China’s Pacific Wave: Understanding Beijing’s Expanding Influence Across Oceania

Introduction

China’s engagement in the Pacific Islands region has dramatically transformed over the past decade, evolving from primarily economic partnerships to a comprehensive strategy encompassing security, infrastructure, maritime activities, and diplomatic influence.

This multifaceted approach, characterized by unprecedented levels of investment, strategic agreements, and assertive maritime operations, represents what can be understood as China’s “Pacific wave” - a systematic effort to establish Beijing as a dominant regional power.

FAF, Beijing.The forum analyzes the implications of this expansion extending far beyond the immediate region, challenging established security architectures, threatening traditional alliances, and reshaping the Indo-Pacific's geopolitical landscape in ways that have profound consequences for global trade, regional stability, and the balance of power between China and Western nations.

Strategic Framework: The Blue Dragon Strategy

China’s approach to the Pacific region is anchored in what scholars and strategic analysts have termed the “Blue Dragon” strategy, a comprehensive geopolitical framework that seeks to extend Chinese influence across three major bodies of water: the East China Sea, the South China Sea, and the Indian Ocean.

This strategy represents a fundamental shift from China’s historical focus on continental concerns to a blue-water orientation that prioritizes maritime dominance and power projection capabilities.

The Blue Dragon approach is geographically anchored between two critical “unsinkable aircraft carriers” - Taiwan in the north and Sri Lanka in the west - creating a strategic arc that enables China to project influence across vast maritime expanses.

The Pacific component of this strategy serves multiple interconnected objectives that extend beyond simple economic or diplomatic gains.

China views the Pacific Islands as essential stepping stones for breaking through what it perceives as a Western-imposed maritime encirclement, particularly the island chain strategy that has historically limited Chinese naval operations beyond the first island chain.

China seeks to complicate U.S. and allied contingency planning by establishing influence in Pacific Island nations while simultaneously creating alternative pathways for Chinese maritime forces to operate in the broader Pacific Ocean.

This strategic positioning allows China to challenge the traditional dominance of the United States and its allies in what has long been considered an American sphere of influence.

Implementing the Blue Dragon strategy in the Pacific has been characterized by a sophisticated blend of economic incentives, diplomatic engagement, and increasingly assertive security cooperation.

Unlike traditional colonial or imperial approaches, China’s strategy emphasizes mutual benefit and development partnership while advancing its strategic objectives.

This approach has proven particularly effective in the Pacific, where small island nations face significant development challenges and have historically depended on aid from a limited number of donors.

The strategy’s effectiveness lies in its immediate material benefits and its ability to create long-term dependencies and strategic alignments that serve Chinese interests.

Economic Engagement and Investment Trends

China’s economic engagement with Pacific Island nations has reached unprecedented levels. Cumulative investment over the past decade totaled USD 530 billion by 2023, including approximately USD 245 billion in construction contracts and USD 285 billion in non-financial assets.

This massive financial commitment represents a strategic calculation transcending simple economic returns, positioning China as an indispensable development partner for nations historically struggling to attract significant international investment.

The scale of this engagement becomes even more remarkable when considered against the backdrop of the COVID-19 pandemic, during which many other donors reduced their commitments.

At the same time, China maintained and even increased its focus on the Pacific.

The trajectory of Chinese investment in the Pacific has demonstrated remarkable resilience and adaptability.

Following a reduction during the initial COVID-19 period in 2020, China resumed its focus on Pacific projects with renewed vigor in 2022, increasing its financing by 6% to reach $256 million.

This recovery was accompanied by a 94% increase in new deals worth USD 37 billion in 2023 compared to USD 29 billion in 2022, indicating a return to pre-pandemic levels and an acceleration of Chinese engagement.

The composition of this investment has also evolved significantly, with technology sector engagement increasing by 305% and metals and mining sector investment growing by 149% in 2023, reflecting China’s strategic focus on critical minerals essential for the green transition and electric vehicle batteries.

China’s position as the second-largest bilateral donor to the Pacific Islands, surpassing the United States and trailing only Australia, represents a fundamental shift in the region’s development finance landscape.

This achievement is particularly significant given that China’s engagement in the Pacific is relatively recent compared to the historical involvement of traditional powers.

