Bargaining with the Boss: Top Countries Winning Trump’s Deals

Executive Summary

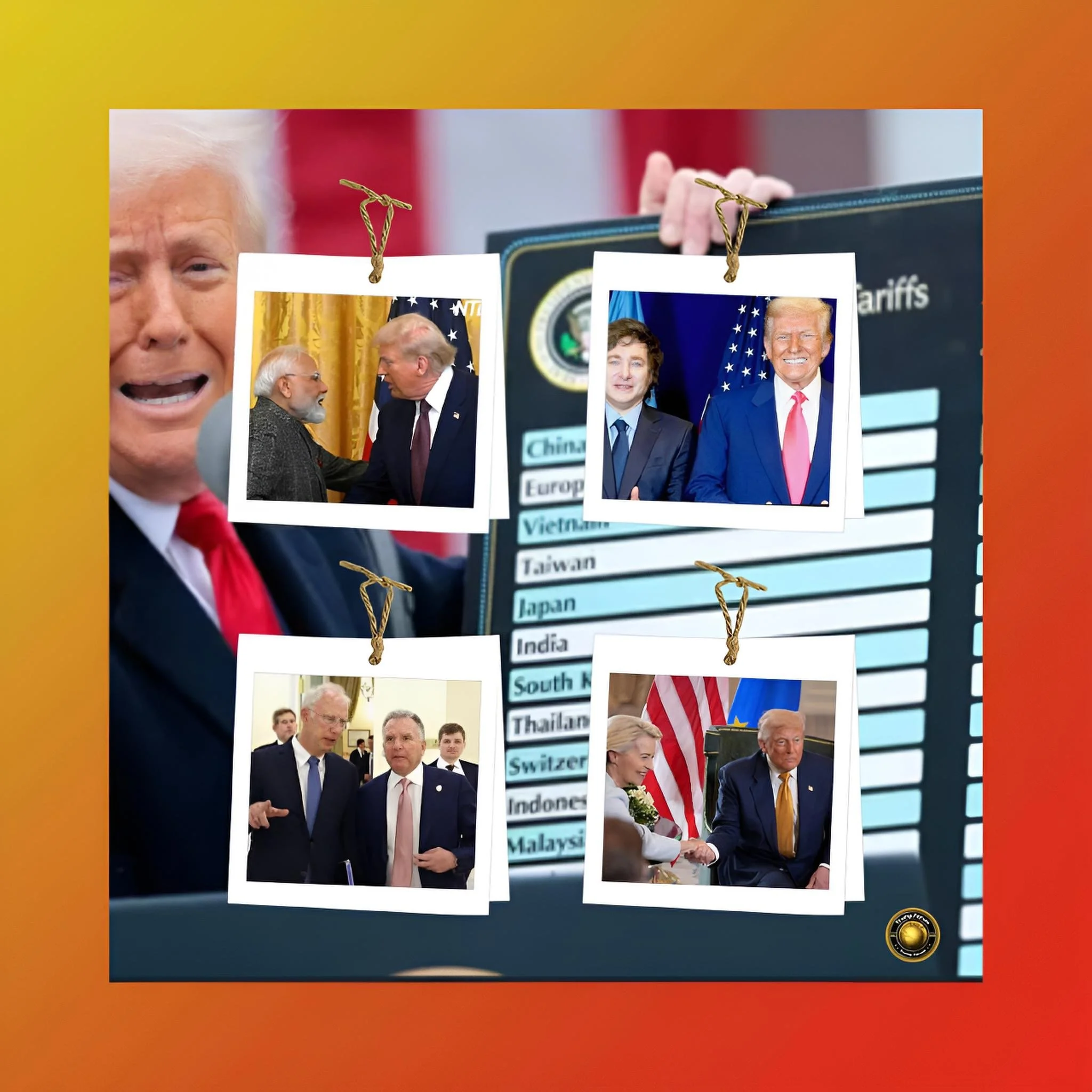

Trump’s Trade Deals: Who Snagged the Sweetest Victories Worldwide?

In the labyrinthine arena of international commerce, President Donald Trump’s recent bilateral accords with Argentina, India, and the European Union exemplify a paradigm of asymmetric bargaining wherein ostensibly reciprocal concessions mask profound imbalances.

These pacts, forged amid escalating tariffs and geopolitical leverage, ostensibly aim to rectify perceived trade inequities in favor of the United States, yet empirical scrutiny reveals varied outcomes.

Argentina emerges as a quintessential beneficiary, securing substantial tariff reductions and expanded export quotas for agrarian commodities while offering minimal reciprocal market access, thereby preserving domestic protections.

Conversely, India’s concessions, encompassing cessation of Russian petroleum procurements and sweeping tariff reductions on American manufactures, engender domestic agrarian disquietude, positioning the accord as a capitulation to hegemonic exigencies.

The European Union’s entente, characterized by a 15% tariff imposition on its exports juxtaposed with the nullification of duties on American ingress, elicits accusations of subservience, as articulated by the erstwhile French premier.

