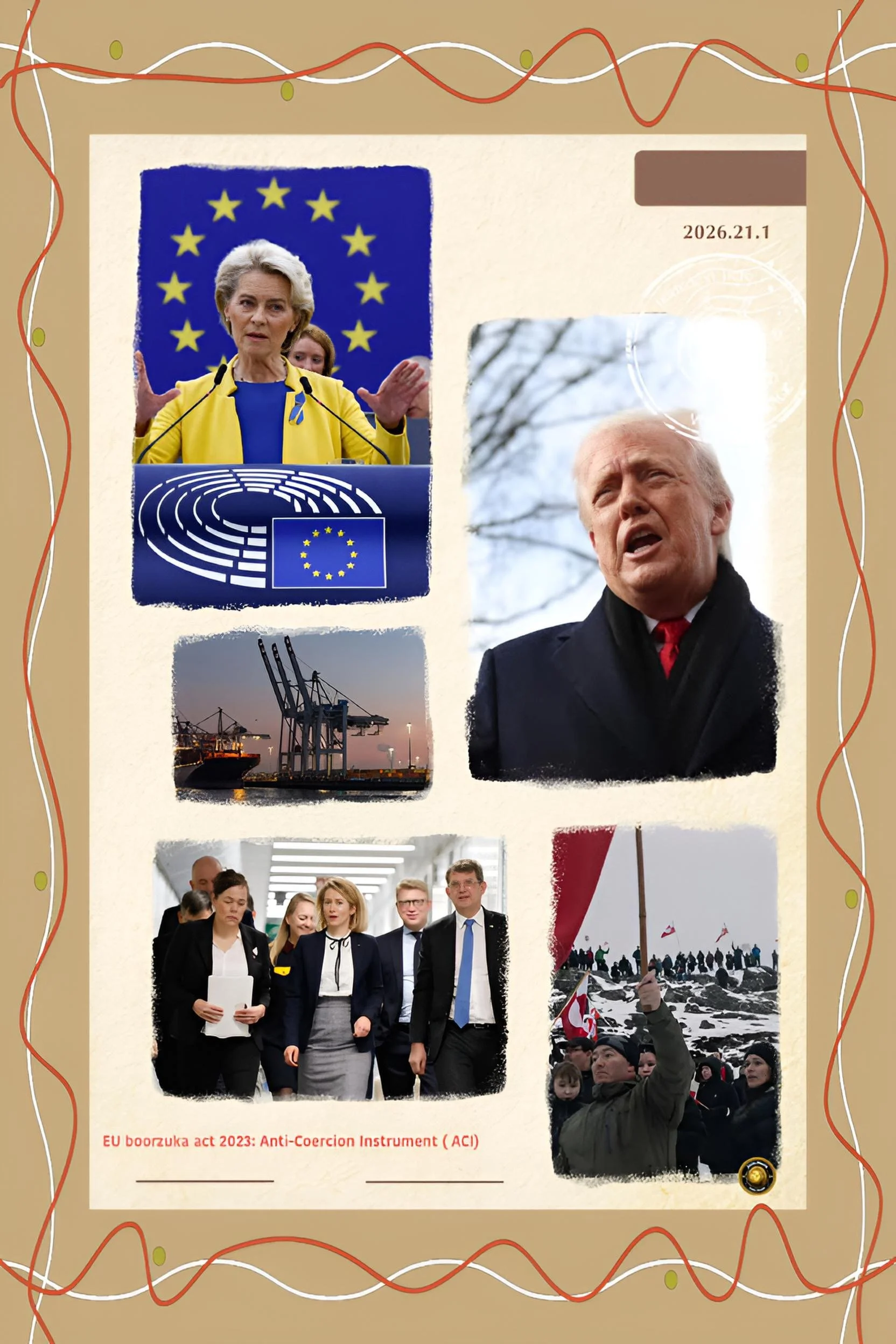

EU Bazooka Act: The Alliance at Breaking Point: Greenland, Tariffs, and the Collapse of Seventy-Five Years of Transatlantic Partnership

Introduction

When Allies Become Adversaries: Understanding the Unraveling of American-European Relations

The events of January 2026 mark a historic inflection point in the relationship between the United States and the European Union.

For seven and a half decades, the transatlantic alliance has been the stabilizing foundation of the Western world, providing security, prosperity, and a framework for addressing global challenges. The tariff threats over Greenland represent not merely a trade dispute but a fundamental challenge to the principles and institutions that have governed the relationship since the Marshall Plan rebuilt Europe after World War II.

