How Profit Beat Out Geopolitics in the AI Race: A Comprehensive Analysis of 2025's Watershed Moment

Executive Summary

The year 2025 marked a decisive inflection point in the field of artificial intelligence competition. While deepening technological tensions between the United States and China could have accelerated a bifurcated global economy, economic incentives instead proved more potent than security imperatives.

The emergence of China's DeepSeek R1 in January exposed the limitations of American export controls, yet rather than triggering tighter restrictions, the Trump administration pivoted toward what might be termed "monetized competition"—permitting advanced chip sales to China while extracting tariff revenue.

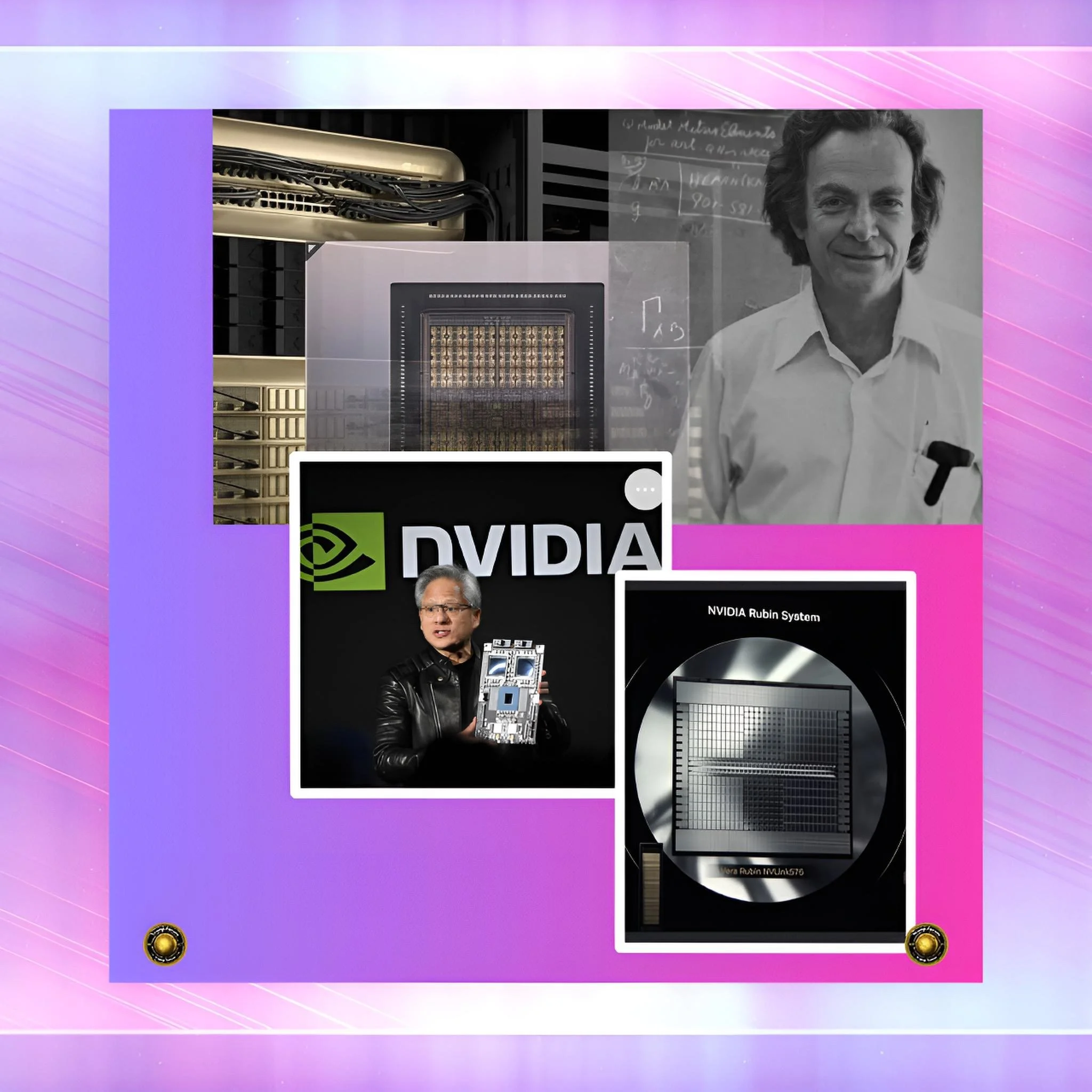

Simultaneously, Silicon Valley's most powerful executives, particularly Nvidia's Jensen Huang, successfully lobbied against congressional measures that would have restricted such exports. The confluence of these events reveals a fundamental reality: in 2025, too many stakeholders were profiting from AI advancement to allow geopolitical restraint to prevail.

Introduction

The rivalry between the United States and China in artificial intelligence has grown steadily since the mid-2010s, with significant policy interventions beginning in 2022.

The Biden administration implemented comprehensive export controls on advanced semiconductors, targeting companies like Nvidia and AMD to deny Chinese firms access to cutting-edge compute capacity. These restrictions reflected a strategy rooted in Cold War thinking—the belief that technological denial could indefinitely suppress an adversary's capabilities.

The export control regime distinguished between chips intended for different use cases, imposed bandwidth limitations, and required strict licensing for exports. By late 2024, this architecture appeared largely intact, with proponents arguing that the controls had successfully constrained China's access to frontier computing resources.

Yet the strategic foundation of this policy crumbled almost immediately upon the arrival of 2025. On January 20, DeepSeek, a Chinese AI laboratory, released its R1 reasoning model, achieving performance metrics comparable to or exceeding OpenAI's frontier models, trained on hardware generations behind American technology and at a fraction of the cost.

Released publicly under the MIT open-source license, the model became the most downloaded app on the iOS App Store within a week. The release catalyzed a period of reassessment within Washington policymaking circles regarding the efficacy of export controls. Simultaneously, it accelerated a transition toward a different policy regime.

Current Status: The Pivot from Containment to Monetization