The Lowy Institute’s Pacific Aid Map reveals that China’s overseas development finance has acquired “a more targeted focus on winning influence in specific countries, involving more grants and community-level outreach.”

This evolution from loan-heavy to grant-inclusive financing models demonstrates China’s learning curve, adaptation to Pacific Island preferences, and concerns about debt sustainability.

The sectoral distribution of Chinese investment reveals strategic priorities that align with broader geopolitical objectives.

Energy-related engagement in 2023 reached USD 3.1 billion, representing the greenest absolute investment in any period since 2013, though this was still outstripped by continued fossil fuel engagement.

Battery-related investments alone reached approximately USD 3.7 billion, highlighting China’s focus on securing supply chains for critical technologies.

The emphasis on metals and mining sectors, particularly those relevant to lithium extraction and processing, underscores China’s long-term strategy to secure resources essential for its domestic energy transition while potentially creating dependencies among Pacific Island nations.

Security Agreements and Military Implications

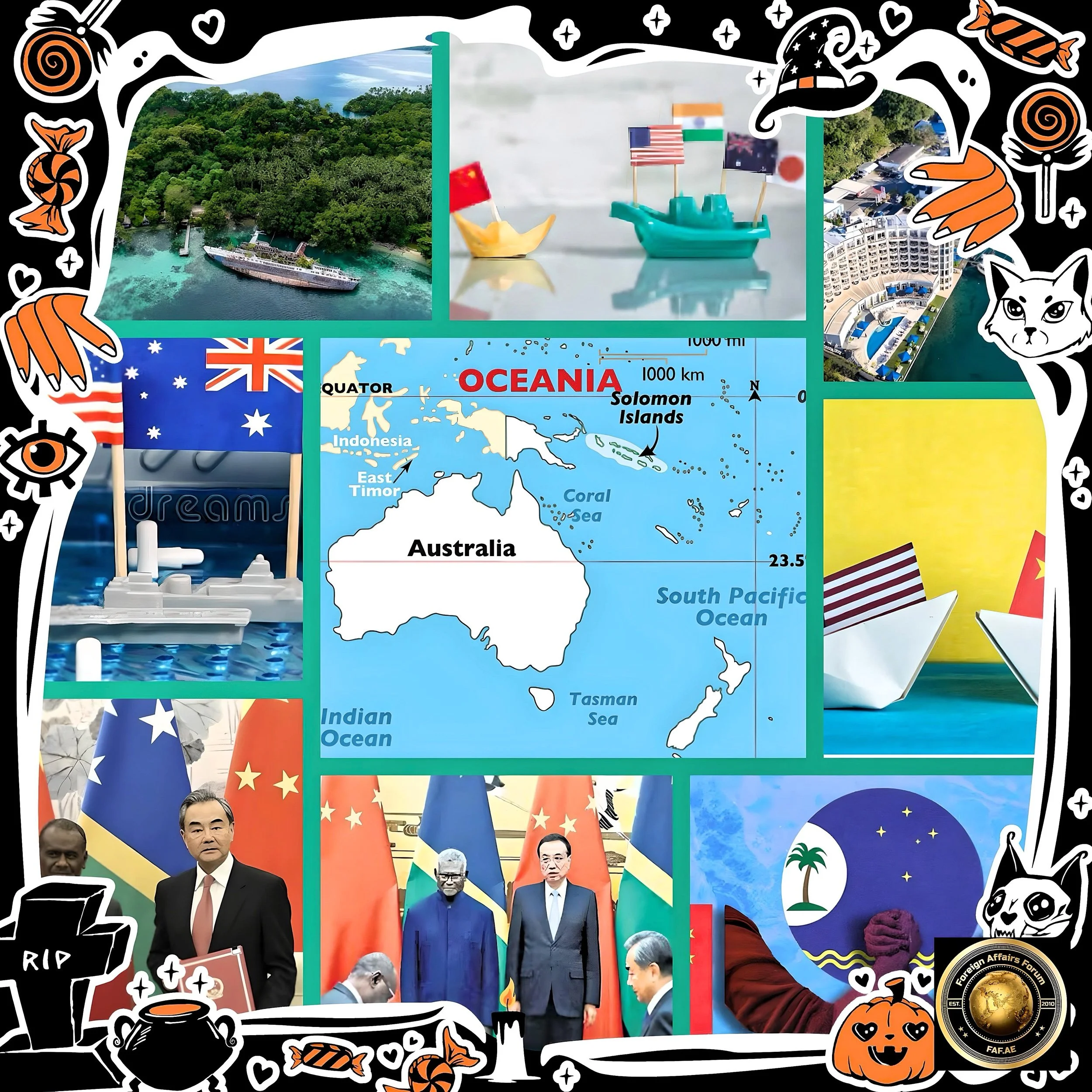

The signing of the China-Solomon Islands security agreement in April 2022 marked a watershed moment in Pacific geopolitics. It represented China’s first known bilateral security arrangement in the region and fundamentally altered the strategic landscape.

While this agreement does not explicitly mention the establishment of military bases, it provides for the deployment of Chinese “police, armed police, military personnel, and other law enforcement forces” to the Solomon Islands, creating unprecedented opportunities for a Chinese military presence of just 1,200 nautical miles from Australia.

The implications of this development extend far beyond the immediate bilateral relationship, signaling China’s willingness to project hard power capabilities into a region traditionally dominated by Western security arrangements.

The strategic significance of the Solomon Islands agreement lies in its immediate provisions and its demonstration effect for other Pacific Island nations.

The agreement allows China to “make ship visits to, carry out logistical replacement in, and have stopover and transition in the Solomon Islands” while enabling Chinese forces to “protect the safety of Chinese personnel and major projects.”

These provisions create a framework for a sustained Chinese military presence that could be expanded and formalized over time, potentially leading to the establishment of China’s second overseas military base after Djibouti.

The Solomon Islands' location along critical shipping lanes connecting the United States and Australia amplifies the strategic importance of this development.

