The Day Money Changed: What Happened in 1971 and Why Global Leaders Are Worried It Will Happen Again

Summary

What Happened in 1971 and Why It Matters to You Today

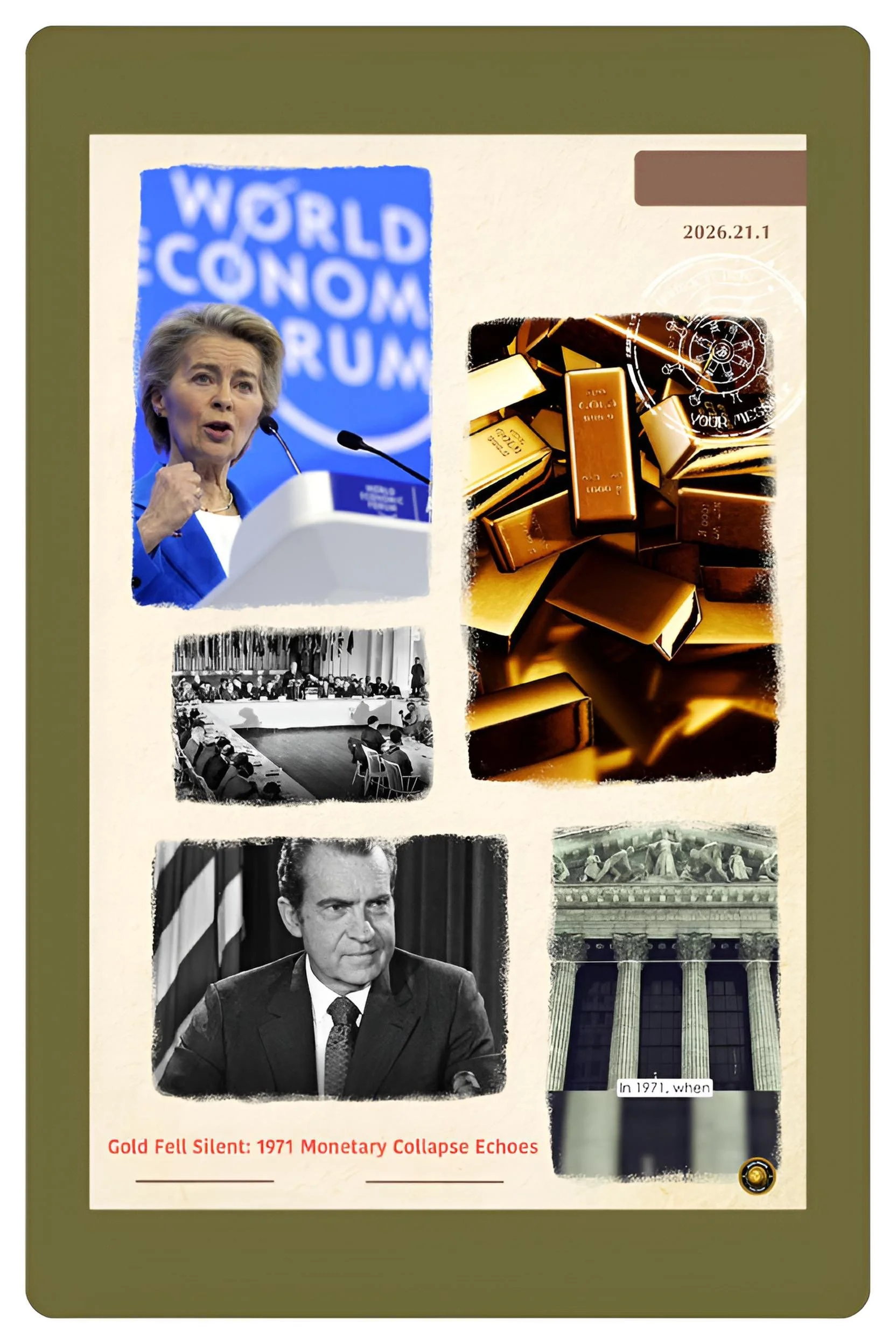

In August 1971, something happened that changed the world forever. But most people never heard about it, and those who did might not have understood why it mattered.

President Richard Nixon made a decision that collapsed the entire global financial system that had been built after World War II. He did this without warning anyone ahead of time. And he did it with three simple words: close the gold window.

For more than twenty-five years, the world had operated under a system called Bretton Woods. This system said that the US dollar was backed by gold. If you were a country that held dollars, you could trade those dollars for gold at a fixed price of $35 per ounce.

This made the dollar trustworthy. If you were worried about your dollars losing value, you could always trade them for gold, which could never lose value because it is gold.

What happened?

During the 1960s, America was spending enormous amounts of money. The Vietnam War was costing billions of dollars. The government was also spending money on social programs at home.

To pay for all this, the American government had to print lots and lots of dollars. More dollars were printed than the US had gold to back them. By 1971, there were roughly four times as many dollars floating around in the world as the US actually had gold sitting in Fort Knox.

Other countries noticed this problem. They said, if the US does not have enough gold to back all these dollars, maybe those dollars are not trustworthy.

So countries like France and Switzerland started demanding that America trade their dollars for gold. The US gold reserves started going down, down, down. America was running out of gold. At some point, there would be no gold left, and the whole system would break apart.

When Nixon realized this was happening, he decided to act.

Over a weekend in August 1971, he and his economic advisers met at Camp David, a presidential retreat. They made a big decision. America would no longer trade dollars for gold. If someone wanted to trade a dollar for gold, America would say no. This sounds simple, but it was actually enormous.

When Nixon announced this decision on television on August 15, 1971, the entire global monetary system collapsed. Just like that. The agreement that had held the world's finances together for more than two decades fell apart.