The transformation occurred in three distinct phases across 2025. In the first phase, spanning January through March, the DeepSeek release triggered alarms and calls for tighter restrictions from bipartisan congressional figures. Senator Elizabeth Warren and others urged the Commerce Department to strengthen controls on H20 chips and comparable hardware.

However, by mid-year, the momentum had reversed. In May, the Trump administration approved the sale of hundreds of thousands of advanced semiconductors to the United Arab Emirates, representing a significant departure from Biden-era constraints. These approvals accelerated throughout the year, culminating in November announcements that Saudi Arabia's HUMAIN and the UAE's G42 would each receive access to approximately 35,000 Blackwell-equivalent chips—among the most advanced processors in Nvidia's portfolio.

The capstone of this policy transformation came on December 8, 2025, when President Trump announced that Nvidia's H200 chips could be exported to Chinese customers. The measure differed fundamentally from previous restrictions. Rather than maintaining a "presumption of denial," the administration established a revenue-sharing mechanism under which the United States would collect a 25% tariff on H200 chip sales to China.

The explicit calculation was geopolitical but fundamentally monetized: allow American companies to tap the world's second-largest economy while capturing tax revenue and maintaining a persistent technological lead through version control. Subsidiary provisions required third-party verification of chip specifications. They prohibited Chinese cloud providers from using the hardware outside Chinese territory, yet these safeguards did little to obscure the essential reversal.

By January 2026, the administration had formalized these arrangements through regulatory channels, establishing explicit export caps. The regulation permitted China to acquire H200 chips equivalent to 50% of domestic American sales—a threshold expected to reach approximately 850,000 units, representing computing power comparable to several extensive American AI research facilities. This represented a full-scale abandonment of the containment strategy that had defined the previous administration's technology policy.

Key Developments: Corporate Power and Policy Reversal

The transition from restriction to permission did not occur organically through bureaucratic processes. Instead, it reflected sustained corporate influence on policy formation. NVIDIA's CEO Jensen Huang personally met with President Trump in early December to discuss export policy. Huang's message to lawmakers proved consistent: export controls, he argued, would not slow Chinese advancement but would instead push the Chinese government to subsidize domestic semiconductor manufacturing.

