The S&P 500 faces its worst November since 2008: causes, outlook, and analysis - Will a Santa Claus Rally happen?

Introdiction

The S&P 500’s November 2025 Decline: A Deep Dive

In November 2025, the S&P 500 experienced its worst performance since the 2008 financial crisis.

Unlike the 2008 crash—which stemmed from a collapse in the financial system—this downturn was driven by a mix of structural and cyclical challenges that had built up over the year.

The market is now facing a complex set of pressures that have unsettled investor confidence and triggered a broad sell-off.

Key Root Causes of the November 2025 Selloff

Federal Reserve Policy Uncertainty

The biggest immediate trigger was a sharp shift in expectations about interest rates.

Markets had been betting on a December rate cut by the Federal Reserve, with about a 92% probability priced in.

However, Fed officials—such as Governor Michael S. Barr, Vice Chair Philip N. Jefferson, and others—signaled caution, suggesting that rate cuts were no longer certain.

This unexpected “hawkish” stance led to a spike in Treasury yields, making higher interest rates more likely for longer.

Chairman Jerome Powell further unsettled markets by saying a rate cut was “far from a forgone conclusion.”

As a result, the likelihood of a December cut dropped to around 63%.

Higher interest rates hurt technology stocks the most, because their value depends on future earnings.

When rates rise, the present value of those future earnings falls, making growth stocks less appealing.

This led to a sharp drop in the tech sector, which had driven much of the market’s gains in 2025.

Market Concentration in AI and Tech

The market’s focus on a small group of mega-cap technology companies has created a fragile structure.

Technology now makes up 36% of the S&P 500, nearly double its share a decade ago.

AI-related stocks alone accounted for 75% of the index’s returns, 80% of earnings growth, and 90% of capital spending growth since late 2022.

This concentration is unprecedented, and about 62% of the broader market is in some form of decline, signaling weak internal market health.

Despite extraordinary earnings by top technology firms, the S&P 500’s forward price-to-earnings ratio is 22.4—well above its five-year average of 20 and ten-year average of 18.7.

This means most gains are driven by a few companies, increasing the risk of a sharp correction if their earnings falter.

