Understanding Italy's Debt Problem: A Simple Explanation

Summary

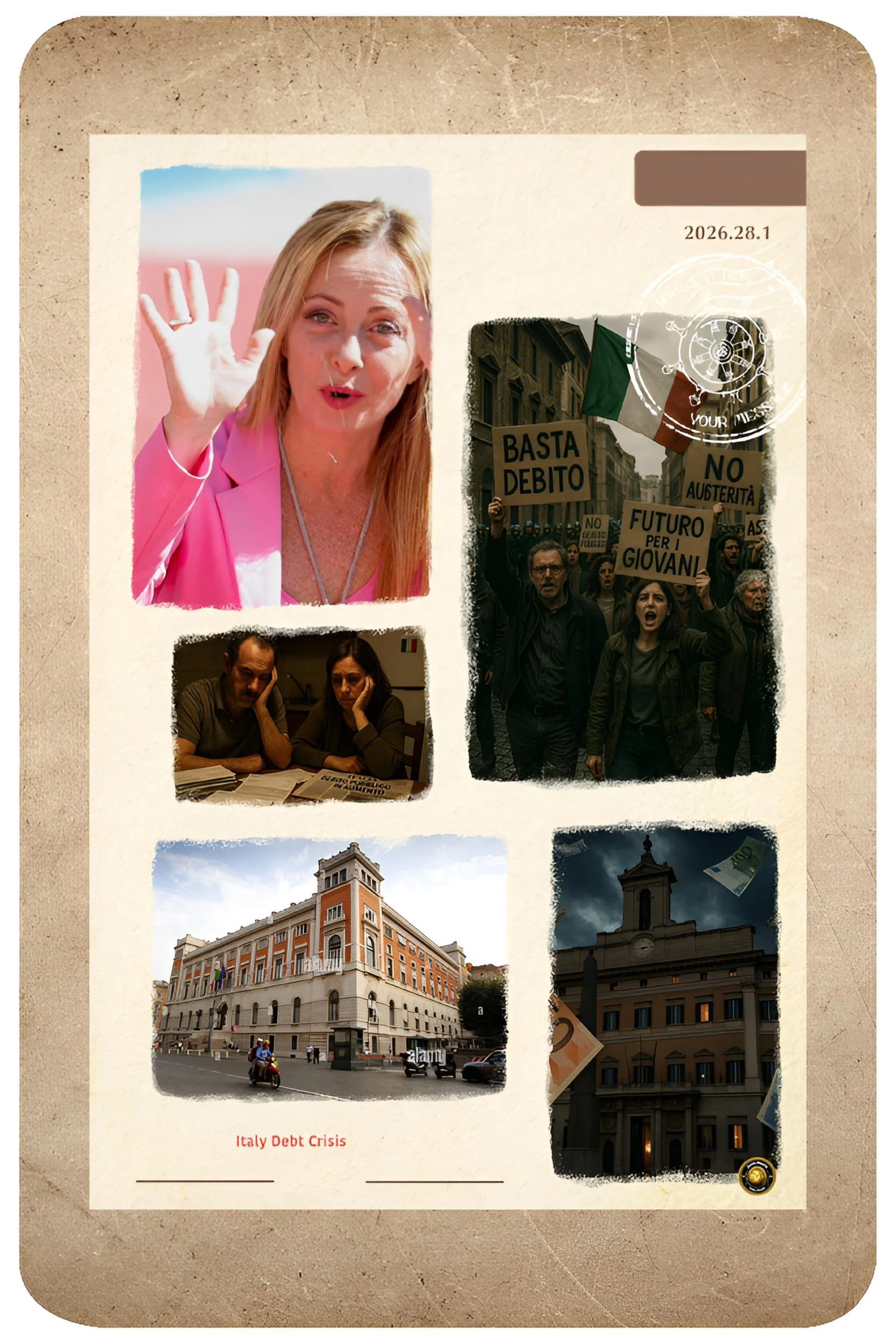

What is Happening in Italy Right Now?

Italy has a very serious money problem that threatens the entire European economy. Imagine a family that has accumulated huge debts over many years.

Every month, the family earns money, but a very large part of that money goes to paying interest on old debts instead of buying food, fixing the house, or sending children to school.

This is Italy's situation. As of December 2025, Italy owes €3.1 to €3.6 trillion. This is money that Italy must repay to banks and investors around the world.

For every €1 of goods and services Italy produces, it owes €1.35 to €1.38. This is the 2nd worst debt problem in the eurozone, after Greece. The situation is dangerous because the debt keeps growing even though the government is trying to cut spending.