This argument, repeatedly deployed before Senate committees, reflected a calculation rooted in corporate interests. By maintaining a technological lead and ensuring that Chinese companies remained dependent on American chips, Nvidia could preserve its dominant market position while capturing global market share. The alternative—total denial—risked accelerating Chinese self-sufficiency, ultimately eliminating Nvidia's largest growth market.

The White House AI czar, David Sacks, emerged as the key government advocate for relaxing restrictions. Sacks moved aggressively to prevent the "GAIN AI Act" from being included in defense authorization legislation. The GAIN AI Act would have mandated that chipmakers prioritize domestic customers before exporting to nations subject to embargoes.

The measure represented precisely the kind of national-security-first approach that export control orthodoxy would have endorsed. Yet Sacks, a venture capitalist with deep ties to Silicon Valley, mobilized the White House Office of Legislative Affairs to torpedo the initiative. His argument paralleled Huang's: maximizing American AI dominance required permitting American companies to compete globally rather than imposing artificial constraints.

The numbers underlying corporate incentives proved staggering. NVIDIA's fiscal year 2025 revenue reached $130.5 billion, representing 114% growth year over year.

Gross margins remained extraordinarily high, approaching 75%, providing the company with sufficient profitability to fund ongoing research while expanding global operations. The data center segment, which accounted for nearly 90% of revenues, remained capacity-constrained throughout 2025. Customers waited eighteen months for chip allocations. Under such circumstances, expanding addressable markets became a natural corporate imperative. China, despite sanctions, represented potentially the world's second-largest AI market. Denying it entirely meant accepting foregone revenues that competitors might otherwise capture through illicit channels or alternative suppliers.

This calculation extended across the broader semiconductor ecosystem. TSMC, the foundry that manufactures Nvidia's chips, experienced explosive growth in 2025, with AI accelerators accounting for nearly 30% of total revenues by year's end.

The company's management explicitly elevated its five-year growth outlook for AI accelerators to a midpoint of fifty to fifty-five percent annually through 2029. Such projections rested upon sustained global demand. Middle Eastern sovereign wealth funds and Chinese firms alike represented critical components of these revenue forecasts. Restricting access would compromise the growth narratives that justified the extraordinary capital expenditures required by TSMC and similar suppliers.

The Competitive Disruption: DeepSeek and Open-Source Economics

Paradoxically, the policy reversal accelerated by corporate lobbying was fundamentally enabled by technological disruption originating from China itself. DeepSeek's breakthrough did not rest primarily on access to cutting-edge chips but rather on architectural innovation and training methodology.

The company achieved remarkable performance improvements by deploying a Mixture-of-Experts architecture, in which only 37 billion of its model's total 671 billion parameters were activated during each forward pass. This innovation reduced training costs to estimates ranging from five to six million dollars—a figure that seemed impossible given frontier model training costs of hundreds of millions of dollars mere years earlier.

The R1 model's open-source release amplified its impact. Unlike OpenAI's proprietary ChatGPT or Google's Gemini, DeepSeek provided full model weights under a permissive MIT license, enabling anyone with sufficient computational resources to run, modify, and deploy the system.

This democratization fundamentally threatened the economics of proprietary AI businesses. OpenAI responded by slashing API pricing: the company's o3-mini model, released in response to DeepSeek, undercut its previous flagship offering by orders of magnitude. The broader market shifted from a regime in which advanced AI capabilities commanded premium prices—OpenAI's o1 reasoning model initially priced at $60 per million output tokens—to a commodity economics in which cost compression became inevitable. DeepSeek's 55-cent-per-input-token pricing established a new market baseline, forcing competitors to recalibrate their business models or risk obsolescence.

This competitive disruption created an unexpected alignment between geopolitical rivals. American companies found themselves under pressure to compete not only with DeepSeek but with a proliferation of open-source models that reduced barriers to entry. The alternative to opening Chinese markets was not preservation of American dominance but rather cession of global market share to open-source alternatives or Chinese competitors.