To understand the significance of this moment, one must recognize that the alliance has weathered numerous crises: the Suez Crisis of 1956, disagreements over Vietnam, tensions during the Cold War regarding nuclear weapons deployment, and disputes over burden-sharing in NATO. Yet even during these confrontations, there existed a framework of mutual respect and shared strategic interest.

The current crisis differs fundamentally because it involves the weaponization of trade tariffs against allied nations in pursuit of a territorial objective that directly contradicts NATO principles.

The Economic Architecture Under Stress

The economic dimensions of transatlantic disruption merit serious examination because they reveal the depth of integration between American and European economies.

The United States and European Union conduct approximately $308 billion in trade annually.

American companies have invested over $1 Trillion in the European Union, and European companies have invested similarly vast sums in America. These investments represent factories, offices, supply chains, and employment for millions of workers on both sides of the Atlantic.

The 2025 trade agreement that was supposed to settle these disputes for years specified a fifteen percent tariff rate on European Union goods entering America. In exchange, the European Union eliminated tariffs on American industrial goods and committed to purchasing $750 billion American energy exports.

These concessions represented the European Union's attempt to accommodate American concerns while maintaining the economic relationship. The announcement of additional tariffs just weeks after this agreement was concluded suggested that the underlying dispute was not truly about traditional trade concerns but rather about America's geopolitical ambitions regarding Greenland.

Consider the practical implications for a multinational corporation.

A German pharmaceutical company with factories in Europe and research facilities in America suddenly faces uncertainty about tariff rates, market access, and regulatory treatment. Does the company invest another $100 million in American research facilities, or does it consolidate research in Europe and relocate American operations?

The uncertainty itself becomes a costlier factor than any specific tariff rate. Companies that face unpredictable tariff regimes reduce investment, delay hiring decisions, and consolidate operations rather than expand them.

The Sectoral Consequences That Transform Everyday Life

Understanding how this dispute translates into real-world impacts requires examining specific sectors that connect to people's daily lives.

The Pharmaceutical Sector: Americans depend on European pharmaceutical companies for approximately one quarter of all imported medicine.

Companies like Roche from Switzerland, Novartis from Switzerland, Bayer from Germany, and numerous others conduct research in America and Europe while manufacturing in multiple countries to serve global markets.

Tariffs and market access restrictions would immediately increase medicine prices. For diabetes patients requiring insulin, cancer patients needing chemotherapy, and people managing chronic conditions, medication costs would rise.

A disease management program costing $1000 monthly might become $1200.

For families with limited incomes, this becomes a choice between purchasing medicine and purchasing food.

The Automotive Industry

The American automotive supply chain is deeply integrated with Europe. German companies like BMW, Mercedes-Benz, and Volkswagen manufacture extensively in America for the American and global markets. They depend on importing precision components from Germany and Italy.

American manufacturers like General Motors and Ford depend on European suppliers for advanced technology. Additional tariffs would compress margins across the industry. To maintain profitability, manufacturers would raise vehicle prices.

A new car that currently costs $35 K might cost $39 K or more. For working families, this increases the threshold for vehicle purchases. Some families would keep aging cars longer, reducing demand for auto workers and for the manufactured goods that go into new cars.

The Energy Sector

Under the 2025 agreement, the European Union committed to purchasing American energy exports. If that agreement collapses due to tariff disputes, European energy supplies become uncertain and potentially more expensive. American energy companies depending on European customers lose markets. Energy prices for consumers on both sides of the Atlantic could rise.

The Technology Sector

American technology companies including Microsoft, Apple, Meta, Google, and Amazon depend substantially on revenue from European operations. If the European Union restricts American technology companies' market access as retaliation, these companies lose billions in anticipated revenue.

American consumers benefit from access to European technology services including sophisticated manufacturing equipment and specialized software. Restrictions would reduce options and increase costs for American businesses relying on European technology.

The Agricultural Sector

American farmers depend on European markets for crops including grains, dairy products, and specialty foods. Tariffs reduce European demand for American agricultural products. Farm income declines.

In rural areas where agriculture dominates the economy, declining farm income spreads through the community. Equipment dealers lose business, banks experience agricultural loan defaults, and agricultural towns struggle economically.

The NATO Security Crisis That Nobody Expected

The geopolitical implications may ultimately matter more than the economic ones. NATO was constructed on the principle that an attack upon one member constitutes an attack upon all members, binding them to mutual defense.