Looking Back: How Did Italy Get Into This Mess?

To understand Italy's problem, we need to look at history. In 1988, Italy owed about 90.5% of what it produced. This was manageable. But over the next 30 years, Italy kept spending more than it earned. Then came the 2008 financial crisis. Italy's economy fell 7%. Then it grew 3%. Then it fell again 5%.

This triple-dip recession was very painful. The government borrowed money to help people and businesses survive. This created more debt.

Then in 2011 and 2012, Europe had a big debt crisis. Investors got scared about Italian debt. They demanded much higher interest rates. The spread between Italian bonds and German bonds widened to 500 basis points. This means Italy had to pay much more to borrow money. If this spread got higher, Italy could not borrow money anymore.

Then came COVID-19 in 2020. Italy's government spent huge amounts of money to help people who could not work. The debt exploded to 157.7% of GDP. This was the highest in modern times, except during World War 2.

Now in 2026, the debt is still very high at 135.3-137.8% of GDP. Even though the government is cutting spending, the debt is still rising.

Why Is Italy's Debt So High?

Italy has 5 major problems that cause its debt to stay high and grow bigger.

Aging population and shrinking workforce

Italy's biggest problem is demographic. In 1950, 8 Italian workers supported 1 retiree. By 2050, less than 2 workers will support 1 retiree. This is a huge change. Why? Because people are having fewer babies. In 2024, Italy had only 370,000 births. This is the lowest number ever recorded. Most families have only 1.18 children. Italy needs 2.1 children per family just to keep the population stable.

This means fewer young people are working. But more old people are retiring. The government must pay pensions to these retirees. Pensions already cost 15.3% of GDP.

By 2042, they will cost 17%. This money comes from taxes, but there are fewer working people to pay taxes. This is like the scissors closing: expenses go up, income goes down.

Weak economic growth

Italy's economy grew only 0.7% in 2024. In 2025, it is growing just 0.5%. In 2026, it will grow 0.8%. These are very weak growth rates. Germany grows faster. France grows faster. The entire eurozone grows faster.

Why? Because Italian workers are not more productive.

Since 2000, productivity per worker has stayed flat. A worker in Italy produces about $52-55 of value per hour. A worker in France produces $57-65. A German worker produces $56-69. This difference adds up over time. If workers are not more productive, companies do not make more profit. If companies do not make more profit, the economy does not grow fast. If the economy does not grow fast, the government collects less tax money.

Interest payments are exploding

Here is the scariest part: Italy now pays a huge amount just to pay interest on its debt. In 2020, Italy paid €36.2 billion in interest. In 2026, Italy will pay €75-100 billion in interest. This is more than double in just 6 years. By 2026, interest payments will be 4.6% of all government spending. This is money that cannot be spent on hospitals, schools, or roads.

Why are interest payments rising so fast? 2 reasons. 1st, the debt is getting bigger, so more interest accrues on it. 2nd, interest rates are higher. When the European Central Bank raised interest rates from 2022 to 2023 to fight inflation, borrowing costs for Italy went up. Now when Italy borrows new money, it must pay higher interest rates.

Labor productivity is stagnant

Italy has a broken labor market. Young people struggle to find permanent jobs. Many have temporary contracts with low pay. Older workers with permanent contracts have high job protection and good wages. This creates 2 classes of workers.

Companies do not invest in training temporary workers because they may not stay. So workers do not get better at their jobs. If workers do not get better at their jobs, they cannot produce more value. If they produce more value, the economy grows slow.

Youth unemployment is 18-20%. This is more than double the overall unemployment rate. It is hard for young people to find their 1st permanent job. Once they get a job, they may stay in it for 30-40 years even if they would be more productive somewhere else. This system does not work well.

The Superbonus tax credit problem

Between 2021 and 2023, Italy's government gave out huge tax credits for home renovation and energy efficiency. The total was about €180 billion. Companies and homeowners are using these credits over many years. Each year, about €24 billion of these credits are applied.

This creates an artificial problem for the government's budget numbers. Even though the government is cutting spending, the deficit looks bad because of the Superbonus credits. These credits will continue to hurt the budget until 2027.

What Is the Government Doing to Fix the Problem?

Italy's government, led by Prime Minister Giorgia Meloni, approved a 2026 budget on December 30, 2025. The budget totals €22 billion in deficit-reduction measures. Here is what the government is trying to do.

