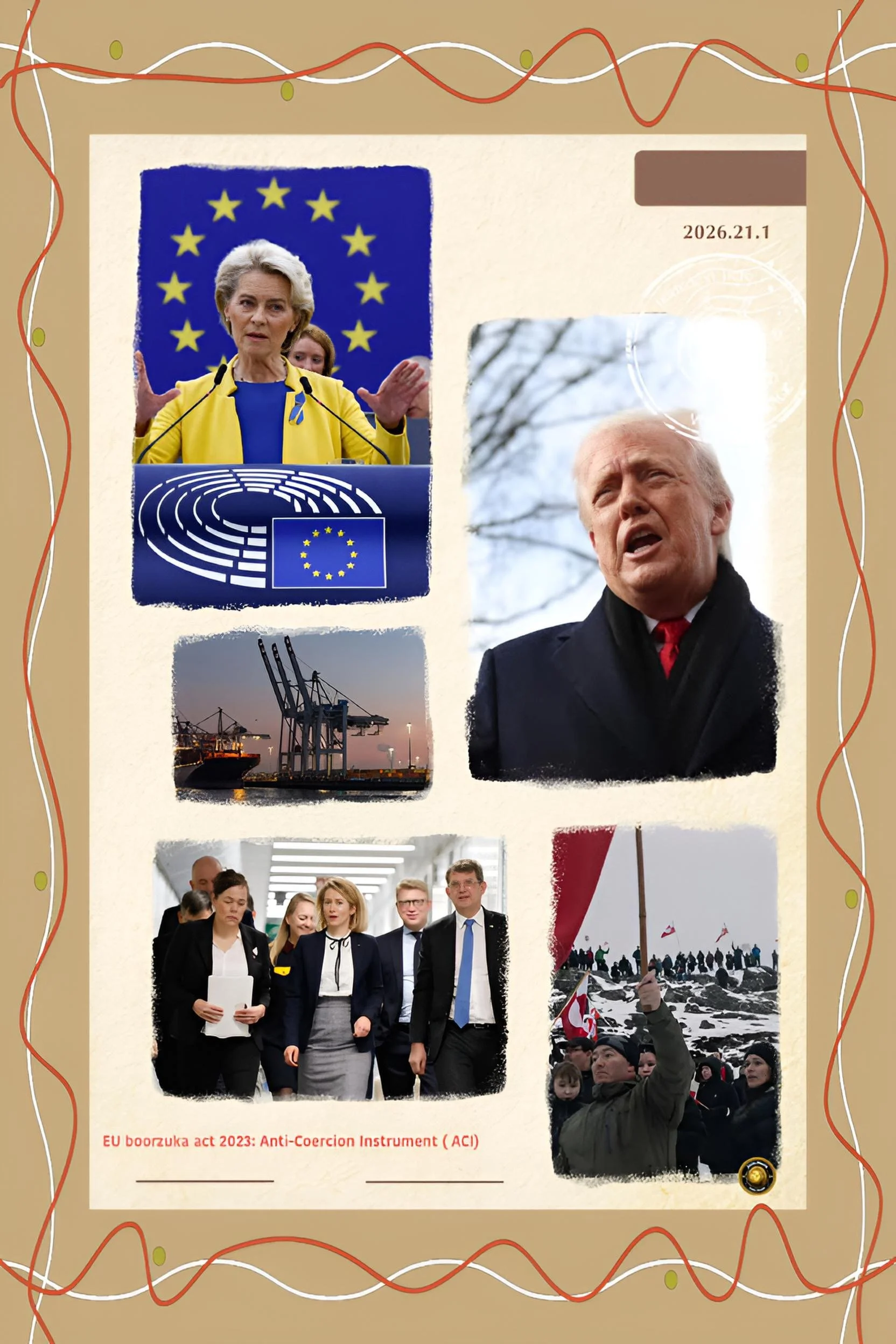

Transatlantic Disruption: EU Anti-Coercion Tool ‘ Bazooka Act’ Targets US Trade Pressure

Executive Summary

The escalation of trade tensions between the European Union and the United States, precipitated by American tariff threats linked to the acquisition of Greenland, represents an unprecedented challenge to the postwar transatlantic order.

