US 145% China Tariff Tsunami: How New Trade Policies Are Upending Online Shopping

Introduction

As of May 2, 2025, millions of American consumers who regularly shop on Chinese e-commerce platforms like Shein, Temu, and AliExpress are experiencing the full impact of dramatic changes to U.S. trade policy.

President Trump’s administration has implemented a 145% tariff on Chinese imports and closed a critical customs loophole that previously allowed low-value shipments to enter duty-free.

These twin policies have triggered significant price increases, changed checkout experiences, and begun reshaping the ultra-affordable online shopping landscape many consumers had grown accustomed to.

The Twin Policy Changes Transforming E-commerce

The transformation of the U.S.-China e-commerce landscape stems from two significant policy changes. First, the Trump administration has escalated tariffs on Chinese imports to an unprecedented 145%.

Second, and perhaps more consequentially for everyday shoppers, the administration eliminated the “de minimis” exemption that previously allowed goods valued under $800 to enter the U.S. without duties or taxes.

The de minimis exemption, dating back to the 1930s, was designed to facilitate small-scale trade by allowing low-value goods to enter the country without complicated customs declarations or tariff payments.

This exemption became the foundation for the business models of platforms like Shein and Temu, which built their U.S. operations around shipping products directly to consumers rather than in bulk to warehouses.

Starting May 2, 2025, shipments through the Postal Service from China will be subject to a tariff equivalent to 120% of the value of the goods or a fee of $100 per package.

Goods imported through other means will be subject to all applicable duties by entry and payment procedures.

This represents a seismic shift in how e-commerce from China operates in the U.S. market.

Chinese E-commerce Platforms’ Immediate Response

Chinese e-commerce platforms adjusted their business practices even before these policies were implemented.

Shein and Temu notified customers that they would raise prices starting April 25, 2025, citing “recent changes in global trade rules and tariffs” that increased their operating expenses.

The platforms have taken different approaches to handling these new costs:

Shein’s Integrated Pricing Strategy

Shein has opted to build tariffs into its displayed prices. A notification on their website states: “Tariffs are included in the price you pay.

You’ll never have to pay extra at delivery”. Price increases vary across products, with examples including

A child’s fleece pants increased from $8.29 to $10.19

A plus-size dress jumping from $22.39 to $27.51

A pair of pants rising from $13.99 to $17.09

Some shoppers report even more dramatic increases, with certain items doubling in price according to social media posts.

Temu’s Controversial Surcharge Approach

Temu has taken a different and more controversial approach by adding separate “import surcharges” at checkout.

This has created sticker shock for many consumers who select items based on their listed prices, only to discover substantial additional fees during purchase.

For example, a vacuum cleaner listed at $16.93 (already up 57% from its previous price of $10.77) had an additional $21.68 tariff surcharge added at checkout.

This approach has sparked significant customer backlash, with many shoppers expressing outrage on platforms like Reddit and vowing never to shop on the app again.

AliExpress’s Transparent Fee Display

AliExpress has taken a more transparent approach by prominently displaying import charges below item prices for goods shipped from overseas.

The tariff rates are substantial; for instance, a pair of sneakers listed at $160 shows an additional import charge of $260.80.

Items shipped from domestic warehouses, however, do not display these charges.

The Real-World Impact on American Consumers

The effects of these policy changes are already rippling through the American consumer landscape, with potentially far-reaching consequences.

Dramatic Price Increases

The most immediate and visible impact is substantial price increases.

With tariffs of 145% plus the elimination of the de minimis exemption, the ultra-cheap products that made these platforms popular are becoming significantly more expensive.

For example, an order comprising three items totaling $172.45 would incur additional tariffs of $282.69.

These increases are particularly significant given the previously rock-bottom prices central to these platforms’ appeal.

Items once priced at just a few dollars now see substantial percentage increases, even if the absolute dollar increase is relatively modest.

Disproportionate Impact on Lower-Income Consumers

The end of ultra-affordable Chinese e-commerce may disproportionately affect lower-income Americans.

A Yale and UCLA economists study found that ending the de minimis exemption will “disproportionately hurt lower-income and minority consumers.”

Research indicates that nearly half of de minimis shipments were sent to low-income ZIP codes, suggesting that these communities had come to rely on platforms like Shein and Temu for affordable goods.

Changing Shopping Behaviors

Consumers are already adapting their shopping behaviors in response to these changes.

Some rush to make purchases before prices increase, while others abandon these platforms entirely in search of alternatives.

The social media discourse around these platforms has shifted dramatically, with confusion and frustration replacing the previous enthusiasm for bargain finds.