Countries did not know what their currencies were worth anymore. Exchange rates between different countries' currencies became unstable. Suddenly, money did not have a clear anchor anymore. What made a dollar worth something? Nobody was sure. It was chaos, at least for a while.

But here is something interesting: out of that chaos came a new system. The world did not end. Instead, new ways of handling money grew up. Eventually, countries agreed to let their currencies float freely, meaning their values would go up and down based on what people thought they were worth.

This turned out to work okay. In fact, it worked well enough that for the last fifty years, the world has operated under this system, and the US dollar remained very powerful.

But fast forward to 2026. The world is now facing something that reminds many leaders of that 1971 moment. And that is why Ursula von der Leyen, who runs the European Commission, brought it up at the World Economic Forum in January 2026. She was saying: we saw what happened in 1971. We are seeing similar pressures building today. We need to prepare.

What are these pressures?

Well, the dollar is still powerful, but it is not as powerful as it used to be.

Think of it like this: in 1999, if you looked at all the money that countries kept in reserves at their central banks, about 71 % of it was in dollars. By 2023, only about 58 % percent was in dollars. That does not sound like a huge drop, but it is significant. Countries are putting less trust in the dollar.

Why? One big reason is that America has weaponized its control over the dollar system. After Russia invaded Ukraine, America used its control of the Swift system—the network that processes most international payments—to kick Russian banks out. This showed the world that if America does not like you, it can prevent you from using the dollar system.

Countries like China, Iran, and others said, we do not want to depend on a system that America can turn off against us. So they started building alternatives.

China created its own way of moving money between countries called CIPS. Russia and China started trading with each other in their own currencies instead of using dollars. India started buying oil from Russia using Indian rupees instead of dollars.

Brazil and China made agreements to trade with each other in their own currencies. All over the world, countries were saying: we are going to reduce how much we depend on the dollar.

The BRICS group—which includes Brazil, Russia, India, China, and South Africa, and was recently expanded to include Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates—started working on a payment system that would be an alternative to Swift.

They also created a bank called the New Development Bank, which lends money in local currencies instead of dollars. They were building a parallel financial system.

At the same time, countries started developing digital versions of their money. China created a digital yuan and started testing it. Europe started working on a digital euro. Sweden, the UK, and many other countries did the same.

These are not cryptocurrencies like Bitcoin. These are official money issued by governments, just in digital form. And they can potentially talk to each other and allow countries to trade without needing the dollar system in the middle.

All of this is happening for a reason: countries want to reduce their risk. When you have to use someone else's currency and they can take you off their system whenever they want, you are vulnerable. So countries are building ways to trade with each other that do not depend on American infrastructure.

Now, this does not mean the dollar is going to collapse next week. The dollar is still very powerful. America still has the deepest financial markets in the world.

American Treasury bonds are still considered the safest investment in the world. The dollar is still used for most international trade. But what is changing is that the dollar is no longer a monopoly. It is becoming one option among many.

Think of it like this: imagine a small company that delivered packages to everyone in the city. For decades, they were the only option, so everyone used them. But then new companies started offering delivery services too. The original company is still big and still has many customers, but they do not have complete control anymore. That is what is happening to the dollar.

The question for Europe, which is why von der Leyen brought this up, is: how does Europe position itself in this new world?

Europe cannot control whether other countries stop using the dollar. Europe can only control whether Europe itself builds the infrastructure it needs to be independent. That means developing its own financial systems, its own payment networks, its own digital currency. It means making sure that Europe is not too dependent on the dollar or on any other single country's system.

Von der Leyen was basically saying: we saw what happened in 1971 when the system that everyone depended on broke. We saw what happened when America unilaterally decided to change the rules. We learned then that if you do not control your own destiny, you become vulnerable. So we need to learn that lesson again today. We need to build European independence.

This is happening right now

The European Union is working on a European digital currency. It is making trade agreements with countries in Latin America, Asia, and Africa instead of depending only on trade with America. It is building defense capabilities so it is not completely dependent on American protection. It is diversifying its energy supplies so it is not dependent on any single country for power.

None of this is meant to be hostile to America. It is just realistic.

The world has changed since 1971. America is still powerful, but it is not the only powerful country anymore.

China is huge. India is growing fast. Russia is pursuing its own interests.

The Middle East is more independent.

Africa is developing rapidly.

So it makes sense that they would want financial systems that work for them, not systems that depend on one country.

What does this mean for ordinary people?

It probably means that the world is going to be more complicated financially. It probably means that in the future, you might have multiple options for how to send money, what currency to use, and where to store your wealth.

It might mean that prices for things you buy could be affected by changes in currency values. It might mean that the job you do, the salary you get, and the value of your savings could be affected by which currencies are strong and which are weak.

But it also means that the system will be less dependent on one country, which some people think is better. If the financial system does not depend on the US dollar, then America cannot use that system as a weapon as easily.

If countries can trade with each other in their own currencies, maybe there will be less conflict and more cooperation.

The lesson from 1971 is that financial systems change.

They have to change when the reality underneath them changes. The reality in 1971 was that America did not have enough gold. The reality today is that the world has many centers of power, not just one.

The financial system will eventually reflect this new reality. How quickly it happens, and whether it happens smoothly or chaotically, depends on how well countries manage the transition.

Von der Leyen was saying at Davos: we need to manage this transition smoothly. We need to recognize what is happening. We need to build systems that will work for us in the new world that is coming. That is the lesson from 1971. When the world changes, you have two choices: you can understand the change and position yourself to handle it, or you can ignore the change and be caught off guard when it hits you.

Europe, she was saying, intends to understand the change. Europe intends to prepare. And so should everyone else.