Vietnam’s Bold Breakout: Mastering the U.S.-China Bind Through Global Diplomacy

Executive Summary

Vietnam pursues a sophisticated strategy to avoid entrapment between the United States and China by extending diplomatic, economic, and security partnerships far beyond the Indo-Pacific.

Hanoi elevates ties with Middle Eastern nations such as Kuwait and Algeria, African powers such as South Africa, and global forums such as the BRICS, while deepening European Union trade integration through the EVFTA.

This globalised hedging embeds Vietnam’s traditional principles of independence, self-reliance, diversification, and multilateralism within a broader framework that reduces dependence on any single great power and amplifies Hanoi’s agency as a middle power.

Recent milestones include Prime Minister Pham Minh Chinh’s November 2025 tour, which yielded a strategic partnership and over 10 cooperation agreements in energy, minerals, and logistics, alongside Vietnam’s June 2025 entry into BRICS as a partner nation.

The approach counters vulnerabilities exposed by 2025 U.S. tariff shocks and Chinese assertiveness in the South China Sea, yet faces risks from a narrowing hedging space amid intensifying rivalry and challenges in translating rhetoric into enduring economic interdependence.

Introduction

Vietnam occupies a precarious geopolitical position, hemmed in by China’s proximity and maritime ambitions while courted by the United States, intent on countering Beijing’s rise.

Historical conflicts with both powers, coupled with economic interdependence—China as a key supplier and market, the U.S. as Vietnam’s largest export destination—compel Hanoi to reject alignment in favor of calibrated hedging.

This doctrine, formalized since 1991, prioritizes autonomy through diversified relations rather than bloc membership, allowing Vietnam to deepen U.S. defense ties without antagonizing Beijing or compromising sovereignty claims in the South China Sea.

The current intensification of U.S.-China competition transforms this regional balancing act into a potential trap, where Indo-Pacific confinement risks forcing binary choices.

Hanoi responds by globalizing its diplomacy, forging partnerships in the Middle East, Africa, Europe, and the Global South to redistribute strategic risks, secure alternative energy and investment flows, and embed Vietnam in multipolar networks.

This evolution elevates Vietnam from a frontline state to a networked middle power, leveraging economic dynamism—exports accounting for nearly 30 percent of GDP—and diplomatic agility to claim disproportionate influence.

