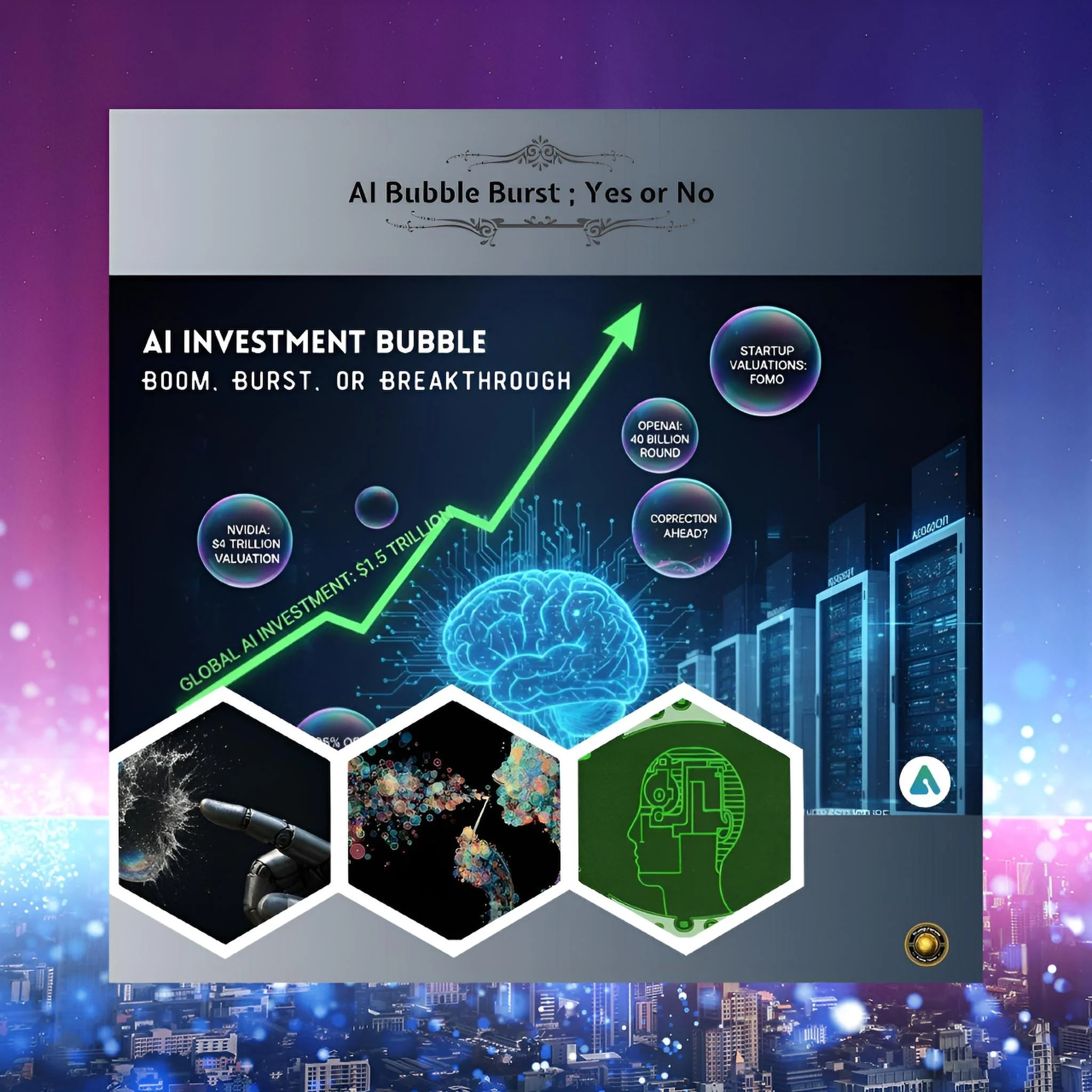

Will the AI Bubble Pop? What You Need to Know Right Now

Summary

Why Some Investors Are Fleeing the AI Gold Rush

Artificial intelligence has taken over the stock market. The companies developing AI technology—such as Nvidia, Microsoft, and Google—have generated enormous profits for investors.

But some financial experts are now asking an important question: Is this growth real, or are we seeing another bubble that will eventually burst?

Understanding this issue matters whether you have money in the stock market or care about the economy.

Think of a bubble like blowing air into a balloon. You keep blowing, and the balloon keeps getting bigger. Everyone watching thinks the balloon will grow forever. But eventually, too much air gets pumped in, the rubber stretches too far, and the balloon pops.