Under such circumstances, even national security–conscious policymakers found themselves aligned with corporate profit maximization. NVIDIA's executives could credibly argue that providing chips to China served American interests by preventing Chinese self-sufficiency, while simultaneously capturing revenues that would otherwise migrate to competitors.

Cause and Effect: The Triumph of Economics Over Strategy

The causal chain linking DeepSeek's release to the policy reversal involved multiple reinforcing mechanisms. The technical demonstration that advanced AI capability could be achieved without access to the most cutting-edge American chips directly undermined the premises upon which export controls rested.

If China could produce competitive models using restricted H800 and H20 hardware through innovative optimization, the marginal value of denying access to newer generations appeared diminished.

Simultaneously, Chinese adoption of older-generation chips created inventory pressure in Nvidia's supply chain. Rather than allowing this inventory to remain stranded or selling at discounted prices, the company could pursue a more favorable arrangement.

The geopolitical dimension reinforced the economic logic. The Trump administration, unlike its predecessor, showed skepticism toward perpetual restrictions on Chinese access to technology. Trump's earlier tenure had involved both aggressive trade measures and, critically, moments of pragmatic accommodation where commercial interests prevailed.

David Sacks and other administration figures aligned with this pragmatism. When Huang and other executives demonstrated that profit and national security need not conflict—that indeed, permitting chip sales would preserve American competitive advantage while generating revenue—the political barriers to policy change evaporated.

Congressional opposition weakened as well. While senators, including Elizabeth Warren, maintained public positions opposing chip sales to China, the GAIN AI Act failed to advance through legislative processes. The White House's aggressive opposition proved dispositive.

Without executive branch support, legislative initiatives stood on their own. This reflected a broader political alignment in which the technology industry's contributions to campaigns and political action committees, combined with the revolving door between venture capital and government service, ensured that corporate interests exerted substantial influence over technology policy.

The Middle Eastern development accelerated these dynamics further. By establishing precedents for selling advanced chips to non-adversarial nations aligned with American interests, the Trump administration created templates for expansion into other markets. The narrative shifted from "deny advanced chips to competitors" toward "leverage chips as tools of diplomatic engagement."

This reframing permitted the sale of Blackwell chips to Gulf states while restricting them from China, creating a hierarchical system wherein technological access became a commodity distributed according to geopolitical alignment and commercial viability.

The mechanism by which profit overcame geopolitics operated through several distinct channels. First, corporate communications expertise and sustained lobbying enabled companies to reshape policy narratives.

When Huang and others repeatedly argued that restrictions would accelerate Chinese self-sufficiency, they provided policymakers with frameworks for rationalizing policy reversals. Second, the existence of genuine technological uncertainty about the efficacy of export controls created space for profit-motivated reinterpretation.

If restrictions might not work, why not monetize exports instead? Third, the labor of venture capitalists and tech entrepreneurs embedded within government—exemplified by Sacks—ensured that pro-business perspectives achieved institutional representation at the highest levels.

Critically, no organized countervailing force possessed comparable resources. National security analysts and foreign policy establishments issued warnings, but these voices lacked the organizational coherence and financial resources of Silicon Valley. Congressional advocates for stricter controls confronted White House opposition.

The Department of Commerce, responsible for enforcement, remained under-resourced and politically subordinate. Under such circumstances, the structural advantage lay with corporate interests.

Future Implications: A New Model of Strategic Competition

The policy transformation instantiated in 2025 established what might be termed "competitive coexistence" as the governing framework for AI-era great-power competition. Rather than pursuing technological denial through export restrictions, the United States moved toward a "persistent lead" strategy.

The objective shifted not from preventing Chinese AI advancement but from ensuring that the United States remained one to two technological generations ahead at all times. This required sustained investment in innovation and manufacturing capability but permitted commercial engagement with rival nations and markets.