Key Events

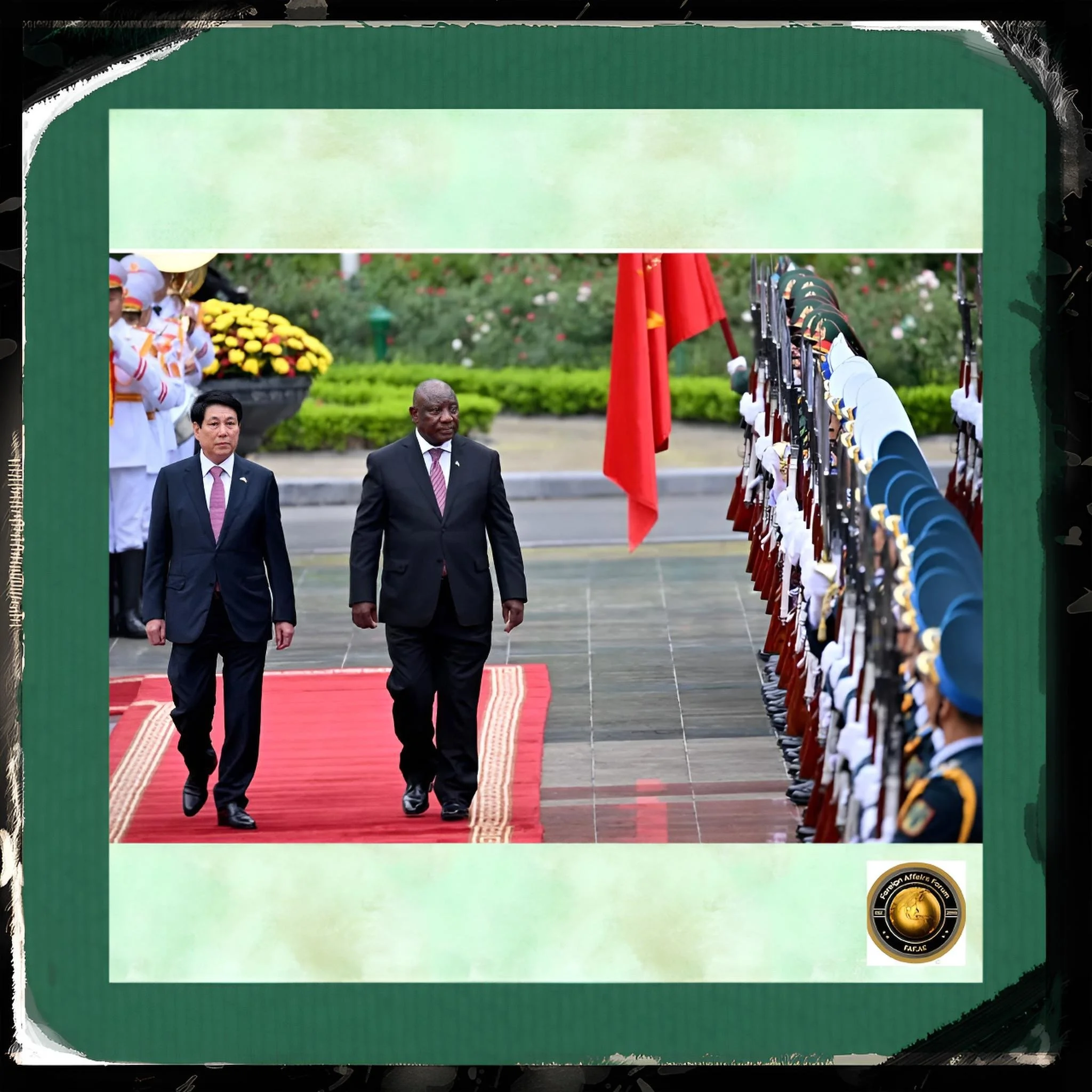

Prime Minister Pham Minh Chinh’s November 2025 tour of Kuwait, Algeria, and South Africa marked Vietnam’s boldest extra-regional thrust, upgrading relations with each to strategic partnerships—the first such designations in those regions.

The visits produced over ten agreements covering energy, petrochemicals, mining, agriculture, logistics, and green supply chains, positioning Kuwait for oil imports and development aid, Algeria for energy ventures, and South Africa as a G20-BRICS gateway for critical minerals and trade.

In June 2025, Vietnam joined BRICS as its tenth partner, the fourth ASEAN state to do so, gaining access to the New Development Bank, South-South investment, and platforms for advocating trade and finance reforms.

This complemented Vietnam’s roster of 14 comprehensive strategic partnerships by late 2025, spanning all five UN Security Council permanent members—U.S., China, Russia, France, UK—plus India, Japan, South Korea, Australia, and ASEAN peers.

The EU-Vietnam Free Trade Agreement, effective since 2020, drove bilateral trade to 67 billion euros, eliminating 99 percent of tariffs and integrating Vietnam into European supply chains as a counterweight to U.S. and Chinese markets.

Meanwhile, U.S. defense cooperation expanded with maritime training and port calls, calibrated to avoid anti-China optics, even as April 2025 tariffs of 46 percent on Vietnamese exports prompted emergency negotiations yielding a 20 percent reduction and major Boeing purchases.

Facts and Concerns

Vietnam’s hedging rests on stark asymmetries: a 1,300-kilometer border with China fuels persistent South China Sea tensions, where Beijing’s island-building challenges Hanoi’s Paracel and Spratly claims, yet economic ties—China supplies 30 percent of imports—preclude confrontation.

U.S. trade hit $142 billion in 2024, but 2025 tariffs exposed an overreliance on electronics and textiles, which comprise 80 percent of exports.

Energy insecurity looms large, with depleting domestic reserves driving 90 percent of crude oil imports, mostly from Kuwait, amid net-zero goals by 2050 that demand LNG diversification.[digital-c

Regime security preoccupies the Communist Party, wary of Western democracy promotion amid deepening ties, while party-to-party links with China enable Beijing’s influence. Extra-regional outreach mitigates entrapment—fear of U.S.-led conflicts—or abandonment, given Washington’s precedent of the Afghan withdrawal.

Still, implementation lags: Middle East-Africa pacts remain declaratory, while BRICS yields rhetorical rather than transformative capital flows. Great-power demands erode ambiguity, as the U.S. pushes anti-China trade curbs and Beijing insists on deference to “core interests.”

Domestic tensions arise from global openness clashing with political control; EVFTA-driven reforms pressure for transparency, while U.S. concessions, such as fast-tracked Trump investments, stir environmental backlash. Narrowing rivalry space risks forcing alignment, undermining hedging’s viability.

Steps Ahead

Hanoi will deepen Indo-Pacific ties—U.S. maritime capacity-building, Japan-South Korea investments—while reassuring China through AI and green energy pacts, avoiding bloc symbolism.

Middle East-Africa partnerships advance via joint ventures in oil, minerals, and logistics “priority corridors,” targeting $10 billion trade by 2030. BRICS and G20 engagements amplify Global South advocacy on finance reform and supply chains.

Multilaterally, Vietnam pushes ASEAN centrality for South China Sea rules, embedding extra-regional gains in inclusive forums.

Economically, supply-chain upgrades from low-cost assembly to high-productivity manufacturing attract EU-Japanese FDI, cushioning tariff risks. Domestically, the Party adapts governance for tech exchanges without ceding control, balancing growth imperatives with ideological redlines.

Conclusion

Vietnam’s extra-regional expansion redefines hedging from a regional tightrope to a global web, transforming vulnerabilities into assets through diversified stakes that raise coercion costs for great powers.

Successes like BRICS entry and Gulf energy locks demonstrate middle-power ingenuity, yet fragility persists: tariff shocks reveal market perils, maritime disputes test resolve, and rivalry compression threatens ambiguity.

Sustainability hinges on execution—converting summits to sustained flows—and external tolerance for non-alignment. Domestically, reconciling openness with control proves pivotal.

Ultimately, Hanoi’s gambit asserts that even shadowed states can weave autonomy from the threads of multipolarity, potentially reshaping Indo-Pacific dynamics if emulated by peers.