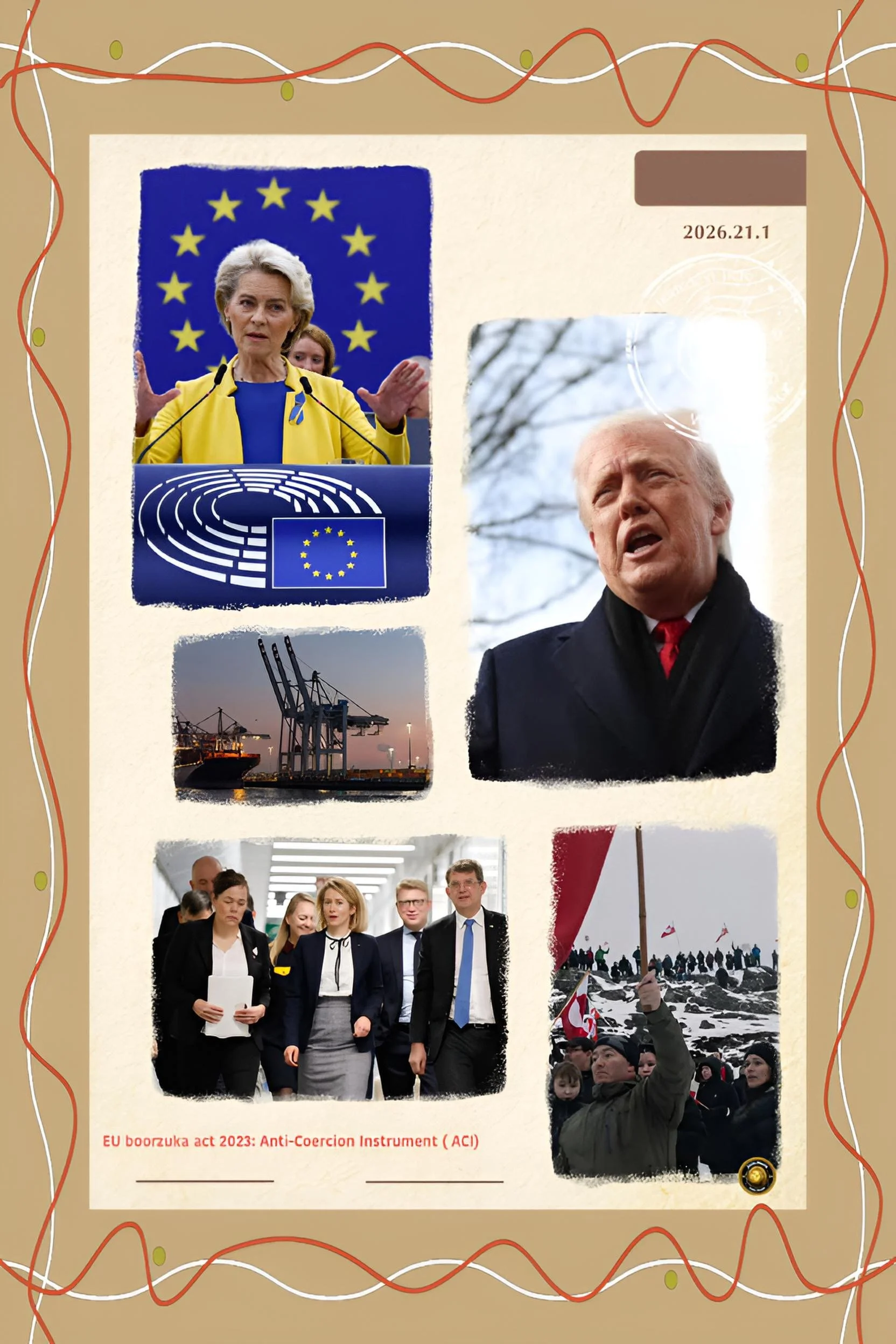

EU Bazooka Act: How trade war between America and Europe would hurt your wallet and your job: A complete guide to the Greenland crisis

Introduction: A Conflict That Affects You

In January 2026, something unusual happened that will change how Americans and Europeans shop, work, and live.

President Trump announced that eight European countries would face special taxes on their goods starting February 1, rising to higher levels by June. He demanded that Greenland, a large island owned by Denmark, be sold to the United States. If Europe refused, the punishment would be expensive taxes on everything from European cars to medicine to wine.

The European Union, the group of 27 European countries that work together on trade and other issues, considered fighting back by using a powerful economic weapon they created for situations just like this.

They called it the Anti-Coercion Instrument, or "trade bazooka." Nobody had ever used this weapon before. Think of it like two neighbors who have been friends for 75 years suddenly arguing about money and threatening to stop doing business with each other entirely.

This article explains what would happen to regular people like you if this conflict turns into a real trade war.

