Summary

Many US technology companies are now spending huge amounts of money on AI.

This year, just a few of the biggest firms together plan to spend around $650 billion on new data centers and equipment for AI.

That is more than many countries produce in a year. This spending wave is already changing the US economy, and it makes people ask whether this is smart investment or the start of a dangerous bubble.

What is happening right now

AI systems do not live in the cloud as a light idea. They live in buildings full of computers.

These buildings, called data centers, need land, steel, chips, power lines, and a lot of electricity and water.

Construction companies build them.

Electricians wire them.

Utilities add new power plants to serve them.

In the first half of 2025, most of US economic growth came from investment in data centers, computers, and software.

One study found that without this spending, growth would have been close to zero.

In other words, AI building projects are doing the job that in other times might have been done by government highways or housing booms.

How this helps the economy

Think of a small town where a big AI data center arrives.

First, workers build it, so local people get jobs on the site.

Nearby restaurants, shops, and hotels see more customers.

The local government collects more tax and can fix roads or schools.

After the center opens, it employs staff to run the machines and guard the site.

Power companies invest in new lines and plants to feed it.

Now multiply that example across many towns and states.

This is why AI spending can feel like a huge private stimulus plan.

It keeps builders busy, supports factories that make equipment, and helps the national numbers look strong even when other parts of the economy, such as offices or factories, are weak.

Why some people are worried

A bubble happens when people invest because they believe prices will keep rising, not because the real earnings justify the cost.

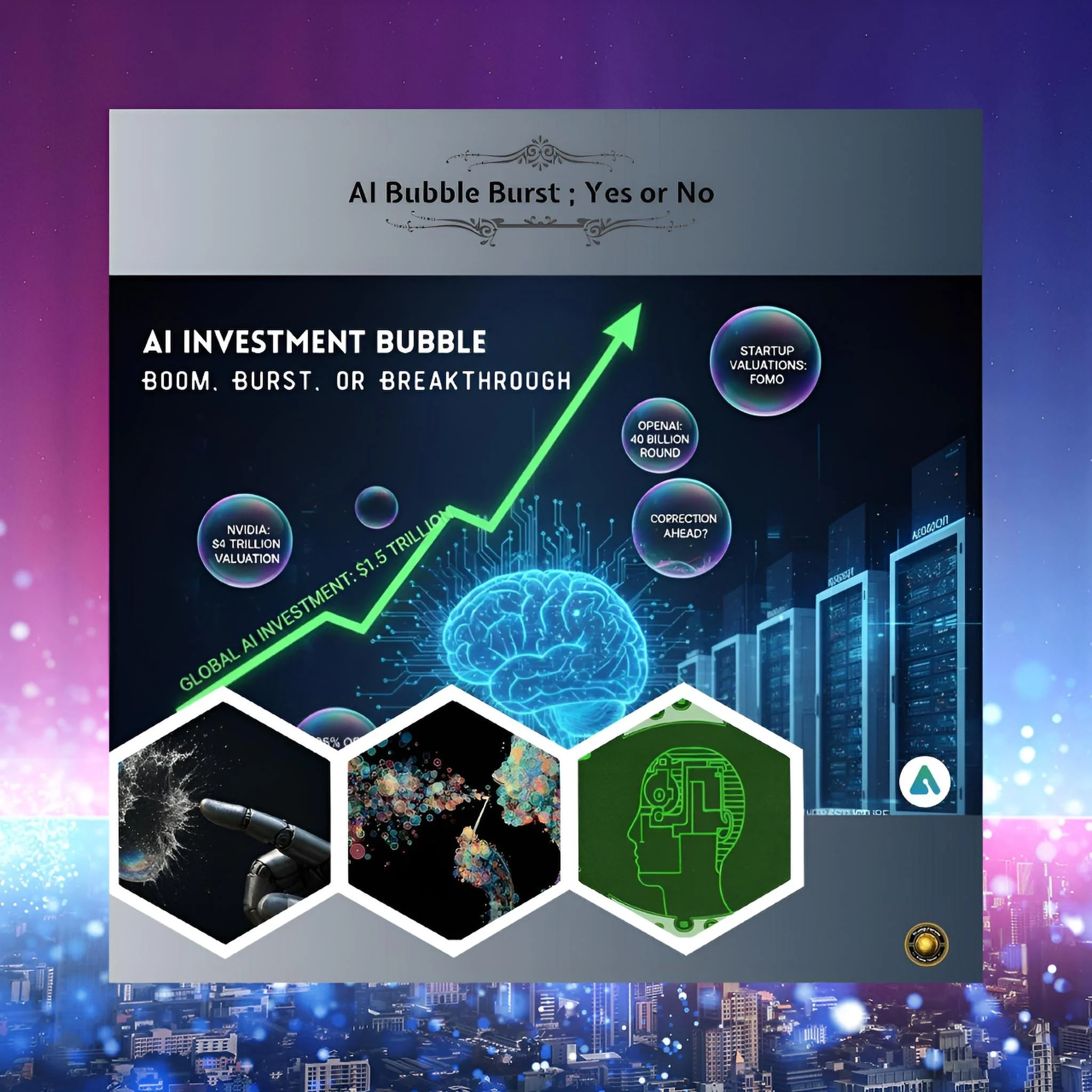

Some facts about AI today look risky.

Companies are spending hundreds of billions on data centers every year, but the money they earn directly from AI services is still much smaller, maybe only tens of billions.

That means the gap between cost and income is huge.

Imagine building a fleet of luxury buses because you think millions of people will soon pay high fares to ride them.

If only a small group of people actually use the buses, you have a problem.

You still must pay for fuel, drivers, and repairs, but you do not have enough ticket income.

Something like this could happen with AI data centers if customers are slower to pay for AI tools than companies expect.

Some experts warn that AI chips and servers also lose value very quickly.

Each new generation is much faster and more efficient than the last, so last year’s machines can become outdated in just a few years.

It is like buying very fancy phones for every worker, then needing to replace them again and again.

This makes it hard to earn back the original cost.

Bubble or useful overbuilding?

History gives a mixed message.

In the 19th century, investors poured money into railway lines.

Many companies went broke and shares crashed, so it was clearly a bubble.

But the tracks stayed in the ground and were used for decades, helping business and travel.

The same thing happened with internet cables in the 1990s: too many were built, some firms failed, but cheap fast internet later helped everyone.

AI could follow the same pattern.

Even if some companies lose money, the country might still gain from having many powerful data centers ready for new uses in health, science, education, and business.

But this does not remove the risk for workers and savers if a sharp slowdown in AI spending hurts jobs, stock markets, or pensions.

What to watch next?

There are three simple things to watch.

First, do real AI revenues start to catch up with the huge spending, or do they stay far behind?

Second, do we see clear gains in productivity – for example, workers getting more done with AI tools without big problems – or does AI mainly create low-value “slop” that humans must fix?

Third, does public policy make sure that local communities, workers, and energy systems can cope with the new data centers?

If the answers are mostly positive, then today’s huge AI spending may look, in hindsight, like a bold but sensible bet on the future.

If not, it may look more like a classic bubble that kept the economy afloat for a while, then burst and left behind a painful adjustment.

Right now, the truth is that AI is both: a powerful engine for growth and a high-risk experiment whose final outcome no one can yet know.