That is what happened with the dot-com bubble in 2000, when internet companies that had no profits were valued at billions of dollars, then lost nearly everything when reality caught up with the hype. The stock market fell 80 percent, and thousands of companies disappeared.

Right now, we might be watching something similar happen with artificial intelligence.

Companies are spending enormous sums building data centers—huge buildings filled with specialized computers that run AI models. In 2025 alone, the biggest technology companies spent around $400 billion on these data centers. That is more money than the entire annual budget of the United Kingdom.

By 2026, experts predict companies will spend over $500 billion on AI infrastructure. The question investors are asking is simple: Will these investments ever make enough money to justify the spending?

The numbers tell a concerning story.

OpenAI, the company that created ChatGPT, spent $8.7 billion on computing costs in the first nine months of 2025 alone.

During the same period, the company generated about $4.3 billion in total revenue. In other words, just the cost of operating the AI system exceeded the income. It is like running a restaurant that spends $10,000 monthly on food and labor but only takes in $5,000 in sales. The business cannot survive long with those economics.

Consider the broader picture

Experts estimate that all the data centers being built today would need to generate $2 trillion in annual revenue by 2030 to justify the money being spent on them. Currently, worldwide AI revenues total about $20 billion per year.

For the math to work, AI revenues would need to increase 100 times over just four years. Is that realistic? History suggests no.

When you ask actual businesses whether they have made money from artificial intelligence, the answers are disappointing.

McKinsey found that 94 percent of companies using AI have failed to see positive financial returns.

Only 5 % reported actually making money from their AI investments. This means that most of the money companies are spending on AI is not translating into actual profits or business improvements.

The comparison to the dot-com bubble becomes more specific when you look at venture capital funding.

30 years ago, investors would pour billions into any company with ".com" in its name, regardless of whether the business made sense. Now, they are doing the same thing with AI.

A company called Safe Superintelligence raised $2 billion in funding in April 2025 without having released any product.

Another company, Thinking Machines Lab, raised $2 billion without even telling investors what it planned to build. One investor who attended their funding presentation said it was "the most absurd pitch meeting" he had ever attended. This is bubble behavior—money flowing to ideas rather than to proven business models.

The stock market concentration makes this risky.

Eight giant technology companies now account for 36% of the entire stock market value. The five largest companies alone control about 30% of the market.

This means that if something goes wrong with AI, it will damage not just those companies but potentially the entire stock market and the retirement accounts of millions of people.

Think about it this way: if you own an S&P 500 index fund, which is supposed to be a diversified investment, you actually have massive exposure to just a handful of companies betting on AI.

Interestingly, the bond market is sending signals different from those of the stock market. When companies need to borrow money, they sell bonds to investors. Bond investors are more cautious than stock investors because they only receive a fixed interest rate—they do not benefit if the company becomes enormously successful.

A company called Applied Digital had to pay interest rates 70 % higher than those of other companies to borrow money.

CoreWeave, which rents out computing power for AI, received a junk credit rating, indicating bond investors view it as risky.

Oracle's borrowing costs have nearly tripled. This signals that investors who carefully analyze credit risk believe AI companies might struggle to repay debts.

The employment angle matters too. The AI infrastructure buildout has created jobs in data center construction and technology. But here is the uncomfortable truth: the long-term promise of AI is to replace human workers with automation.

If a factory uses AI to automate 80% of its jobs, who buys the products that the factory makes? The economy needs consumers with money to spend. If millions of workers lose their jobs to AI, consumer spending could collapse, triggering a recession.

We can already see some warning signs in the broader economy.

Unemployment has been creeping upward. Hiring has slowed significantly since summer 2025. Manufacturing is weak.

Construction outside of data centers is struggling. The economy is dependent on AI spending for growth. If that spending stops or slows down, the rest of the economy does not have strong enough fundamentals to support development on its own.

However, it is essential to note that, unlike the internet companies of the 1990s, artificial intelligence is genuinely helpful technology. It can improve medical diagnoses, help scientists do research faster, and automate many business processes.

The internet bubble did burst, but the internet itself did not disappear.

By 2023, 95 % of Americans used the internet regularly. The technology survived and thrived. AI will probably do so too, but perhaps at more modest profit levels than investors currently expect, and with more companies going bankrupt along the way.

The key question for 2026 and beyond is whether companies will actually make money from AI, or whether they will keep spending on infrastructure while revenue grows slowly.

If revenue starts accelerating and justifies the spending, then maybe the current valuations make sense. If revenue stays flat or grows slowly, then stock prices will need to fall.

Conclusion

The prophets of economic doom are betting on the second scenario. They are shifting their investments away from AI companies because they believe the math does not work. Time will tell who is right.