Crypto’s Big Freeze: Easy Reasons for the Huge Drop

Executive summary

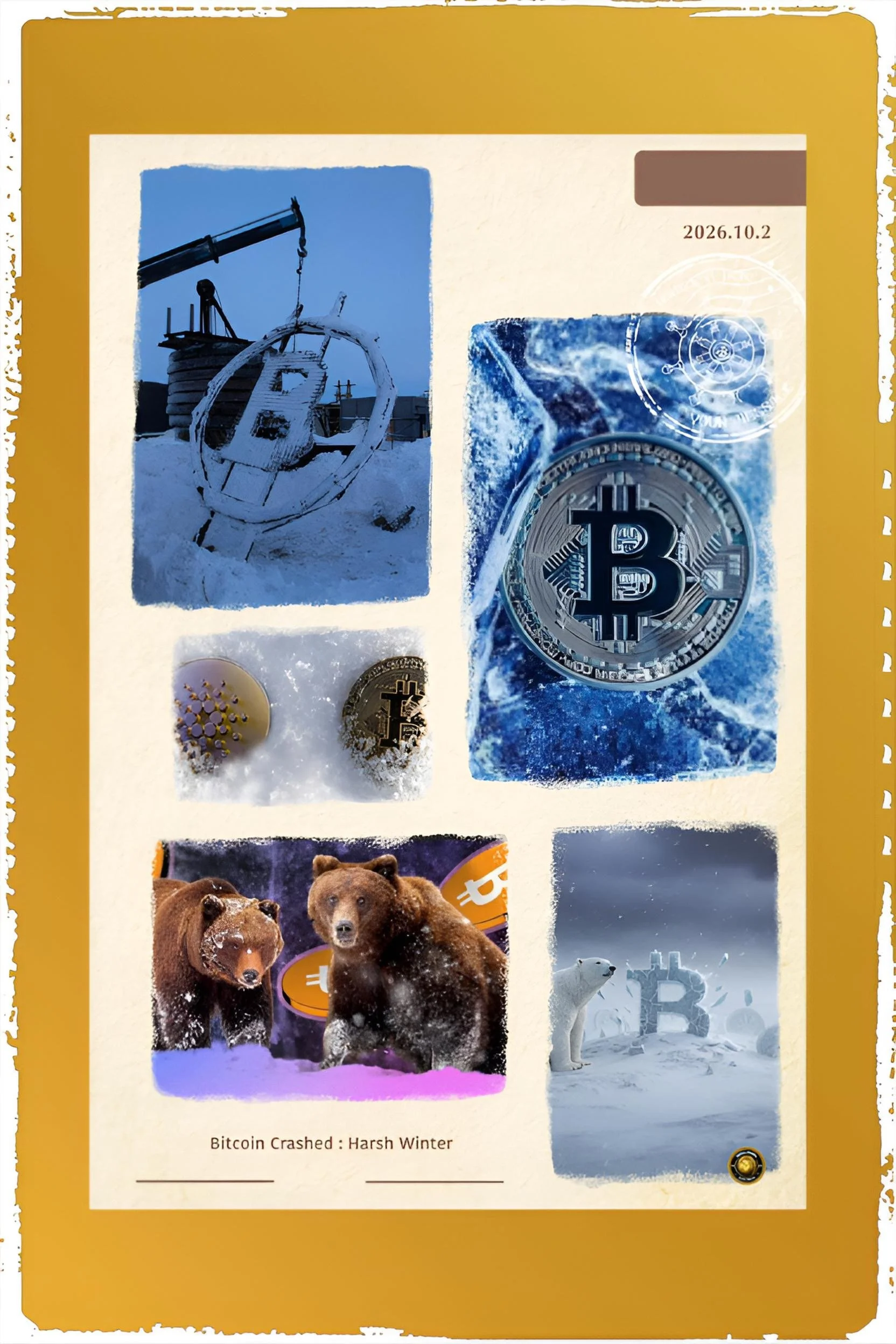

Crypto is in its worst winter ever. Bitcoin fell from $126,000 in October 2025 to $69,000 in February 2026, and the whole market lost over $2 trillion.

This is colder than past drops because old stories like crypto being safe from inflation don’t hold up anymore.

Big reasons include trade wars, big investors selling, and people moving to AI.

We can fix it with better rules and new uses for crypto. In the end, it might get better if the world economy improves.

Introduction

Crypto used to be exciting, like a fun game with big wins. But now it’s like a cold storm that won’t stop.

Think of real winter winds making temperatures drop low in America.

Crypto prices are dropping even lower. Bitcoin went from $126,000 last October to about $69,000 now.

The whole crypto world lost more than $2 trillion.

This feels worse than before because even fans are sad.

We’ll look at why, with simple examples, and what to do next.

History and current status

Crypto started in 2009 with Bitcoin, made to be money without banks.

At first, one Bitcoin cost less than one cent.

By 2017, it hit $20,000, but then fell hard in 2018, losing 83%.

In 2022, big fails like FTX made it drop again.

But in 2025, new funds let people buy Bitcoin easily, pushing it to $126,000.

Now in 2026, it’s at $69,000, down 45%.

The market went from $4.38 trillion to $2.42 trillion. It’s like a party that ended suddenly.

Key developments

Last October, a new U.S. rule added 100% taxes on China stuff.

This scared everyone, and crypto lost $19 billion in one day, like a big sale where everyone rushes out.

In January 2026, a new bank boss made people think money would be tighter, so big funds sold $1.3 billion of Bitcoin.

Fun coins like one named after a leader fell 94%, showing the hype is gone.

Latest facts and concerns

Bitcoin changes a lot, up to 5% a day now. Trading is down 40%, meaning fewer people play. Big groups sold 15,000 Bitcoins this year, unlike buying lots last year.

People worry about crypto using too much power, like a whole country. New computers might break crypto codes by 2030.

Bad news links crypto to crimes, scaring new users. Smart people are going to AI instead, leaving crypto behind.

Cause-and-effect analysis

Big world problems start it. A trade fight makes stocks fall, then crypto falls too, like dominoes. Example: tariffs make things cost more, so people sell risky stuff like Bitcoin.

Big investors pull out, making prices drop more, and that scares others to sell. Crypto was supposed to beat inflation, but gold did better when money got strong.

No more “we’re early” excuse since everyone knows crypto now, but it hasn’t changed banks much. AI takes energy and brains from crypto, making it weaker.

Future steps

Make clear rules so people feel safe, like a game with fair rules.

Use crypto for real things, like owning house parts online. If banks cut rates, more money might come back.

Fix codes to stop new threats. Teach people crypto helps poor areas send money cheap. Companies could buy crypto again if taxes help.

Conclusion

This crypto winter is super cold because old reasons to like it broke.

But like real winter ends, this might too if we fix problems.

With better world money and new ideas, crypto could warm up and grow strong.