATO’s Article 5 guarantees, which assert that an attack on one member is an attack on all.

This reliance highlights a stark reality—without American support, Europe risks significant insecurity.

Looking beyond 2027, the feasibility of Europe achieving a degree of strategic autonomy is predicated on three essential factors: first, the sustained defense expenditure must reach approximately 3.5% to 4% of the continent's Gross Domestic Product (GDP).

Secondly, there needs to be a comprehensive overhaul of the fragmented defense industries across Europe, which currently hampers efficient resource allocation and operational readiness.

Lastly, a unified political will among European leaders is crucial to prioritize defense and security investments, even in the face of competing domestic demands and economic pressures.

Interestingly, Russia’s advantage does not arise from its technological or industrial superiority; rather, it stems from its centralized decision-making process and a steadfast commitment to prioritize military production over economic efficiency—an area where the European Union struggles due to the diverse visions of its member states.

Many EU countries advocate for the formation of integrated military forces, driven by interconnected economic, political, and psychological considerations.

The stakes have only escalated following the unsuccessful Alaska-US summit, which has placed Russia in a more advantageous position.

To navigate this complex landscape, European democratic systems must cultivate a similar degree of focus on security while simultaneously fostering public support for unprecedented levels of military investment—even during peacetime.

The next three years are critical, as they will determine whether Europe can effectively bridge the growing readiness gap before confronting what could be its most significant security challenge since World War II.