What Is the Anti-Coercion Instrument?

To understand this crisis, you need to know what the Anti-Coercion Instrument is.

The European Union created this tool in 2021 as a defense against countries that use tariffs to force other countries to do what they want. It was originally designed for China, but now Europe is considering using it against the United States.

If the European Union activates this instrument, here is what it can do:

(1) Block American companies from selling to European customers

(2) Stop American businesses from investing money in Europe

(3) Prevent American companies from winning contracts to build things for European governments

(4) Add special taxes to American goods coming into Europe

(5) Block American banks from using European financial systems

Think of it as locking American companies out of a market of 450 million customers. That is bigger than the entire United States population.

The Economic Impact on Your Wallet

When countries fight over tariffs, prices go up for regular people. Here is how it works in real life:

If the European Union and United States start a trade war, American families would pay about $1800 more per year for everything they buy. That comes from taxes added to products.

Clothing would become about 17 % more expensive. Food would cost more because American farmers who sell to Europe would have fewer customers and would raise prices at home.

Let's use a real example. Imagine you want to buy a European car, like a BMW or Mercedes-Benz. Right now, American buyers already pay a 15 % tax on imported cars because of earlier trade disagreements.

If the trade war gets worse, this could rise to 25 % percent or higher. A car that costs $50 K would suddenly cost between $57K - $62K.

Many families would not buy cars, hurting both American car salespeople and European car manufacturers.

For prescription medicine, Americans depend on European pharmaceutical companies for about a quarter of all imported medicine.

If trade wars restrict these imports, medicine prices would rise. A European drug company that currently sells a popular medicine in America for $100 per dose might have to raise the price to $115 or more. For families already struggling with healthcare costs, this hits hard. American families especially about 40 million depending on lingering Affordable care act, ( ACA) would loose more money.

For food, American grocery stores sell European chocolate, cheese, wine, and olive oil. All of these would become more expensive.

A bottle of French wine that costs $15 today might cost $17-$18. European beer and chocolate would become luxury items instead of everyday purchases.

For technology, many Americans use European software and services.

If Europe blocks American technology companies like Microsoft, Apple, Oracle, Google or AI companies from European markets as revenge, Europe loses access to these products and services, but they might find replacements. Amazon largest American on-line retailer would loose a market of 450 million people.

Both America and Europe have fewer options for replacement so consumers suffer more.

The Impact on Your Job

Trade wars destroy jobs.

This is the most serious consequence for working people. When countries fight over tariffs, companies stop hiring and start firing.

Here is how it works. If American farmers cannot sell crops to Europe, farming towns lose income. A grain farmer in Iowa who normally sells wheat to European customers would sell less wheat. The farmer might not hire seasonal workers. The equipment seller who sells tractors to farmers loses business. The truck driver who transports grain loses work. The bank that lends money to farmers sees defaults increase.

The American automotive industry would suffer greatly. Many American car factories use parts made in Europe. If tariffs make those parts very expensive, American carmakers would either build fewer cars or raise prices so high that people stop buying cars. Either way, factory workers get laid off or work fewer hours.

In manufacturing, workers in industries that use imported parts would lose jobs. According to 2025 labor data, when Trump launched the earlier tariff programs, manufacturing lost about 59K jobs, even though tariffs were supposed to protect it.

Companies facing uncertainty about tariff rates stopped hiring new workers and stopped investing in new factories. The uncertainty kills business confidence.

For European workers, the situation would be similar but in different industries. German automotive workers depend on selling cars to America. If American tariffs make European cars unaffordable, German car factories would close or reduce workers. French wine regions would lose their American market. Belgian chocolate manufacturers would struggle.

For example, in Germany, automotive workers earn good middle-class wages. A worker at a BMW factory might earn €40 K per year. If trade war causes car sales to fall, the factory might reduce shifts from 5 days to 4 days per week. The worker's income drops by 20 % immediately.

Some workers face permanent layoffs. In a small German town where the automotive factory is the major employer, losing factory jobs means the town struggles. Restaurants and shops that serve factory workers lose customers and lay off their own workers.

In America, agricultural workers would face similar challenges. A family farming operation in Nebraska or Kansas depends on export markets. When those markets close due to tariffs, the family might not be able to pay loans on their land and equipment. American agricultural bankruptcies would rise.

The Historical Example That Explains What Happens

To understand what a trade war looks like, we can look at 2018 and 2019 when Trump was president the first time and started tariffs on steel, aluminum, and Chinese goods. Even though he said tariffs would help American workers, the data showed something different.

In those two years, American manufacturers using steel and aluminum in their products faced much higher costs. Car manufacturers, appliance makers, and machinery companies all had to pay more for inputs. Instead of building new factories and hiring workers, they reduced hiring. Even though the government was supposed to protect them with tariffs, these companies lost jobs overall.