This disquisition elucidates that Argentina and the United Kingdom, through adroit diplomacy and fortuitous alignments, wrangled the most propitious terms, attenuating concessions whilst amplifying gains.

The ramifications portend a reconfiguration of global supply chains, inflationary pressures in conceding polities, and potential escalations in multilateral frictions, underscoring the exigency for nuanced prognostications on forthcoming negotiations.

Introduction

Tariff Tango Triumphs: Secrets of the Savviest Trade Partners

The resurgence of mercantilist proclivities in American foreign economic policy under President Donald Trump’s second tenure has precipitated a cascade of bilateral trade negotiations, ostensibly predicated on the doctrine of reciprocity yet invariably tilted toward augmenting American commercial hegemony.

These accords, consummated in the nascent months of 2026 and with antecedents in 2025’s tariff impositions, encapsulate a strategic calculus in which tariffs serve as coercive instruments to extract concessions from trading partners.

FAF analysis delves into who among the interlocutors wrangled the most efficacious accord from Trump—necessitates a granular exegesis of the pacts with Argentina, India, and the European Union, augmented by comparative insights into analogous dealings with entities such as the United Kingdom and Southeast Asian nations.

These negotiations unfold against a backdrop of global economic recovery from prior disruptions, in which Trump’s “Liberation Day” tariffs—initially levied at punitive rates—compelled adversaries to the bargaining table.

The ensuing compacts, while lauded in Washington as victories, have evoked vociferous domestic opprobrium in counterparty nations, evoking specters of economic vassalage.

FAF further dissects the historical antecedents, contemporaneous vicissitudes, pivotal evolutions, empirical verities and apprehensions, causal nexuses, prospective trajectories, and synthesizing inferences, employing advanced lexicon to illuminate the intricacies of these geopolitical maneuvers.

History and Current Status

The historical tapestry of Trump’s trade ethos traces to his inaugural administration (2017-2021), during which he repudiated multilateral frameworks such as the Trans-Pacific Partnership and renegotiated the North American Free Trade Agreement into the United States-Mexico-Canada Agreement, emphasizing stringent rules of origin and labor standards to curtail offshoring.

This era witnessed the imposition of Section 232 tariffs on steel and aluminum, ostensibly for national security reasons, and a protracted Sino-American trade imbroglio culminating in the Phase One accord, which mandated Chinese purchases of American agricultural and energy commodities exceeding $200 billion.

These precedents established a template of tariff escalation as prelude to negotiation, a stratagem reprised in his 2025 re-ascendancy.

Upon inauguration, Trump promulgated “Liberation Day” tariffs on April 2, 2025, encompassing sweeping levies on virtually all trading partners, with rates calibrated to perceived deficits: 50% on India for its Russian oil affiliations, 30% initially on the European Union, and variegated impositions elsewhere.

By mid-2025, these tariffs catalyzed a global rush to negotiate ameliorations, yielding framework accords with over a dozen entities by November 2025.

Presently, as of February 2026, five plenary reciprocal pacts have materialized, sans congressional ratification, binding enforcement, or robust adjudication mechanisms, rendering them susceptible to unilateral abrogation.

The Argentina-United States Agreement on Reciprocal Trade and Investment, inked on February 5th, 2026, exemplifies this status quo, with tariffs abated to a 10% baseline, exemptions for 1,675 Argentine commodities, and expanded beef-trimming quotas reaching 100,000 metric tons annually.

India’s interim framework, announced February 2nd, 2026, reduces American tariffs from 50% to 18%, contingent on New Delhi’s abjuration of Russian crude and zeroing duties on myriad American exports.

The European Union’s July 2025 entente, modified to 15% tariffs on its egress, persists amid parliamentary ratifications, with extensions for American seafood and agrarian ingress.

This current tableau reflects a precarious equilibrium, wherein short-term alleviations belie long-term structural asymmetries.

Key Developments

The evolutionary arc of these pacts commences with Trump’s April 2025 tariff blitz, which precipitated diplomatic overtures from beleaguered economies.

For Argentina, under President Javier Milei—an ideological confrere of Trump—negotiations burgeoned from a November 2025 framework, culminating in the February 2026 accord that nullifies tariffs on 1,675 goods, encompassing agrarian staples, while Argentina reciprocates with abatements on 200 American categories, including pharmaceuticals and machinery.

A salient development was Trump’s executive directive augmenting Argentine beef imports by 80,000 metric tons for 2026, addressing American affordability imperatives amid domestic supply constrictions from droughts and maladies.

India’s trajectory evinced greater acrimony: initial 50% tariffs in August 2025 stemmed from N1Delhi’s Russian oper dayocurements, which plummeted to one million barrels daily by late 2025.

The February 2026 interim agreement, following Modi-Trump telephonic parleys, mandates India’s cessation of such imports, substitution with American or Venezuelan alternatives, and tariff nullifications on industrial goods, alongside intentions for $500 billion in American energy and technology acquisitions over indeterminate horizons.

