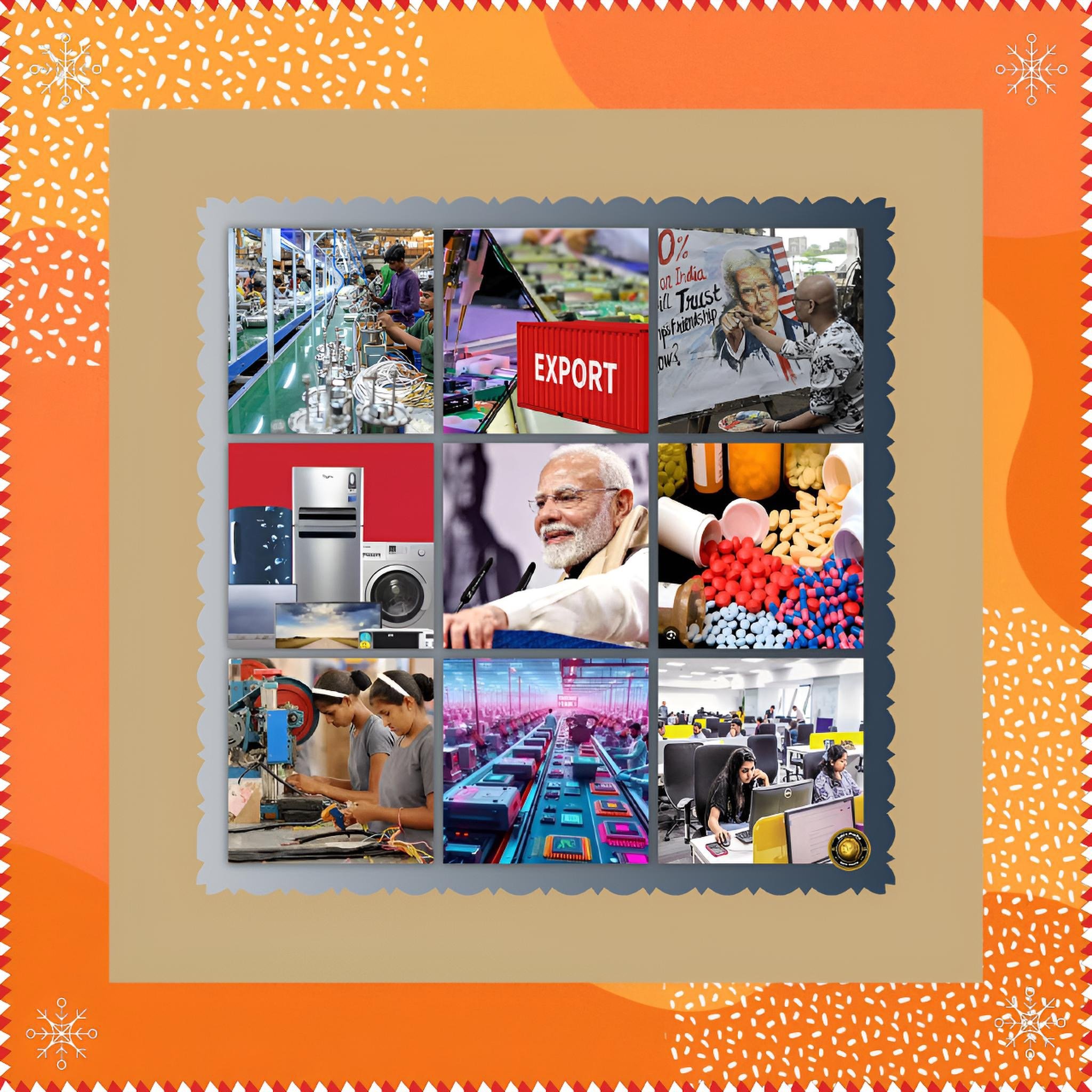

Trade Wars and New Allies: India’s Bold Pivot to Defy US Sanctions in 2026 - Part I

Executive Summary

As India approaches 2026, its economy presents a paradox of robust domestic resilience against a backdrop of severe external headwinds. While the global trade environment has deteriorated significantly—marked most notably by the imposition of punitive 50% tariffs by the United States in late 2025—India remains the fastest-growing major economy, with GDP growth forecasts for Fiscal Year 2026 (FY26) converging between 6.5% and 7.3%.

This continued expansion is fueled primarily by strong domestic consumption, a recovery in rural demand, and a surging services sector that is expected to offset stagnation in merchandise exports.

The strategic response from New Delhi has been swift and decisive, characterized by a rapid pivot toward new trade partners, evidenced by concluded free trade agreements with the United Kingdom, Oman, and New Zealand.

The economic narrative for 2026 is thus defined by a decoupling of India’s growth trajectory from Western protectionism, driven by an “inward-outward” strategy that prioritizes domestic industrial capacity and alternative export markets.

Introduction

The year 2026 promises to be a definitive stress test for India’s ambition to become a global economic pole. Entering the fiscal year with a growth momentum that outpaces both advanced economies and emerging market peers, India stands as a stabilizer in a volatile global system.

However, this stability is being challenged by a radical shift in geopolitical trade dynamics. The era of benign globalization has been replaced by transactional bilateralism, forcing New Delhi to navigate a complex matrix of sanctions, tariffs, and strategic realignments.

