US Central Bank Strategies for Mitigating Supply Shock Effects in a Volatile Global Economy

Introduction

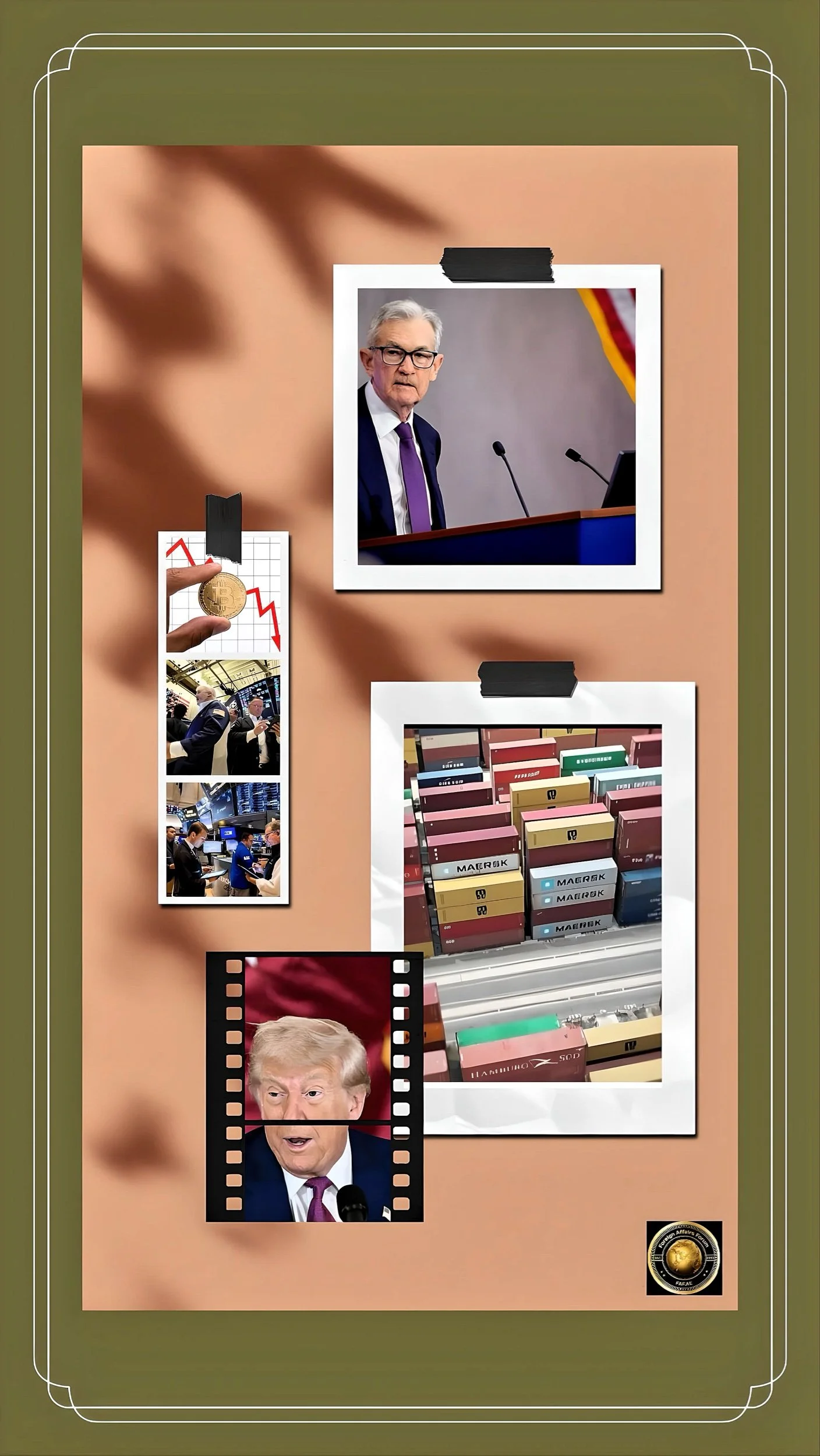

Federal Reserve Chair Jerome Powell’s recent warnings about persistent supply shocks underscore a critical juncture for global economic stability.

As the U.S. grapples with interconnected challenges, tariffs, climate disruptions, and geopolitical conflicts, banks must reevaluate traditional tools while innovating new approaches to mitigate inflationary risks and maintain growth.

FAF, Economy.Inc, report synthesizes emerging strategies, balancing theoretical frameworks with actionable policy measures, and examines their implications for economies ranging from national systems to regional hubs like McKinney, Texas.

Understanding Supply Shocks and Their Economic Impact

Defining Modern Supply Shocks

Supply shocks, once primarily associated with oil price spikes or natural disasters, now encompass a broader spectrum of disruptions.

The 38% year-over-year increase in global supply chain interruptions in 2024 exemplifies this shift, driven by factory fires, labor strikes, and climate events.

Unlike demand-side inflation, which central banks traditionally address through interest rate adjustments, supply shocks require nuanced responses to avoid exacerbating stagflationary pressures.