The European Union’s odyssey commenced with von der Leyen’s July 2025 concessions in Turnberry, Scotland, averting an all-out tariff war via 15% caps on EU exports, zero duties on American industrial ingress, and $600 billion EU investments in America during Trump’s term.

Subsequent developments included parliamentary freezes in January 2026 over Trump’s Greenland territorial assertions, thawed post his retraction, with ratifications incorporating suspension clauses for sovereignty infractions.

Comparatively, the United Kingdom’s May 2025 Economic Prosperity Deal, establishing 10% baselines with exemptions for financial services and agrifoods, underscores London’s leverage from post-Brexit autonomy and special rapport.

Southeast Asian nations like Cambodia and Malaysia, conversely, acceded to precipitous frameworks in October 2025, yielding extensive market apertures sans commensurate gains, emblematic of diminished bargaining puissance.

Latest Facts and Concerns

Empirical delineations from February 2026 evince disparate impacts: Argentina’s beef exports to America are projected to burgeon by $800 million annually, bolstering its fiscal convalescence, yet American ranchers decry potential price depressions, with Iowa progenitors apprehending market inundations.

India’s pact has incited agrarian unions to denounce it as “total surrender,” forewarning of dumping perils from American surpluses; latest data indicate a 900% prospective escalation in American imports, from sub-$50 billion, straining indigenous sectors.

The European Union’s 15% tariffs imperil €1.6 trillion bilateral trade, with German automakers and French viniculturists facing billions in surcharges, prompting intra-EU schisms—France lambasts it as “submission,” while others exhale relief from escalation aversion.

Broader apprehensions encompass inflationary cascades in conceding economies, with EU GDP projections attenuated by 0.5%; supply chain disruptions, as India’s Russian oil pivot exacerbates global energy volatilities; and geopolitical realignments, wherein Milei’s Trump affinity yields Argentine dividends, yet India’s strategic autonomy erodes.

Latest White House fact sheets laud these as “historic milestones,” yet independent analyses, such as Capital Economics’, posit American hegemony, with deficits potentially mitigated by $40 billion vis-à-vis Switzerland alone, though aggregate global trade patterns evince minimal havoc in 2025 due to anticipatory surges.

Cause-and-Effect Analysis

The causal underpinnings of these ostensibly one-sided pacts reside in Trump’s leveraging of America’s market immensity—constituting 25% of global GDP—against partners’ dependencies.

For Argentina, Milei’s libertarian reforms and ideological consonance with Trump effected a symbiotic nexus: Buenos Aires’ minimal concessions stem from its negligible deficit and strategic irrelevance, yielding effects of economic invigoration sans profound domestic dislocations.

India’s concessions, causally linked to its Russian oil reliance amid Ukraine vicissitudes, effectuated a punitive tariff regime, compelling Modi to acquiesce; resultant effects include agrarian unrest, as tariff nullifications expose farmers to American sorghum and soybean influxes, potentially depressing local prices by 20%.

The European Union’s capitulation traces to von der Leyen’s aversion to tariff wars amid post-pandemic frailties, causing a 0.5% GDP contraction and eroding solidarity, as peripheral members resent core concessions.

Broader effects encompass global reindustrialization accelerations in America, supply chain diversifications away from China, and inflationary pressures in partners, with causal loops reinforcing Trump’s mercantilism: initial tariffs beget negotiations, concessions perpetuate imbalances, fostering resentments that may precipitate retaliatory coalitions.

Future Steps

Prospective trajectories hinge on ratification vicissitudes and exogenous perturbations.

For Argentina, implementation of beef quotas necessitates veterinary harmonizations, with potential expansions into energy collaborations. India’s interim framework augurs a plenary Bilateral Trade Agreement by mid-2026, entailing dispute mechanisms and investment safeguards, contingent on verifiable Russian oil cessations.

The European Union anticipates parliamentary endorsements by March 2026, incorporating sovereignty safeguards, with extensions to digital trade and climate stipulations.

Globally, Trump’s April 2026 China sojourn portends escalations, while multilateral fora like the World Trade Organization may adjudicate complaints.

Partners could coalesce for collective bargaining, or pursue hedges like the EU-India pact, mitigating U.S. volatility. Domestically, congressional oversight may impose bindings, though Trump’s executive latitude persists.

Conclusion

Tariff Tango Triumphs: Secrets of the Savviest Trade Partners

In synthesizing these vicissitudes, Argentina and the United Kingdom indubitably wrangled the most propitious accords from Trump, leveraging ideological affinities and strategic nimbleness to secure maximal access with minimal surrenders.

India’s and the European Union’s pacts, conversely, evince concessions disproportionate to gains, perpetuating narratives of asymmetry.

These developments augur a fractious global order, wherein bilateralism supplants multilateralism, potentially engendering inefficiencies yet catalyzing domestic resiliences.

The enduring query—whether such mercantilism augments or attenuates American primacy—remains empirically unresolved, yet the immediate consequences underscore the inexorable interplay of power and commerce in contemporary geopolitics.