The broader pattern of Chinese security engagement in the Pacific extends beyond the Solomon Islands to encompass a range of activities designed to normalize Chinese military presence and expand operational capabilities.

Recent demonstrations of Chinese Coast Guard capabilities to Pacific Island ministers, including showcases of vessels capable of traveling 18,000 kilometers for up to 60 days without resupply, illustrate China’s growing confidence in projecting its security apparatus throughout the region.

These demonstrations serve dual purposes: they showcase Chinese capabilities to potential partners while simultaneously sending messages to competing powers about China’s determination to establish a permanent security presence in the Pacific.

The evolution of Chinese security engagement has been characterized by increasingly sophisticated diplomatic approaches emphasizing consultation and relationship building rather than the heavy-handed tactics that initially generated regional pushback.

When Pacific Island nations rejected Chinese Foreign Minister Wang Yi’s comprehensive regional security arrangement proposal in 2022, China adapted its strategy to focus on bilateral and mini-lateral agreements that have proven more acceptable to regional partners.

This adaptability demonstrates China’s learning capacity and long-term commitment to establishing security relationships in the Pacific, even when faced with initial resistance.

Chinese Presence and Activities in Santo, Vanuatu

Historical and Demographic Context

Chinese migration to the South Pacific, including Vanuatu’s Espiritu Santo (commonly called Santo), dates back to the 19th century. Early Chinese arrivals became contract laborers, traders, and businesspeople, shaping local economies and communities.

Over time, both “old” Chinese immigrants (mainly Hakka and Cantonese speakers) and “new” immigrants (primarily Mandarin speakers from mainland China) have settled in the region, sometimes leading to internal divisions and tensions with indigenous communities due to economic competition and cultural differences.

Recent Economic and Commercial Engagement

China’s engagement with Santo has accelerated in recent decades, reflecting its broader strategy in the South Pacific. Key developments include:

Infrastructure Projects: China has funded major infrastructure on Santo, most notably the construction of a large wharf by the Shanghai Construction Group, financed by China’s EXIM Bank.

While officially intended for commercial use (such as cruise ships), the wharf’s size and location have fueled speculation about potential military applications, raising concerns among Australia, the US, and other regional actors.

Logging and Resource Extraction: Chinese companies have logged activities on Santo.

For example, Vanuatu Forest Industry Ltd, a Chinese firm, attempted to export round logs from the island but was suspended by Vanuatu authorities for violating export regulations and failing to comply with local laws.

