China jumps from a low cost option to a global leader- 2025

Introduction

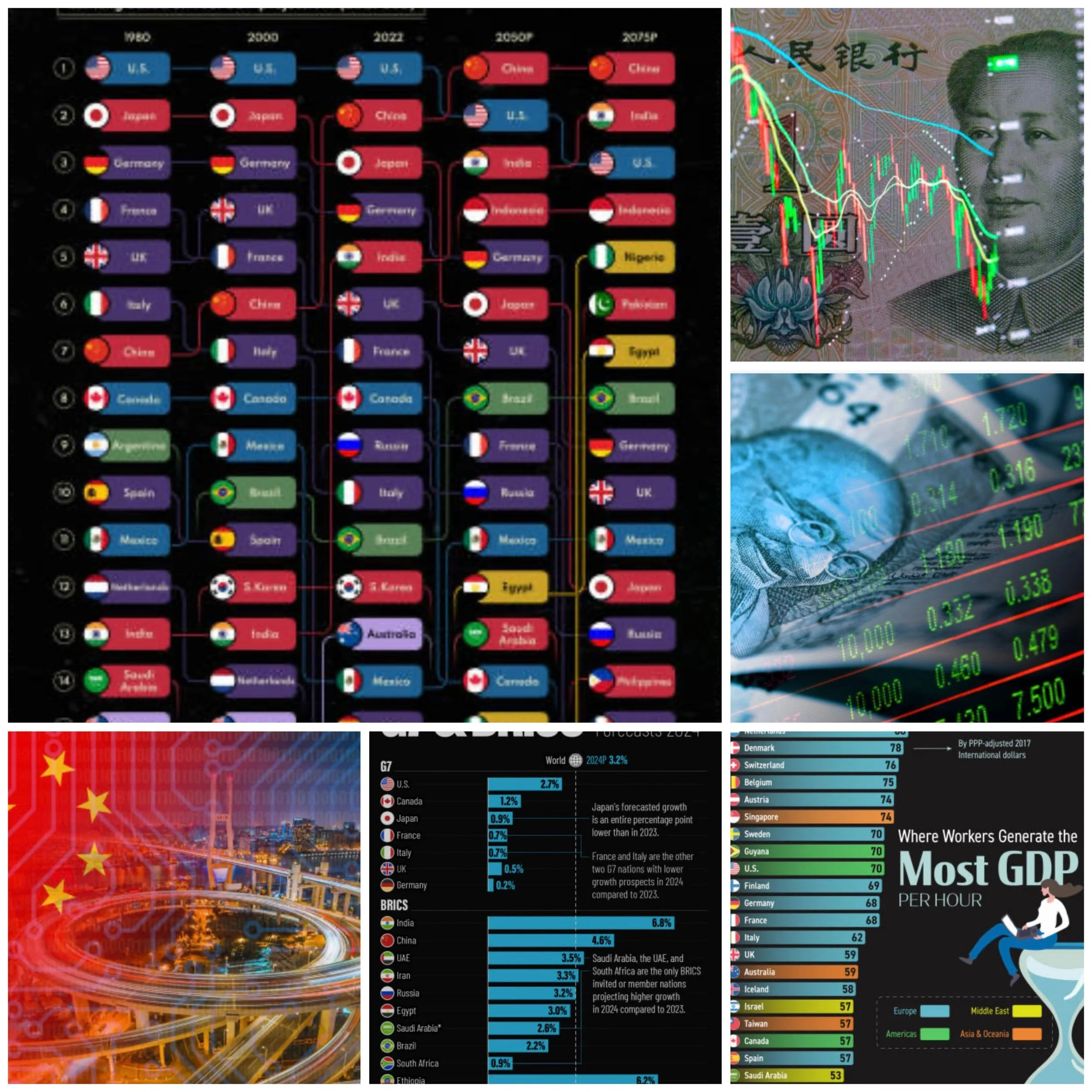

China’s rapid economic ascent from a low-cost offshore manufacturing hub to a global economic powerhouse over the past two decades stems from a calculated mix of state-driven industrial policies, strategic globalization efforts, and adaptive responses to global crises. Here are the key strategies that enabled China to outpace competitors:

Dual-Track Economic Reforms

China combined market liberalization with robust state control, creating Special Economic Zones in the 1980s to attract foreign investment while maintaining CCP oversight of strategic sectors.

Post-2001 WTO accession accelerated this model, allowing foreign firms to offshore production while requiring technology transfers and local partnerships. By 2014, U.S. affiliates employed 1.7 million Chinese workers, half in manufacturing.

Industrial Policy Dominance

Made in China 2025

Launched in 2015, this $300 billion initiative targeted dominance in 10 high-tech sectors (e.g., semiconductors, AI) through subsidies, forced IP transfers, and market barriers.

It aimed to reduce foreign tech reliance from 32% to 15% by 2030.

State-Owned Enterprises (SOEs)

SOEs control 35% of China’s economy and 66% of its global Fortune 500 firms, channeling resources into strategic sectors like 5G and renewable energy.

Government Guidance Funds

$1.2 trillion deployed since 2014 to finance tech startups and critical industries like integrated circuits.

Global Infrastructure Expansion

The Belt and Road Initiative (BRI), launched in 2013, extended China’s economic reach to 150+ countries through $1 trillion in infrastructure loans and projects. BRI enabled China to

Export overcapacity in steel/construction sectors

Set global tech standards via “Digital Silk Road” investments

Increase diplomatic posts from 276 in 2019 (surpassing the U.S.) to 304 by 2023

Crisis-Driven Growth Model

China leveraged global disruptions to consolidate power:

2008 Financial Crisis

A $586 billion stimulus focused on infrastructure revived growth to 9.4% by 2009 while Western economies faltered.

COVID-19 Pandemic

Early recovery (4.9% GDP growth in 2020) allowed China to capture 35% of global medical exports and expand BRI vaccine diplomacy.

Transition from Low-Cost to Innovation Economy

While initially reliant on cheap labor (2013 Chinese manufacturing wages were 11% of U.S. levels), China systematically upgraded its capabilities:

R&D Investment

Increased from 0.9% of GDP in 2000 to 2.4% by 2020, surpassing the EU

Smart Manufacturing

Robotics adoption grew 400% from 2015–2022, reducing labor dependency

Dual Circulation Strategy

Redirected focus to domestic consumption, aiming for 60% of GDP from services by 2035

Impact on U.S. Competitiveness

Manufacturing Shift

3.2 million U.S. jobs lost to China offshoring from 2001–2013, with Mexico now absorbing 45% of new offshoring as wages rise.

Tech Race

China holds 40% of global AI patents and 70% of 5G infrastructure contracts, challenging U.S. tech leadership.

Conclusion

Despite U.S. reshoring efforts and tariffs, China’s integrated policy framework – blending state capitalism, global infrastructure leverage, and crisis adaptation – has entrenched its position as the world’s manufacturing center and a rising innovator. However, challenges like the “middle-income trap” and debt-driven growth (295% of GDP in 2025) test the sustainability of this model