Should the European Union activate its Anti-Coercion Instrument in retaliation, the consequences would extend far beyond bilateral trade dynamics, encompassing severe economic disruptions, a fundamental degradation of NATO cohesion, profound implications for global supply chains, and a reconfiguration of the strategic balance between democratic and authoritarian powers.

FAF analysis examines the multifaceted socioeconomic and political ramifications for the European Union, the United States, and the broader international system should such retaliation materialize.

Introduction

The intersection of trade policy and territorial ambition has long represented a source of international friction.

However, the current dispute between the United States and the European Union regarding Greenland introduces a novel dimension to transatlantic relations: the weaponization of tariffs against long-standing allies in pursuit of territorial acquisition, coupled with the prospect of invoking economic measures previously conceived as defensive mechanisms against authoritarian regimes.

In January 2026, President Trump announced that eight European nations would face escalating tariffs beginning at 10 % in February, rising to 25 % by June, ostensibly in exchange for the European Union facilitating the American acquisition of Greenland, a semi-autonomous territory of Denmark.

This ultimatum has prompted European leaders, particularly those in France and Germany, to contemplate activating the Anti-Coercion Instrument, a previously unused European Commission mechanism designed to counter economic coercion from non-European states.

The potential activation of this instrument represents the first instance in which the European Union might deploy its most formidable economic weapon against its primary security ally.

Historical Context and Current Status

The evolution of European trade policy defense mechanisms reflects decades of experience navigating contested relationships with major trading partners. The Anti-Coercion Instrument emerged from deliberations initiated in 2021, specifically designed in response to perceived coercive trade practices by China.

The mechanism was conceived as a last-resort deterrent, enabling the European Commission to restrict access to the European single market, impose tariffs or fees on imports and services, prohibit foreign direct investment, and exclude entities from public contracts within the Union.

Prior to January 2026, this instrument had never been activated, remaining dormant as a theoretical constraint against external economic pressure. The decision to consider its deployment against the United States would represent a historic rupture in the transatlantic relationship.

The dispute itself emerged against the backdrop of an August 2025 European Union-United States trade agreement, negotiated after months of contentious discussion regarding American reciprocal tariffs.

This agreement established a 15 % baseline tariff rate on European Union goods, representing a significant reduction from earlier Trump administration threats, which had ranged from twenty to thirty percent.

The agreement required mutual commitments: the European Union undertook to eliminate tariffs on American industrial goods and provide preferential market access for agricultural and energy products, while committing to acquire seven hundred fifty billion dollars in American energy exports.

The European Union also agreed to direct an additional $600 billion in investment toward the American economy. This negotiated settlement appeared to resolve the immediate crisis, and the European Parliament had scheduled ratification procedures for late January 2026.

The Greenland tariff announcement, delivered mere weeks after the conclusion of these negotiations, fundamentally altered the strategic calculus for European policymakers and rendered the trade agreement's ratification uncertain.

Key Developments and Latest Facts

The timeline of escalation compressed into approximately one week reflects the intensity of current transatlantic tensions.

On January 17, 2026, President Trump announced via Truth Social that eight European nations would face tariff increases, with the initial 10 % rate applying to Denmark, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland. Norway, while not an European Union member, was also included among the targeted nations.

The announced escalation to 25 % by June 1 created a temporal constraint designed to pressure European leaders toward capitulation before mid-year.

Trump characterized the tariffs as a response to military deployments by European nations to Greenland, which he described as unusually threatening and destabilizing.

In response, the European Union convened emergency sessions of its Council of Ambassadors on January 19, 2026, following an extraordinary meeting the preceding Sunday.

The meeting produced a consensus commitment to coordinate a proportional response while simultaneously maintaining diplomatic channels with the American administration.

The European Parliament, which had been prepared to vote on ratification of the August 2025 trade agreement, announced a suspension of these proceedings pending resolution of the Greenland dispute.

This suspension functioned as a politically significant signal that the European Union viewed Trump's actions as a violation of the negotiated framework and as grounds to reconsider previous commitments.

French President Emmanuel Macron emerged as the strongest advocate for activation of the Anti-Coercion Instrument, calling repeatedly for the European Union to deploy what has been colloquially termed the "trade bazooka."

German leadership, by contrast, signaled preference for continued diplomatic engagement, reflecting Germany's greater vulnerability to trade disruptions given its substantial manufacturing export base.