This model creates several foreseeable complications. First, it requires genuine technological superiority to maintain itself. If American innovation falters, the competitive gap could narrow rapidly. The surveillance of China's development, once a bureaucratic detail, becomes existentially essential. Second, the strategy depends on allies accepting technological hierarchies in which some nations receive advanced chips while others do not.

Japan, Taiwan, South Korea, and the Netherlands—countries whose cooperation proved essential to export control enforcement—now face uncertainty about whether the United States remains committed to coordinated technology restriction.

The credibility damage from the reversal may prove substantial. Third, the model requires confidence that monitoring and verification provisions prevent circumvention. If Chinese firms utilize American H200 chips outside the stipulated parameters or route them through prohibited applications, the regime collapses.

For the semiconductor industry specifically, the new framework creates opportunities and risks in equal measure. Companies gain access to previously prohibited markets, addressing revenue pressures and supply chain redundancy concerns.

Yet they simultaneously confront expectations of self-regulation and cooperation with American intelligence services. The government's 25% tariff on exports to China represents a permanent tax on revenue, reducing profit margins relative to domestic sales. The requirement for third-party verification of chip specifications imposes operational costs. Over the long term, these frictions may compress margins and limit the sector's ability to compete with state-subsidized manufacturers in allied nations.

China's position remains complex. Gaining access to the H200 represents a meaningful capability improvement relative to the restricted environment of recent years. Yet the government's understanding that American companies will never provide genuinely cutting-edge hardware first creates an incentive structure whereby indigenous development becomes essential rather than optional.

Chinese firms, aware that the United States maintains an asymmetric information advantage and can withdraw permissions at any moment, will intensify investment in domestic manufacturing. The "persistent lead" strategy, by permitting perpetual American advantage, may paradoxically accelerate the very self-sufficiency trajectory it seeks to prevent.

The Middle Eastern dimension suggests that the primary beneficiaries of the policy shift may be neither the United States nor China, but rather entrepreneurial nations willing to position themselves as neutral technology hubs.

The UAE and Saudi Arabia, through strategic investments and partnerships with American companies, secured commitments for world-class AI infrastructure while avoiding the technology warfare afflicting Sino-American relations.

These nations could emerge as preferred locations for global AI development, AI services, and data center operations—a transformation as significant as the Middle East's historical role as an oil supplier.

Conclusion

Institutions Capture and the Primacy of Profit

The year 2025 will be remembered as the moment when profit beat out geopolitics in the artificial intelligence race. The release of DeepSeek exposed the limitations of export controls while simultaneously creating market conditions in which America's most powerful technology companies found their interests aligned with commercial expansion rather than strategic denial.

The Trump administration, influenced by venture capitalists and corporate executives positioned within government, accepted arguments that permitting chip sales served American interests better than restricting them. Congressional opposition, lacking coordinated executive branch support, foundered. By year's end, the policy regime had transformed fundamentally.

This transformation illuminates the extraordinary concentration of power within technology industries and the mechanisms through which corporate influence shapes national strategy.

It also reveals genuine complications in technology policy: national security and economic competitiveness do not always align, export controls do impose real costs, and innovation may indeed prove more resilient to restriction than policymakers assume.

Yet the process by which policy was reversed—through sustained corporate lobbying, narrative reframing, and institutional capture—reflects patterns concerning democratic governance.

The implications extend beyond semiconductors or AI. As other technologies—quantum computing, synthetic biology, advanced manufacturing—become subjects of strategic competition, the precedent established in 2025 suggests that corporate profit will likely prevail over security concerns unless explicitly constrained through legislation with binding force.

The challenge for policymakers is to build institutions and mechanisms capable of maintaining long-term strategic advantage while resisting the concentrated influence of industries with immense financial and political resources.

Moving forward, the "persistent lead" strategy may prove effective in maintaining American technological superiority. Yet it rests upon assumptions about technological dominance, international coordination, and monitoring capacity that may not hold across the decade ahead.

If they do not, 2025 will be remembered not as a pragmatic acceptance of economic reality but as the moment when strategic myopia triumphed over long-term national interest—a triumph ultimately engineered through the concentrated power of private interests over public ones.