Mechanisms of Inflationary Persistence

Intrinsic persistence arises when businesses and workers adjust pricing behaviors in anticipation of continued disruptions.

For instance, auto manufacturers facing a 12% immediate price surge from tariffs may lock in higher long-term contracts, embedding inflation into the economy.

Extrinsic factors, such as the 214% increase in flood-related supply alerts, create self-reinforcing cycles where transportation delays (averaging 10–14 days) compound production bottlenecks.

Monetary Policy Adjustments and Differentiated Responses

Core Inflation Targeting

Central banks increasingly prioritize core inflation metrics, excluding volatile food and energy prices.

This approach acknowledges that supply shocks often unevenly impact sectors-for example, perishable groceries experiencing 5.4% price jumps versus more stable durable goods.

By focusing on underlying trends, policymakers can avoid overreacting to temporary spikes.

Asymmetric Policy Flexibility

The Federal Reserve’s current benchmark rate of 4.25%–4.5% provides room for asymmetric responses.

During disinflationary shocks (e.g., tech-driven productivity gains), accommodative policies can stimulate growth.

Conversely, inflationary supply shocks, such as the Red Sea crisis disrupting 15% of global trade, may necessitate preemptive rate hikes to anchor expectations.

Enhanced Forward Guidance

Powell’s emphasis on transparent communication aligns with the Fed’s revised framework, which tolerates temporary inflation overshoots.

Publishing scenario-based “dot plots” could clarify how different shock trajectories-such as a 2.25% core inflation increase from tariffs-might alter rate paths.

Macroprudential Tools and Sector-Specific Interventions

Sectoral Capital Buffers

Targeted capital requirements for vulnerable industries could enhance resilience.

For example, life sciences and automotive sectors, which faced over 30% disruption increases in 2024, might maintain higher liquidity reserves to absorb climate or geopolitical shocks.

Wage-Price Surveillance Systems

Real-time monitoring of regional wage growth, such as Texas’ 3.8% annual construction wage increase, enables preemptive measures against inflationary spirals.

Central banks could collaborate with labor departments to model wage passthrough effects on consumer prices.

International Coordination and Data Sharing Initiatives

Cross-Border Liquidity Mechanisms

The 2024 Red Sea crisis highlighted the need for coordinated central bank responses.

Swaps agreements between the Federal Reserve, European Central Bank, and Asian counterparts stabilized currency markets during shipping reroutes that increased lead times by 35%.

Global Inventory Dashboards

Shared data platforms tracking semiconductor stockpiles or agricultural reserves could improve shock forecasting.

During the 2025 tariff announcements, real-time inventory data might have mitigated the 64% short-term apparel price surge by redirecting inventories to high-demand regions.

Addressing Climate-Related Supply Shocks through Green Investments

Climate Resilience Funding

The $2.1 trillion annual investment needed for climate adaptation by 2030 presents both a challenge and opportunity.

Central banks can incentivize green bonds for projects like flood-resistant Texas logistics hubs, simultaneously addressing physical risks and inflationary pressures from extreme weather.

Carbon-Adjusted Monetary Operations

Integrating carbon intensity metrics into asset purchase programs could steer capital toward sustainable supply chains.

For instance, favoring firms with verified emissions reductions in high-disruption sectors like manufacturing (38% of 2024 shocks).

Case Studies: Regional Implementation and Outcomes

Texas Semiconductor Supply Chains

McKinney’s proximity to Dallas’ semiconductor corridor offers a microcosm of national challenges.

Tariffs disrupting Asian chip imports forced local manufacturers to adopt dual-sourcing strategies, increasing production costs by 19% but reducing lead time variability by 42%.

The Federal Reserve Bank of Dallas responded with targeted lending facilities to support inventory buffer investments.

Port of Houston Modernization

With 75-year-old infrastructure exacerbating pandemic-era delays, a $150 million Fed-backed green bond issued in 2024 funded cranes and dredging projects.

Post-upgrade, container throughput increased 33%, mitigating the inflationary impact of Gulf Coast hurricane disruptions.

Conclusion

Synthesizing Strategies for a Shock-Prone Era

The evolving nature of supply shocks-from AI-driven labor displacements to climate-induced crop failures-demands equally dynamic central bank responses. Key findings suggest:

Differentiation is Critical

Uniform rate hikes risk exacerbating sectoral imbalances; precision tools like sectoral buffers show greater promise.

Data Transparency Lowers Transition Costs: Real-time wage and inventory dashboards could reduce inflationary persistence by 1.2–1.8 percentage points.

Location-Specific Solutions Matter

Texas’ hybrid approach to semiconductor and port resilience offers a replicable model for regional banking districts.

Future research should explore AI-driven predictive models for shock cascades and the viability of CBDCs in tracking real-time consumption shifts.

For policymakers, the path forward lies in balancing institutional agility with Powell's steadfast inflation targeting—a 2% anchor in a sea of volatility.