Residents have accused the company of environmental harm, including the felling of protected trees.

Aid and Development: China has significantly aided Vanuatu, including building government buildings, a stadium, and a presidential palace. These projects are part of a broader pattern of Chinese development assistance across the Pacific.

Geopolitical and Security Dynamics

Espiritu Santo’s strategic location has made it a focal point in the growing rivalry between China and traditional Pacific partners like Australia and the US:

Military Speculation: Reports have circulated since at least 2018 about possible discussions between China and Vanuatu regarding a permanent Chinese military presence or naval base on Santo.

Both governments have denied these claims, but the scale of Chinese-funded infrastructure (such as the wharf) continues to prompt suspicion that it could be adapted for future dual civilian and military use.

Naval Visits: Chinese naval vessels have made port calls in Vanuatu, sometimes at facilities on Santo, signaling a growing Chinese maritime presence in the region.

These visits are officially described as logistical stops but are seen by some analysts as part of a broader strategy to expand China’s influence and operational reach in the Pacific.

Social and Cultural Impact

The influx of Chinese migrants and businesses has had a mixed impact on local communities in Santo and elsewhere in Vanuatu:

Economic Tensions

Chinese businesses, often more capitalized and connected, have sometimes outcompeted local enterprises, leading to resentment and social friction.

Religious and Cultural Divides

While the indigenous population is predominantly Christian, most recent Chinese immigrants are not religious, and there are few Chinese Christians in Santo.

This has contributed to a degree of social separation and limited integration.

Chinese engagement in Santo, Vanuatu, spans migration, business, infrastructure, and potentially strategic interests.

While Chinese-funded projects have brought development, they have also sparked local controversy, environmental concerns, and regional geopolitical anxiety—especially regarding possible military uses of new infrastructure.

The situation remains dynamic, with China’s role in Santo and the broader Pacific likely to continue evolving

Infrastructure Development and Dual-Use Concerns

China’s infrastructure development projects across the Pacific Islands serve dual purposes that extend far beyond their stated civilian objectives, creating what analysts describe as “undercover infrastructures supporting the PLA’s power projection toward the Third Island Chain.”

This dual-use infrastructure strategy encompasses four key categories: ports and wharves, fishery facilities, aeronautical hubs, and information and communications technology (ICT) networks. Each can be weaponized during a transition from peace to war.

The strategic nature of these projects reflects China’s long-term planning for potential conflict scenarios while providing immediate economic benefits that make them attractive to Pacific Island partners.

The recent Cook Islands deep-sea minerals agreement with China exemplifies the sophisticated nature of Chinese infrastructure engagement and its potential security implications.

This five-year agreement covers cooperation in “exploration and research of seabed minerals,” including technology transfer, logistics support, and deep-sea ecosystems research.

It also encompasses broader economic cooperation in maritime industries and development projects involving Chinese grant aid.

The agreement’s timing and scope, particularly its signing despite strong objections from New Zealand, demonstrates China’s willingness to challenge traditional spheres of influence while creating new dependencies through resource extraction partnerships.

The dual-use potential of Chinese-built infrastructure becomes particularly apparent in the telecommunications and digital connectivity sectors, where Chinese companies like Huawei and ZTE have established extensive networks across Pacific Island nations.

While providing essential connectivity services, these networks also create potential vulnerabilities and dependencies that could be exploited to gather intelligence or cause communications disruption in crisis scenarios.

China’s commitment to “collaborating with all parties concerned, particularly developing countries, to promote digital connectivity” has resulted in constructing internet-connected classrooms, national broadband networks, e-government systems, and e-commerce platforms throughout the Pacific.

The construction and development activities reflect broader strategic considerations, prioritizing locations with particular geostrategic values.

Chinese investment has focused heavily on countries “located on pivotal access points for global trade or geostrategic reasons,” particularly those with deep-water ports that can serve as sites for force projection and logistical support.

This investment pattern creates a network of potentially dual-use facilities that, while serving legitimate development purposes, also establish the infrastructure foundation for future military operations or strategic denial capabilities against competing powers.