The central question for observers and policymakers alike is whether India’s domestic structural reforms—particularly in manufacturing and digital infrastructure—can generate sufficient velocity to escape the gravitational pull of a hostile trade war with its largest trading partner, the United States.

Current Status

India’s macroeconomic fundamentals remain remarkably solid despite the external shocks absorbed in the latter half of 2025.

The Reserve Bank of India (RBI) has revised its growth projection for FY26 upwards to roughly 6.8% to 7.3%, citing improved agricultural output and sustained momentum in manufacturing.

International bodies echo this optimism, with the International Monetary Fund (IMF) and Asian Development Bank (ADB) projecting growth rates of 6.6% and 7.2% respectively, positioning India well ahead of the global average. Inflation appears to have been tamed, hovering around the 4% target, which has allowed the central bank to consider monetary easing to further stimulate private consumption.

Fiscal consolidation is also proceeding according to plan, with the government initiating a strict glide path to reduce the debt-to-GDP ratio, signalling fiscal prudence to foreign investors despite the pressure to increase spending to cushion export sectors.

Key Developments

The defining economic development of late 2025 was the sudden and severe escalation of trade tensions with the United States. Citing India’s continued procurement of Russian crude oil, the US administration imposed a staggering 50% tariff on a wide range of Indian goods, effectively neutralizing the price competitiveness of key Indian exports in the American market.

This policy shock, which came into full effect in August 2025, targeted labor-intensive sectors such as textiles, gems, and automotive components, though critical categories like pharmaceuticals and electronics retained some exemptions.

In a strategic counter-maneuver, New Delhi accelerated its diplomatic outreach to non-US markets.

December 2025 witnessed the conclusion of a landmark Free Trade Agreement (FTA) with New Zealand, which promises zero-duty access for Indian textiles and leather goods, directly mitigating the loss of US market share.

This followed closely on the heels of similar pacts signed with the United Kingdom and Oman earlier in the year, signaling a deliberate diversification of India’s export portfolio away from over-reliance on the United States. Simultaneously, the Production Linked Incentive (PLI) schemes have begun to yield tangible results, particularly in the mobile phone sector, where domestic value addition is creating a buffer against global supply chain disruptions.

Facts and Concerns

The disparity between India’s domestic strength and its external vulnerability creates a complex risk profile.

A primary concern is the potential impact of the US tariffs on employment. The sectors most heavily penalized by the 50% duty—textiles, leather, and gems—are also the most labor-intensive, employing millions of semi-skilled workers. While the services sector is projected to cross $400 billion in exports, providing a crucial financial cushion, it cannot absorb the blue-collar workforce threatened by the manufacturing slowdown.

Furthermore, merchandise exports are expected to remain flat throughout FY26, a worrying trend for an economy seeking to emulate the export-led growth miracles of East Asia. There is also the risk that the “inward turn” advocated by some policy analysts could lead to long-term inefficiencies if domestic industries are shielded too heavily from global competition.

Cause-and-Effect Analysis

The causal chain shaping India’s 2026 outlook begins with energy security and geopolitical alignment. India’s decision to prioritize affordable energy through Russian oil imports—a necessity for managing domestic inflation—triggered the punitive US response.

This specific geopolitical friction point has had the direct economic effect of rendering Indian exports uncompetitive in their traditional primary market. Consequently, this external pressure has forced a structural shift in India’s trade policy.

The urgency to finalize FTAs with the UK and New Zealand was largely a second-order effect of the US trade aggression, as New Delhi sought immediate alternative outlets for its goods.

Domestically, the tariff barriers have reinforced the government’s commitment to the “Make in India” initiative, transforming it from an industrial policy into a national security imperative. The PLI schemes, originally designed to boost exports, now serve the dual purpose of import substitution and sustaining domestic industrial activity in the absence of easy access to Western markets.

Future Steps

Moving forward, India is expected to pursue a two-pronged strategy.

First, it will likely intensify engagement with the Global South and expanding markets in the Middle East and Africa, leveraging its new trade deals to route exports through friendlier jurisdictions.

Second, diplomatic channels with Washington will remain active, with potential negotiations aimed at securing sector-specific waivers or a “mini-trade deal” to de-escalate tensions, as hinted by recent diplomatic rhetoric.

Domestically, the government will likely introduce targeted fiscal support for the textile and MSME sectors to prevent job losses from translating into a consumption slowdown.

The focus will shift from aggressive export expansion to “quality over quantity,” targeting higher value-added segments where India retains pricing power regardless of tariff barriers.

Conclusion

India’s economic landscape for 2026 is defined by resilience under pressure. While the aggressive protectionism of the United States poses a formidable challenge, it has arguably accelerated India’s maturity as an independent economic power.

By successfully diversifying its trade alliances and maintaining robust domestic demand, India is poised to weather the storm, albeit with bruised export numbers.

The year 2026 will likely be remembered not for the growth lost to tariffs, but for the strategic autonomy gained through diversification. The country is not merely surviving the trade war; it is rewriting its economic geography to ensure that its rise remains inevitable, regardless of the geopolitical winds blowing from the West.