Behind the Policies

Trade War and Political Context

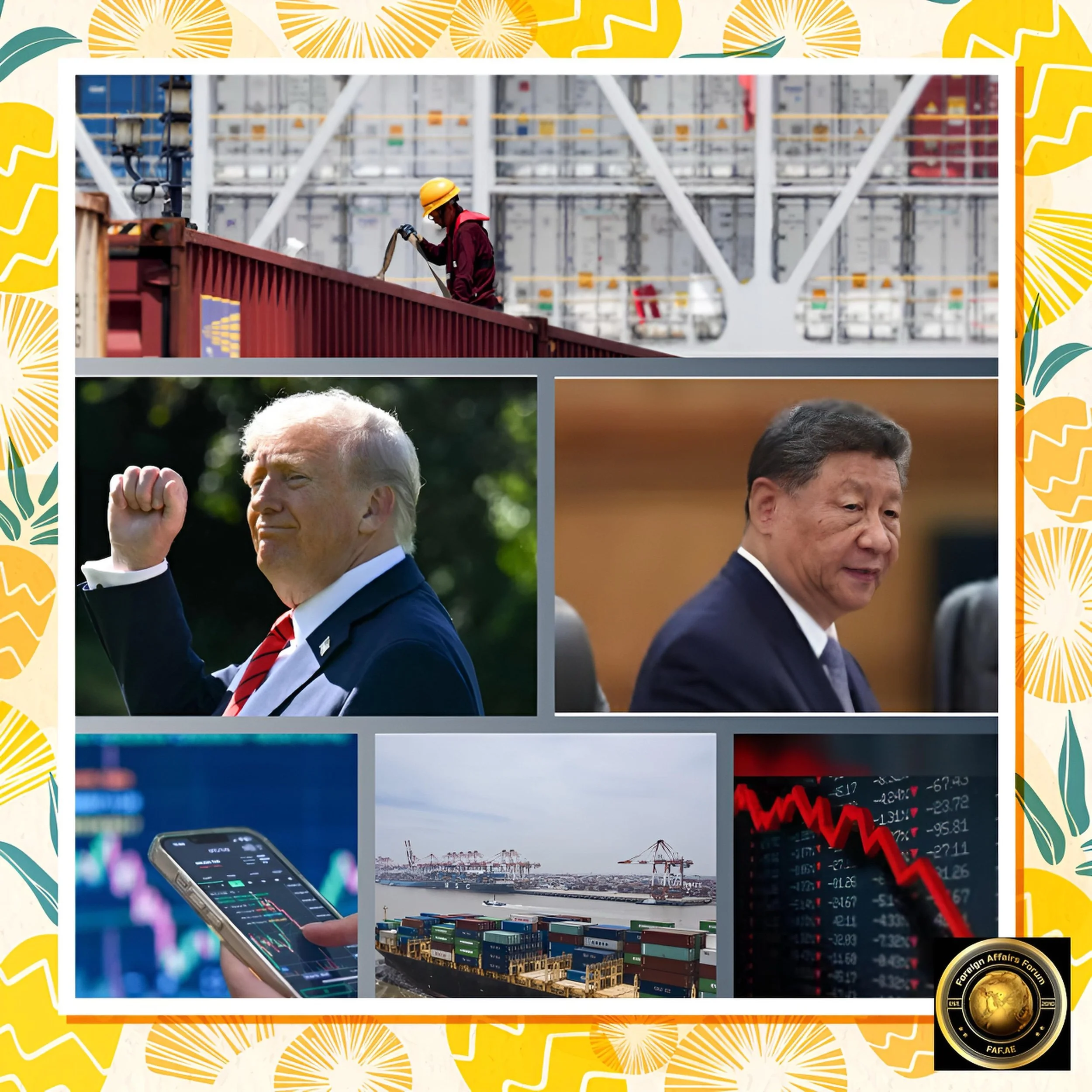

These dramatic changes to e-commerce are part of a broader escalation in U.S.-China trade tensions that has been building throughout 2025.

Escalating Tariff War

The tariff increases are part of an escalating trade war between the U.S. and China.

In April 2025, Trump declared a national emergency to address what he described as a “large and persistent US trade deficit” and announced a 10% tariff on all imports to the U.S., with higher rates for specific countries, including China.

The situation rapidly escalated, with the U.S. implementing a 34% “reciprocal tariff” on most Chinese imports on April 2, which China matched with its 34% tariff on American goods.

This was followed by several more increases, with the U.S. eventually raising the baseline tariff on Chinese imports to 145% and China responding with a 125% tariff on American goods.

Multiple Policy Rationales

The Trump administration has cited several rationales for these policy changes:

Fentanyl concerns

The administration described the elimination of the de minimis exemption as a “critical step in countering the ongoing health emergency posed by the illicit flow of synthetic opioids into the U.S.”

Trade imbalance

The policies aim to address what the administration views as unfair trade practices and a persistent trade deficit with China

Level playing field

Traditional retailers have complained that the de minimis loophole gave Chinese e-commerce platforms an unfair advantage by allowing them to ship directly to consumers at lower costs

Looking Ahead: Adaptation and Uncertainty

As both businesses and consumers adjust to this new reality, several trends are emerging:

Business Model Transformations

Chinese e-commerce platforms are being forced to rethink their business models fundamentally. Some potential adaptations include

Expanding warehouses in the U.S. to avoid international shipping-related tariffs

Working with local suppliers to reduce dependence on Chinese manufacturing

Developing more premium product lines with higher margins that can absorb tariff costs

However, the adjustment will be particularly challenging for companies like Temu, whose business model relies heavily on Chinese suppliers (with “the vast majority of Temu’s inventory sourced from China”).

Market Consolidation and Competition

A Bank of America research note suggested that removing the de minimis exemption could significantly slow the growth of Chinese e-commerce companies in the U.S.

This could potentially benefit traditional U.S. retailers, which have been losing market share to these platforms.

Consumer Adaptation

American consumers must adjust their shopping habits, particularly those with limited budgets.

Some may return to traditional discount retailers, while others may focus more on secondhand markets or reduce discretionary purchases altogether.

Conclusion

A Transformed E-commerce Landscape

Implementing the 145% tariff and eliminating the de minimis exemption mark a watershed moment in U.S.-China trade relations and online shopping.

For millions of American consumers who had grown accustomed to ultra-cheap goods from platforms like Shein, Temu, and AliExpress, the era of $2 gadgets and $5 dresses appears to be ending.

While the full economic impact of these changes will take time, it’s already clear that the landscape of affordable online shopping has fundamentally changed.

Businesses are scrambling to adapt their models, and consumers are experiencing sticker shock at checkout.

Whether these policies address trade imbalances and security concerns remains to be seen, but their immediate effect on e-commerce is undeniable.

As one industry observer noted, “For American shoppers used to rock-bottom prices, the era of ultra-cheap Chinese goods may be coming to an end.”