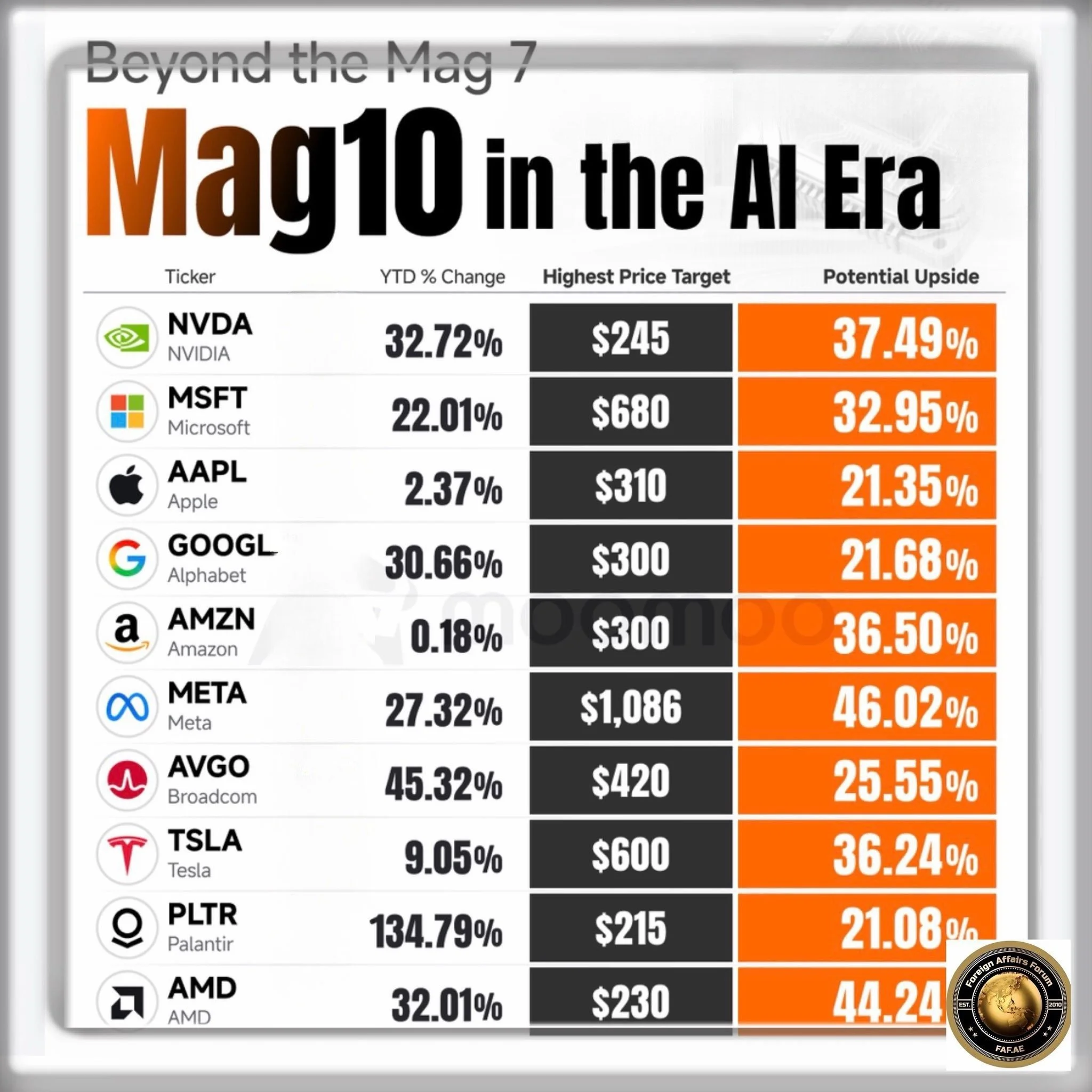

The main AI companies playing a big role in the current market rally are a small group of tech giants known for their leadership in artificial intelligence.

These companies are driving most of the gains, profits, and investments in the broader market right now.

Why These Companies Matter?

AI companies are called the “Magnificent 7” or “Mag 10” in investing circles, and they now make up nearly 40% of the S&P 500’s total value.

Most of the market’s recent gains are due to their explosive growth in AI-related products and investments.

If any of these companies stumble or AI growth slows, the whole market could see a sharp correction.

Labor Market Weakness and Economic Slowdown

The job market began to weaken dramatically in October 2025, with more than 153,000 announced job cuts—the worst since 2003. Unemployment claims rose, signaling a slowdown in hiring.

Consumer spending, while still positive, showed signs of slowing, with the National Retail Federation forecasting only 4% year-over-year growth for the holiday season, well below the 10-year average of 5.2%.

This suggests that households are becoming more cautious, even as wages are rising and markets have rallied.

Persistence of Tariff-Driven Inflation

Tariff policies under President Trump have added 0.4 to 0.5 percentage points to core inflation, pushing the Consumer Price Index to a year-over-year rate of 3.0% in September 2025—the highest since May 2024.

While some tariffs have been lifted on items like beef, coffee, and bananas, overall trade uncertainty is weighing on corporate earnings and business investment.

The broad-based nature of these tariffs means multinational companies are facing margin pressure, holding back broader economic growth.

Holiday Season Outlook: Seasonal Trends and Risks

Historical Seasonality

November and December are typically the best months for market returns, with the S&P 500 averaging 3.1% gains since 1945 and posting positive returns 76% of the time.

If the market finishes October strongly—as it did in 2025—the odds of a year-end rally increase to 92%.

However, the usual seasonal patterns are muddied by current market conditions.

Despite strong retail sales projections (expected to exceed $1 trillion for the first time), the underlying market health is weak.

The VIX (volatility index - fear Index ) remains elevated at 20, signaling that investors expect more turbulence. In past years, high volatility has often preceded further declines rather than rallies.

Scholarly and Institutional Perspectives

Wall Street analysts are divided.

Goldman Sachs predicts the S&P 500 could reach 7,600 by the end of 2026—an 11% gain from current levels—but this forecast assumes limited multiple expansion and strong earnings growth.

The firm warns that if the profitability of tech giants falters, with no new “superstar” sectors emerging, the broad market could struggle.

Academic research is also split.

Some analysts acknowledge that AI is driving real growth and investment, with AI-related capital spending now a major part of GDP growth.

Most venture capital going into AI and machine learning, and a large share of hyperscale spending is funded out of cash flow, not debt, reducing balance sheet risk.

However, others—including Mohamed El-Erian—warn that the AI investment boom could be a “rational bubble,” with overinvestment outpacing monetization and valuations that may not be sustainable if the economic returns don’t materialize.

What Could Spark a Year-End Santa Claus Rally?

Several factors could reverse the November lows and trigger a late-year rally:

Strong Corporate Earnings

The S&P 500 is posting an 83% earnings beat rate, the highest since 2021. Continued positive surprises could restore confidence.

Robust Holiday Spending

Record retail sales projections could boost consumer sentiment and lift the broader market.

End of Tax-Loss Harvesting

Selling pressure from tax-loss strategies typically ends by mid-December, often leading to renewed buying activity.

Holiday Sentiment

The festive season usually lifts investor optimism, and “Santa Claus Rally” expectations can become self-fulfilling.

Fed Rate Cut Hopes

If the Fed signals a dovish pivot, lower rates could make equities more attractive.

Policy and Tariff Relief

Positive developments in trade policy or tariff reductions could quickly lift market sentiment.

Conclusion

The S&P 500’s November 2025 correction is best understood as a fundamental repricing of market expectations in response to a high-risk-free rate environment and extreme concentration in AI and technology valuations.

While the potential for a year-end rally exists—driven by holiday spending, strong earnings, and the end of tax-loss selling—persistent market fragility, ongoing policy uncertainty, and inflation risks mean volatility is likely to continue through December.

Seasonal factors alone cannot guarantee a rally this year. No doubt, VIX is a good indicator of investor anxiety and short-term market shake-ups, but it should not be relied upon as a crystal ball for predicting future market crashes.

The key challenge will be whether corporate earnings and consumer demand are strong enough to justify the current high valuations, especially as the economy faces tariff-driven inflation and labor market uncertainty.

The ultimate outcome will depend on how companies weather the dual pressures of margins, costs, and evolving AI economics heading into 2026.