Maritime Activities and Fisheries Expansion

China’s expanding maritime presence in the Pacific represents one of the most visible and immediate aspects of its regional strategy. It encompasses both civilian fishing activities and coast guard operations that blur the lines between economic and security objectives.

The Chinese fishing fleet, identified as the largest in the Pacific alongside Taiwan’s fleet, has become a persistent source of tension due to its involvement in illegal, unreported, and unregulated (IUU) fishing practices that frequently result in infringement notices from Pacific Island inspectors.

This massive fishing presence serves multiple strategic purposes: it provides food security for China’s domestic market, establishes a persistent civilian presence in disputed or sensitive waters, and creates justification for increased Chinese coast guard activities.

The introduction of Chinese coast guard patrols in Pacific waters represents a significant escalation of China’s maritime strategy. In 2024, China registered 26 guard vessels with the Western Central Pacific Fisheries Commission for high-seas inspections.

This development has profound implications for regional maritime security, particularly given the potential for diplomatic complications if Chinese coast guard vessels attempt to board Taiwanese fishing vessels, since Beijing does not recognize Taiwan as an independent nation.

The expansion of Chinese coast guard activities creates new facts on the water that could gradually normalize Chinese law enforcement presence in areas previously dominated by U.S., Australian, French, and New Zealand patrols.

Recent naval activities have demonstrated China’s growing confidence in projecting military power throughout the Pacific, including unprecedented deployments that circumnavigated the Australian continent and conducted live-fire exercises just outside Australian and New Zealand exclusive economic zones.

These operations, which included drone deployments into Papua New Guinea territory without prior notification, represent a significant escalation of Chinese military assertiveness and a direct challenge to traditional Western maritime dominance.

The timing and scope of these exercises suggest they were designed not only for training purposes but as demonstrations of Chinese capabilities and resolve to regional audiences.

The development of advanced maritime technologies, including China’s new deep-sea cable-cutting device capable of severing underwater communication and power cables at depths of up to 4,000 meters, adds a new dimension to Chinese maritime capabilities.

This technology, developed by the China Ship Scientific Research Centre and integrated with advanced submersibles like the Fendouzhe, represents the first officially disclosed cable-cutting capability of any nation and poses significant threats to global undersea infrastructure that carries 95% of global data transmission.

The strategic implications of this capability extend far beyond the Pacific, creating potential vulnerabilities in global communications networks that could be exploited in conflict scenarios.

Diplomatic Competition and Regional Responses

The Pacific Islands have become the primary arena for diplomatic competition between China and Taiwan, with both sides seeking to maximize their official diplomatic recognition and informal influence among the region’s small island states.

This competition intensified dramatically following the diplomatic switches of Kiribati and Solomon Islands from Taiwan to China in 2019, demonstrating China’s shift from economic partner to major strategic player willing to use financial incentives to reshape regional diplomatic alignments.

The significance of these diplomatic coups extends beyond simple recognition counts, as they provide China with additional platforms for challenging Taiwan’s international participation and legitimacy.

Taiwan’s remaining diplomatic allies in the Pacific - Tuvalu, Palau, and the Marshall Islands - have become increasingly important symbols of Taiwan’s continued international presence and democratic legitimacy.

President Lai Ching-te’s Pacific tour in December 2024, which included official visits to all three remaining allies along with stopovers in Hawaii and Guam, demonstrated Taiwan’s commitment to maintaining these relationships despite intense Chinese pressure.

The tour’s emphasis on shared democratic values and Austronesian cultural connections represents Taiwan’s strategy of leveraging historical and cultural ties to compete with China’s economic inducements.

The responses of traditional Pacific powers - Australia, New Zealand, and the United States - to China’s growing influence have evolved from initial complacency to increasingly urgent countermeasures designed to compete with Chinese offerings while maintaining regional partnerships.

Australia’s position as the largest donor to Pacific Island nations, contributing $1.5 billion compared to China’s $256 million in 2022, reflects Canberra’s recognition that economic assistance remains a critical tool for maintaining influence.

However, the gap has been narrowing as China’s targeted approach focuses on high-impact projects and grants rather than simply loan volumes.

The regional architecture itself has become a contested space, with China’s participation in forums like the Pacific Islands Forum creating tensions over Taiwan’s participation and broader strategic issues.