The divergence between French and German positions regarding the appropriate response reflected deeper European divisions between those prioritizing strategic autonomy from the United States and those emphasizing the continued importance of transatlantic security cooperation, particularly given ongoing Russian military activities in Eastern Europe and the Arctic.

The European Union also contemplated allowing approximately €93 billion in previously suspended retaliatory tariffs to expire their suspension period on February 6, 2026.

This automatic expiration represented what European diplomats characterized as "passive retaliation," requiring no affirmative decision from European institutions while nonetheless imposing substantial costs on American exporters.

These tariffs had been negotiated during the previous trade conflict and subsequently suspended as part of the August 2025 accord.

The financial magnitude of these measures—equivalent to approximately $108 billion—indicated the substantial weaponry available to European policymakers without requiring the unprecedented step of activating the Anti-Coercion Instrument itself.

Cause-And-Effect Analysis: Pathways To Disruption

The activation of the Anti-Coercion Instrument would initiate cascading consequences across multiple dimensions of international economic and political organization.

The immediate economic mechanism operates through market access restrictions, investment limitations, and tariff imposition, but the secondary and tertiary effects extend into labor markets, investment patterns, monetary stability, and security cooperation.

Upon activation, the European Union would restrict American corporations' access to the European single market, encompassing a population of approximately 450 million consumers and representing one of the world's most economically developed regions.

This restriction would particularly impact American technology companies, which currently derive substantial revenue from European operations.

The European Union has already demonstrated willingness to impose substantial fines on American technology firms for non-compliance with digital regulations; in 2024, American technology companies collectively faced €3.8 billion in penalties. Further restrictions would extend these regulatory pressures into explicit market access denial.

For American pharmaceutical manufacturers, which exported significant volumes to European markets and obtained substantial European-derived revenues, such restrictions would generate immediate revenue losses.

The American automotive sector, already facing competitive pressures from European manufacturers in global markets, would lose access to European supply chains and manufacturing partnerships.

The economic impact on the European Union itself, while manageable in macroeconomic terms, would concentrate severely in particular geographic regions and sectors.

Economic modeling suggests that European Union gross domestic product would contract by approximately zero point three percent in scenarios incorporating mutual retaliation, a reduction that appears modest relative to the pre-tariff baseline growth expectation of 1.5%.

However, this macroeconomic aggregate obscures significant regional heterogeneity. Germany, whose export-oriented manufacturing base depends substantially on access to American markets and whose companies serve as crucial nodes in transatlantic supply chains, would experience estimated gross domestic product contraction of zero point four percent or greater.

The German automotive sector, a cornerstone of European industrial capacity, already facing the fifteen percent tariff structure from the August 2025 agreement, would confront additional uncertainty regarding investment decisions and production location.

Similarly, the pharmaceutical sector, concentrated significantly in Germany and Switzerland, would experience margin compression as tariffs raised input costs while potential market access restrictions threatened revenue streams.

The European Union's restriction on American financial services would represent a particularly consequential dimension of retaliation. American banks depend substantially on European operations and access to euro-denominated financial markets.

Restriction of these operations would raise funding costs for American financial institutions, compress profit margins in European operations, and potentially trigger capital flight from European markets as American financial firms consolidated operations elsewhere.

Given that European bond markets and European banking relationships constitute crucial infrastructure for transatlantic financial integration, restrictions on American financial services would generate systemic financial consequences extending beyond the bilateral United States-European Union relationship.

Simultaneously, the retaliation would generate significant welfare losses for European consumers and workers. While American technology companies would face market access restrictions, European consumers would lose access to specific services or face higher prices for services such as cloud computing, digital platforms, and software infrastructure.

The Information and Communications Technology sector, in which American companies maintain substantial market share, would become inaccessible or substantially more expensive, imposing costs on European businesses relying on these services and on European consumers utilizing digital platforms.

Conversely, restrictions on American food products, agricultural goods, and energy imports would raise prices for European consumers already facing inflation pressures from tariff-induced cost increases.

The mechanism would resemble the paradox of mutually assured economic destruction: both sides would impose costs on themselves while seeking to inflict greater costs on the adversary.