One study by the Federal Reserve found that between 2018 and 2019, tariffs resulted in a net loss of 142 K full-time jobs in America.

Steel mills and aluminum plants that were protected did not add jobs fast enough to make up for the job losses in factories using steel and aluminum.

American farmers also suffered. When China responded to American tariffs by refusing to buy American soybeans and corn, American farmers lost sales.

The U.S. Department of Agriculture reported that American farmers lost twenty-seven billion dollars in export sales between 2018 and 2019.

The same pattern would happen again with Europe. Tariffs would hurt more jobs than they help.

What Would Happen to Prices for Regular Things You Buy

Let us look at specific products and what would cost more:

Clothing and shoes: Many Europeans produce high-quality clothing. If tariffs make European clothing very expensive, American stores would either buy less or charge customers more. You might pay one hundred dollars for a pair of shoes that used to cost eighty-five dollars.

Cheese: Europe produces excellent cheese that Americans love. French, Italian, and German cheeses would become much more expensive or disappear from stores. A pound of quality European cheese might go from twelve dollars to fifteen dollars.

Wine: European wine is popular with American consumers. A bottle might go from fifteen dollars to nineteen dollars. Some Americans would buy cheaper domestic wine or stop drinking wine regularly.

Automotive parts: If someone needs to repair a European car, parts from the manufacturer become more expensive. A part costing $200 might cost $250.

Medicine and pharmaceuticals: About a quarter of America's imported medicine comes from Europe. If these become more expensive, Americans with serious illnesses face higher medication costs.

Electricity and heating: Europe sells some natural gas equipment to America. Higher costs would eventually mean higher electricity and natural gas bills for some regions.

The Impact on Global Trade and Developing Countries

When America and Europe fight, the whole world suffers. Here is why.

Many poor countries depend on selling products to America and Europe. Vietnam, Thailand, and Bangladesh make clothes that American stores sell. Mexico makes car parts for American manufacturers.

If America and Europe are fighting and buying less, these countries cannot sell their goods. Workers in Bangladesh who make t-shirts lose jobs. Families in Vietnam who depend on factory income struggle. The money these countries earn from exports buys equipment to build schools, hospitals, and roads. When export income falls, development slows.

Additionally, supply chains that connect the world would break apart. A car made in America might use parts from Europe, materials from Australia, and technology from Asia. If tariffs make this complicated chain too expensive, manufacturers would try to make everything in one place. This is more expensive and less efficient, meaning higher prices for everyone.

Global trade flows would shrink. Economists expect global trade growth to slow from 2.9 % per year to just 1.1 % if tariffs increase.

This is the slowest growth in trade in decades. Many developing countries would experience economic problems including rising unemployment and declining currency values.

What Would Recovery Look Like?

If the European Union and United States eventually end their trade conflict, recovery would take years, not months.

Companies would need to rebuild relationships that were broken. A European pharmaceutical company that was blocked from selling to America would need to reorganize its business. A German car manufacturer that moved production away from America to avoid tariffs would need to bring production back. This costs money and takes time.

Supply chains would need to be reorganized. A company that spent months finding new suppliers in Southeast Asia instead of buying from Europe would eventually go back, but the transition costs money and takes planning.

Jobs would return slowly. Once a factory closes or reduces workers, restarting that factory takes time even if the tariffs end. Companies would be cautious about hiring again, worrying whether future trade conflict would happen.

Consumer prices would not fall immediately even after tariffs ended. Once companies raise prices to cover tariff costs, they often keep those prices even when tariffs disappear. The price increase from tariffs tends to be permanent even after the tariffs themselves end.

Why This Matters for Everyone

This trade conflict matters because it affects you personally. It would make the things you buy more expensive, potentially cost you your job or reduce your income, and would create economic uncertainty that affects investment decisions and business planning.

The broader consequence is that America and Europe have been closely allied for 72 years. That alliance provided security, prosperity, and a stable world order. If that alliance breaks apart due to tariff conflicts, the world becomes less secure. Russia and China would gain advantages. International cooperation on climate change, disease prevention, and security would become harder.

The world would be more unstable.

For regular people, that instability eventually matters. It means fewer good jobs, less investment in education and infrastructure, and more economic anxiety.

Conclusion: What Comes Next

The conflict over Greenland and tariffs between America and Europe remains unresolved. European leaders are meeting to decide whether to use their Anti-Coercion Instrument. American officials are threatening to retaliate if Europe does. The outcome will affect your life through prices, jobs, and economic opportunity.

If negotiations succeed and both sides compromise, prices would not rise dramatically and jobs would be secure. If negotiations fail and both sides escalate tariffs, the economic consequences would spread across the Atlantic to affect regular people in both regions and around the world.

Understanding what is at stake helps explain why leaders on both sides are working hard to avoid the worst outcome, even as political pressure pushes toward confrontation.