The 2024 PIF meeting’s initial inclusion and subsequent removal of Taiwan-related language following Chinese pressure illustrates the delicate balance Pacific Island nations must maintain between competing great power interests.

The upcoming 2025 summit in Solomon Islands will serve as a critical test of Taiwan’s continued ability to participate in regional forums as China’s influence continues to expand through its diplomatic partner and security agreement signatory.

Recent Developments and Escalating Activities

The period from late 2024 through 2025 has witnessed a marked acceleration in Chinese activities across the Pacific, suggesting a new phase of assertiveness that goes beyond previous patterns of gradual influence building.

The Cook Islands deep-sea minerals agreement signed in February 2025, despite vocal New Zealand opposition, represents a qualitative shift in China’s willingness to directly challenge traditional spheres of influence.

This agreement’s significance lies not only in its resource extraction potential but in its demonstration that China is prepared to proceed with strategic partnerships even when they generate significant diplomatic tensions with established regional powers.

The deployment of China’s advanced cable-cutting technology in March 2025 marked another escalation in Chinese capabilities and strategic messaging.

The public disclosure of this technology, unprecedented among global powers, suggests China’s confidence in its technological superiority and willingness to demonstrate capabilities that could threaten critical global infrastructure.

The timing of this revelation, coinciding with increased Chinese naval activities in the Pacific, appears designed to signal China’s growing ability to project power and potentially disrupt adversary operations in any future conflict scenario.

Chinese coast guard demonstrations to Pacific Island ministers in June 2025, featuring vessels capable of extended autonomous operations, represent the formalization of China’s security engagement strategy.

These demonstrations, combined with China’s registration for high seas fishing patrols beginning June 30, 2025, indicate that Chinese maritime law enforcement presence in Pacific waters will become routine rather than exceptional.

The implications for regional maritime security are profound, as these developments create new enforcement overlaps and potential friction points with existing U.S., Australian, and allied maritime operations.

The pattern of recent Chinese activities suggests a coordinated strategy designed to establish new facts on the ground, water, and in diplomatic relationships that will be difficult for competing powers to reverse.

The simultaneity of resource extraction agreements, technology demonstrations, security cooperation expansions, and maritime presence increases indicates strategic planning at the highest levels of Chinese government.

These developments collectively represent what appears to be a decisive phase in China’s Pacific strategy, moving from influence building to actual power projection and strategic positioning for potential future conflicts.

Conclusion

China’s Pacific wave represents a fundamental transformation of the regional order that extends far beyond traditional great power competition, encompassing economic, security, technological, and diplomatic dimensions that collectively challenge the established international architecture.

The evidence reveals a comprehensive strategy that has evolved from opportunistic engagement to systematic power projection, utilizing economic incentives, security partnerships, dual-use infrastructure development, and assertive maritime operations to establish China as an indispensable regional actor.

The scale and sophistication of this engagement, totaling over half a trillion dollars in cumulative investment alongside unprecedented security agreements and technological demonstrations, indicates that China’s Pacific presence is not a temporary phenomenon but a permanent strategic commitment.

The implications of China’s Pacific expansion extend beyond regional boundaries to affect global trade routes, international law, democratic governance, and the broader balance between authoritarian and democratic systems.

The development of capabilities like deep-sea cable cutting technology, the establishment of security agreements enabling potential military presence, and the creation of economic dependencies through resource extraction partnerships collectively represent a challenge to the existing international order that requires comprehensive and coordinated responses from democratic nations.

The Pacific Islands themselves face the complex challenge of balancing development needs with sovereignty concerns while navigating between competing great power interests.

Looking forward, the trajectory of Chinese engagement suggests continued intensification of activities across all dimensions of power projection, with particular emphasis on normalizing Chinese security presence and expanding technological dependencies.

The success or failure of China’s Pacific strategy will likely determine not only the future of regional security architectures but also the broader effectiveness of authoritarian models of international engagement in competing with democratic alternatives.

For policymakers in Washington, Canberra, Wellington, and other allied capitals, understanding and responding to China’s Pacific wave represents one of the most significant strategic challenges of the coming decade, requiring innovative approaches that can compete with Chinese offerings while preserving democratic values and regional autonomy.