At the political level, the activation of the Anti-Coercion Instrument would likely trigger reciprocal escalation from the American administration.

Trade Representative Jamieson Greer explicitly warned that American retaliation would follow immediately upon any European activation of the instrument, characterizing such activation as "unwise."

The administration signaled that reciprocal tariff increases would expand beyond the eight initially targeted European nations to encompass all European Union member states.

Given the integrated nature of European union governance, any successful activation of the Anti-Coercion Instrument would trigger consequences for all member states, not merely those initially targeted by American tariffs.

The resulting tit-for-tat escalation would create a negative feedback loop in which each retaliatory measure prompted counter-retaliation, progressively restricting trade flows and increasing economic uncertainty.

The global implications extend substantially beyond the bilateral transatlantic relationship. Third-country exporters to American and European markets would confront tariff-induced demand contraction as consumers in both regions reduced consumption of import-intensive goods and as supply chain disruptions elevated production costs.

Emerging market economies and developing countries, which frequently depend substantially on exports to the United States or to European Union markets, would experience reduced foreign currency earnings, compressed export growth, and potentially heightened sovereign debt distress as currency values depreciated and commodity prices declined.

Vietnam, Thailand, Mexico, and India, which have benefited from previous American tariff tensions with China through trade diversion effects, would confront a dual pressure: the initial advantage of redirected trade flows would dissipate as global demand contracted and as supply chains reorganized to minimize exposure to transatlantic tariff volatility.

The NATO alliance would face unprecedented structural challenges.

The principle undergirding NATO since its founding stipulates that an armed attack upon one member constitutes an attack upon all, obligating mutual defense.

The use of tariffs against allied nations in pursuit of territorial acquisition—itself a violation of international law and NATO treaty provisions—would create an existential question regarding NATO cohesion. If the United States could unilaterally violate core NATO principles through economic coercion, what would be the mechanism preventing further violations?

Danish Prime Minister Mette Frederiksen issued a stark statement indicating that military action against Greenland would effectively terminate NATO as a functional alliance.

The psychological consequence would extend beyond formal treaty obligations to encompass allied perceptions regarding American reliability as a security guarantor.

European nations might initiate substantial re-armament, responding to American threats by increasing their military capabilities and reducing dependency on American defense commitments.

Germany, which had committed to increasing defense spending toward 5% of GDP, might accelerate this timeline and simultaneously pursue independent nuclear capabilities or closer military coordination with France.

The fragmentation of the transatlantic security community would create power vacuums that Russia and China would likely exploit through military expansion and revisionist activities.

Future Scenarios And Trajectories

The pathway forward from the current crisis encompasses multiple possible outcomes, each with distinct implications for international stability and alliance structure.

The base case among analysts emphasizes continued diplomatic negotiation, with the assumption that Trump administration officials would demonstrate flexibility regarding tariff deadlines and that European leaders would avoid the unprecedented step of activating the Anti-Coercion Instrument.

Under this scenario, the February 1 tariff implementation would proceed, the European Union would allow the suspended retaliatory tariffs to expire, resulting in mutual economic pain but without fundamental institutional rupture.

The European Parliament would continue to delay ratification of the August 2025 trade agreement, but negotiations would eventually produce some accommodation.

The United States and European Union would both claim diplomatic victory while accepting a marginally worse economic outcome than existed in late 2025.

An intermediate scenario involves European activation of selective tariff measures without invoking the formal Anti-Coercion Instrument.

The European Union could impose the €93 billion in suspended tariffs on American exports, targeting sectors and products calculated to maximize political costs within the American political system.

Bourbon from Kentucky, automotive components from Detroit and Ohio, agricultural products from the Midwest—these would be deliberately chosen to inflict concentrated costs on constituencies whose political support Trump considers essential.

This approach would demonstrate European willingness to retaliate while avoiding the institutional precedent of activating the Anti-Coercion Instrument and its unpredictable consequences.

The American administration would respond with targeted counter-tariffs on European luxury goods, automotive exports, and pharmaceutical products.

The resulting trade conflict would resemble the 2018-2019 tariff escalation, with progressive increases in rates, gradual expansion of covered products, and intermittent negotiations creating uncertainty.

The downside scenario—activation of the full Anti-Coercion Instrument accompanied by reciprocal American escalation—would initiate rapid transatlantic decoupling.