Cutting the deficit

The deficit was 3.4% of GDP in 2024. It fell to 3% in 2025. The government wants it to be 2.8% in 2026 and 2.6% in 2027. This is progress. The goal is to reach below 3% to satisfy the European Union rules.

Income tax cuts for working people

The government is cutting income taxes for people earning up to €40,000. This helps workers and families with lower incomes. The idea is to help people have more money to spend, which helps the economy grow.

Taxes on banks and insurance companies

To pay for the tax cuts, the government is raising taxes on banks and insurance companies. About 25% of the budget's savings come from the financial sector. This brings in €3.5-5.5 billion. But there is a problem: if banks pay more taxes, they may lend less money to businesses. This could slow growth.

Spending restraint

The government is controlling spending on pensions and healthcare. But here is the problem: the government temporarily suspended a 2023 pension reform that would have raised the retirement age to 64. So it is not cutting pensions as much as it could. This shows how politically difficult it is to reform pensions.

EU Recovery Plan projects

Italy is supposed to receive about €191 billion from the European Union's Recovery and Resilience Plan. This money is supposed to fund judicial reforms, better administration, digitalization, and green energy projects. These projects are supposed to make Italy more productive. But the deployment of these funds is slow because of bureaucratic problems. The money is not having the impact it should.

What Are the Main Causes of the Debt Problem?

Italy's debt problem has 5 main causes.

1) Italy's productivity has not increased since 2000. Workers are not becoming more productive. Machines and technology are not making workers more efficient. This is different from other countries where productivity increases every year.

2) The population is aging very fast. Fewer young people are working. More old people are retired. This is automatic and cannot be quickly changed.

3) Interest rates are rising. The European Central Bank raised rates to fight inflation. Now Italy must pay more interest on its debt.

4) The labor market is rigid and broken. Young people cannot find permanent jobs. Old people keep jobs even if they are less productive. Businesses do not invest in training.

5) Political leaders have not made big structural changes. For 30 years, different governments have delayed difficult decisions about pensions and healthcare. Each government cut spending a little bit but not enough. The debt kept growing.

Is There a Solution?

Yes, there is a solution, but it requires painful changes.

The 1st step is to continue cutting the deficit. Italy is on track to cut the deficit to below 3% by 2026. This is progress.

The 2nd step is to reform the labor market. Italy must make it easier for companies to hire workers and easier to pay lower wages for temporary workers. This would create more jobs for young people. More jobs means more tax money.

The 3rd step is to modernize education. Schools must teach skills that businesses need. Right now, students learn theory but do not have practical skills. If young people have better skills, they can earn more money and pay more taxes.

The 4th step is to reform pensions carefully. Italy cannot cut pensions drastically because retirees will vote against the government. But Italy must slowly raise the retirement age and reduce benefits for rich retirees. This must happen gradually over 20 years.

The 5th step is to attract immigration. Italy's population is shrinking. Younger people from other countries could work and pay taxes. They could help support retirees. But Italy must change laws to make immigration easier.

The 6th step is to attract private investment. The government must reduce bureaucracy and regulations so that companies can grow. When companies grow, they create jobs. When there are more jobs, there is more tax money.

What Happens If Italy Does Not Fix the Problem?

If Italy does not fix the debt problem, several bad things could happen.

1) interest rates on Italian bonds could go very high. This would make it very expensive for Italy to borrow new money.

2) rating agencies could downgrade Italian debt. This tells investors that Italy is risky. Investors would demand even higher interest rates.

3) banks could lose money because they hold so much Italian government debt. If banks lose money, they cannot lend to businesses. This slows growth.

4) Italy could have a financial crisis like Greece did in 2010-2015. The government might not have enough money to pay pensions and government salaries. This would be very painful for Italian people.

5) Thely could be asked to get help from the International Monetary Fund, as Greece and Ireland did. The IMF would demand spending cuts and reforms that would be very unusual.

Conclusion

Italy's debt problem is serious but not hopeless. The government is cutting the deficit. Interest payments are rising, but they can be managed if growth improves. The biggest challenge is the aging population and weak productivity growth. These problems cannot be fixed overnight. They require years of effort and difficult political choices.

Italy needs to reform its labor market, modernize its education system, raise the retirement age slowly, and attract private investment. These changes would help the economy grow faster. Faster growth would create more tax money. More tax money would allow the government to pay down debt.

The clock is ticking. Italy's government must act now to make these changes. If Italy waits, the problem will get worse. But if Italy acts soon and boldly, the country can stabilize its finances and avoid a crisis. The next 5 years are critical. What the government does now will determine Italy's future for decades.