This principle has worked for seven and a half decades, preventing major European conflicts and providing deterrence against Soviet and Russian aggression. The use of tariffs against a NATO member in pursuit of that member's territory directly contradicts this foundational principle.

When Turkish forces attempted to purchase Russian military equipment, the United States imposed sanctions on Turkey under a US law called CAATSA , a fellow NATO member, on grounds of disagreement with Turkish foreign policy. That action strained NATO relationships.

The current situation is more severe because it involves the use of economic coercion to attempt to acquire territory from a NATO member. This crosses a threshold that NATO never previously encountered.

The psychological consequence may prove more damaging than any specific economic impact. If the United States can unilaterally use economic coercion against NATO allies to achieve territorial objectives, what constraint prevents further violations?

Eastern European NATO members might reasonably wonder whether American security guarantees actually provide protection when the American government can coerce its allies.

Poland, the Baltics, and other Eastern European nations might conclude that American security commitments lack credibility and that they must develop independent military capabilities or nuclear weapons.

Such developments would accelerate increases in defense spending and reduce military coordination within NATO.

The Broader Geopolitical Consequences

Russia and China would be the primary beneficiaries of transatlantic disruption. Russia benefits most directly because NATO disunity reduces the alliance's ability to maintain deterrence in Eastern Europe.

If NATO members reduce coordination and prioritize independent defense development, Russian military options expand. Russia could become more assertive in Eastern Europe, potentially threatening Moldova or other non-NATO countries confident that the fragmented West would lack coordinated response capacity.

China benefits because reduced American-European coordination weakens Western efforts to constrain Chinese technological development and geopolitical expansion. China would increase its technological partnerships with Europe, particularly in sectors where America had maintained coordinating restrictions.

Chinese companies would expand their presence in European markets. European strategic autonomy, which has been a stated objective of EU leadership, would become necessary and would reduce Western coordination on containing Chinese influence.

Global supply chains would reorganize toward regionalization rather than globalization. Companies would shift from integrated global supply chains to regional supply chains.

This would reduce efficiency but would decrease vulnerability to future transatlantic disruptions. American companies would regionalize around North America, European companies around Europe, and Asian companies around Asia. This reorganization would be costly and would ultimately raise prices for consumers as supply chain efficiency declined.

Developing countries would suffer significant negative consequences. Countries dependent on export access to American and European markets would experience reduced demand and reduced income.

Commodity prices would decline as global demand contracted. Sovereign debt servicing would become more difficult for countries already burdened with debt from the COVID pandemic. The development progress that many countries had achieved would reverse.

The Historical Significance of This Moment

The historian might observe that this moment resembles the 1930s when rising protectionist barriers between major economies contributed to the economic devastation and political extremism that culminated in World War II.

The current dispute over tariffs and territory is less immediately threatening than that historical moment, but the direction is similar: major powers fragmenting into competing spheres, reducing institutional coordination, and prioritizing unilateral advantage over collective benefit.

Alternatively, this moment might represent a transition toward a multipolar world in which the American-European dominance that has characterized the postwar period gives way to a more competitive geopolitical order.

In such an order, Russia and China would expand their influence in the absence of coordinated Western constraint, developing countries would struggle with reduced opportunities, and the rules-based international order would fragment into competing regional systems.

The resolution of this crisis will establish precedents that define international relations for decades. If the European Union activates the Anti-Coercion Instrument, it signals that the United States has become a coercive power worthy of defensive responses.

If the European Union capitulates without significant retaliation, it signals that American great power status permits violations of alliance principles without consequence. If negotiations produce some accommodation, the precedent would suggest that persistent coercion can extract concessions from powerful alliance partners.

Conclusion

The Alliance Confronts Its Future

The Greenland crisis represents far more than a disagreement over territorial acquisition or tariff rates. It represents a fundamental challenge to the institutional architecture and shared understandings that have defined the Western order since 1945.

The resolution of this crisis will determine whether that order survives or whether it fragments into competing regional systems lacking the coordination capacity to address global challenges cooperatively.

The consequences for regular Americans and Europeans will manifest through prices, employment, investment decisions, and the stability of the international environment in which they conduct their lives.

The stakes extend beyond economics to encompass security, stability, and the viability of democratic governance in a world increasingly characterized by authoritarian alternatives. The alliance at the breaking point faces its defining moment.