American companies would reorganize operations to minimize exposure to European markets, European companies would seek non-American alternatives for supply chains and partnerships, and the integration that had characterized the postwar Western economy would begin to unwind.

This process would unfold over months and years, not weeks, but the trajectory would be toward increasing economic separation.

The European Union would simultaneously accelerate initiatives toward strategic autonomy, pursuing indigenous European capabilities in semiconductor manufacturing, artificial intelligence development, cloud computing infrastructure, and space technology.

European defense spending would escalate rapidly, European nuclear capabilities would expand, and European diplomatic coordination with Russia might become more transactional as nuclear deterrence replaced American security guarantees.

Impacts on the Broader International System

The cascading consequences of transatlantic disruption would extend dramatically into global governance, international law, and the positioning of authoritarian powers.

The European Union and United States have historically functioned as joint architects of the liberal international order, establishing institutions, negotiating multilateral agreements, and enforcing norms regarding sovereignty and international behavior.

A rupture in this relationship would fundamentally alter this stabilizing function. Russia would gain strategic advantages as the primary beneficiary of transatlantic fragmentation.

NATO cohesion, already strained by Trump administration skepticism regarding mutual defense obligations, would deteriorate further, creating opportunities for Russian military expansion in Eastern Europe, the Balkans, and the Arctic.

The protection that NATO membership extended to eastern European nations would become questionable as the credibility of mutual defense commitments weakened. Russia might pursue aggressive action against non-NATO countries such as Moldova or Georgia, calculating that the fractured West would lack the cohesion to mount a unified response.

China would simultaneously benefit from reduced Western coordination on technological competition and supply chain security. American efforts to restrict Chinese access to advanced semiconductors, artificial intelligence technology, and other strategic industries would lose European coordination and enforcement.

China could deepen technological integration with Europe through investment, joint ventures, and supply chain partnerships that bypassed American restrictions.

The "de-risking" strategy that the European Union had begun to pursue regarding Chinese economic dependence would halt, and Europe might develop closer technological ties with Beijing to compensate for lost access to American technology and to fund defense spending increases.

The global supply chain architecture would undergo forced reorganization. Companies currently relying on transatlantic production networks would need to recononfigure sourcing, manufacturing, and distribution.

This reorganization would impose substantial costs initially but would ultimately produce more regionalized supply chains with greater redundancy and lower exposure to transatlantic trade disruptions.

The United States would move toward "nearshoring" and "friendshoring," sourcing from Mexico, Canada, and Central America rather than from Asia and Europe.

The European Union would develop more autonomous supply chains within the EU or within allied countries such as the United Kingdom, Norway, and Switzerland.

Global trade flows would decline as supply chains fragmented, transport costs increased, and companies accumulated excess capacity as supply chain rationalization proceeded.

The fragmentation would particularly harm developing economies dependent on export access to American and European markets.

Emerging market nations in Southeast Asia, Latin America, and Sub-Saharan Africa would confront reduced demand, compressed commodity prices, and capital outflows as global financial conditions tightened.

The sovereign debt distress that already characterized many emerging market economies would intensify, with debt-to-GDP ratios rising, currency values depreciating, and social stability deteriorating.

Conclusion

The potential activation of the European Union's Anti-Coercion Instrument in response to American tariff coercion would represent a pivotal moment in postwar history, marking the transition from a Western alliance system toward a multipolar arrangement characterized by transatlantic competition, regional power consolidation, and the emergence of authoritarian alternatives to the liberal international order.

For the European Union, retaliation would impose immediate economic costs but might prove strategically necessary to demonstrate credibility as a political actor capable of defending its interests against great power coercion.

For the United States, such a rupture would sacrifice the strategic advantages that alliance cohesion provided while potentially intensifying economic pressures that tariffs were ostensibly designed to alleviate.

For the broader international system, transatlantic fragmentation would remove the primary institutional constraint on great power competition, reducing incentives for cooperation on climate change, pandemics, terrorism, and other transnational challenges.

The resolution of the current crisis, whatever form it takes, will establish precedents regarding the acceptability of economic coercion against allies, the credibility of security alliance commitments, and the stability of the rules-based international order that has underwrote human welfare and democratic governance across the Atlantic for eight decades.